SYNC Network (SYNC) isn’t another flashy crypto project. It’s a quiet, almost invisible one - a Layer 2 blockchain built around something called CryptoBonds. At first glance, it sounds clever: use NFTs to turn long-term staking into tradeable, interest-earning assets. But beneath that idea, there’s a deeper story - one of extreme risk, near-zero liquidity, and a token that’s barely moving.

What SYNC Network Actually Does

SYNC Network’s core idea is simple: take money locked in decentralized finance (DeFi) protocols like Uniswap and turn it into fixed-income products. Instead of just earning yield over time, you get a digital bond - called a CryptoBond - packaged as an NFT. This NFT can be sold anytime on marketplaces like OpenSea or Rarible. Think of it like a government bond, but on the blockchain. You buy it, it earns interest, and if you need cash, you sell it before it matures.

This isn’t just theory. The protocol was designed to solve a real problem in DeFi: volatility. Most yield farms give you unpredictable returns. SYNC tried to fix that by creating something predictable. But here’s the catch: nobody’s using it.

The Numbers Don’t Lie

As of November 2025, SYNC had a market cap of just $209,510. That’s less than the cost of a small apartment in Perth. The circulating supply is 210 million tokens out of a total 234.7 million. At a price of around $0.0005, each SYNC coin is worth less than half a cent.

Here’s where it gets worse: 24-hour trading volume is $0. Zero. Not $500. Not $50. Nothing. CoinMarketCap, the most trusted source for crypto data, says there’s been no trading activity in over a month. That means if you bought SYNC today, you wouldn’t be able to sell it - not easily, not at all. There’s no buyer. No exchange is listing it meaningfully. Bybit, Bitget, and MetaMask all show conflicting prices, suggesting the data is either outdated, inaccurate, or from different token versions.

Who Holds SYNC?

Only 3,420 wallets hold SYNC. That’s fewer people than live in a small Australian town. Compare that to Ethereum, which has over 100 million holders. Or even Solana, which has millions. SYNC has no community. No active Discord. No Twitter following. No Reddit threads. No GitHub commits in months. No blog updates. No press releases. No team bios. No whitepaper revisions. It’s like a website that stopped updating in 2021.

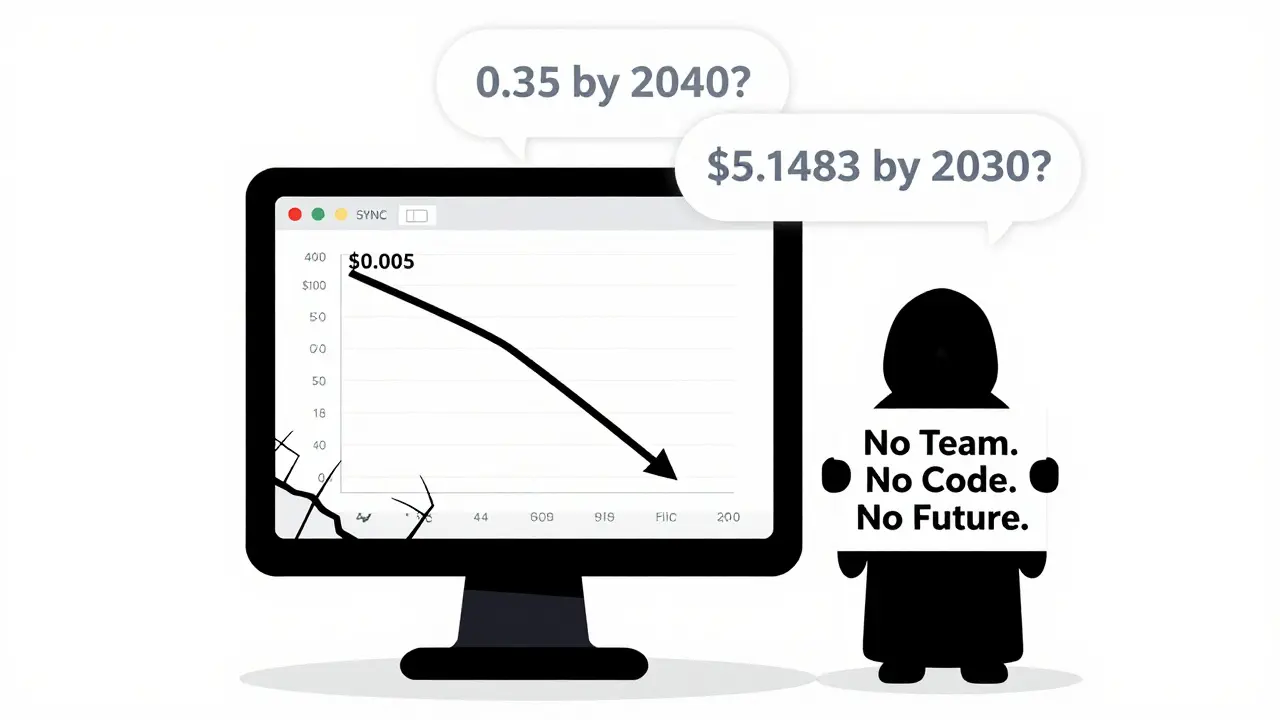

And yet, some price prediction sites still claim SYNC could hit $0.35 by 2040. BitScreener says $0.044 by December 2025. CoinLore says $0.1483 by 2030. These aren’t forecasts - they’re fantasies. They’re based on zero trading activity, zero adoption, and zero development. If a coin has no volume, no holders, and no team, any price prediction is just gambling.

Why Does This Even Exist?

SYNC Network operates in a niche: fixed-income DeFi. Protocols like Element Finance and Notional are building real products with real users and real liquidity. SYNC tries to do the same thing - but without the infrastructure. There’s no clear smart contract address. No audit reports. No developer documentation. No API. No wallet integration beyond MetaMask, which just lists it as an ERC-20 token with no special features.

It’s possible SYNC was launched as a test, then abandoned. Or it was a pump-and-dump scheme that faded. Either way, the lack of transparency is a red flag. Legitimate DeFi projects publish their code, audit results, and team identities. SYNC doesn’t. And in crypto, that’s a death sentence.

The Bigger Picture: Where SYNC Fits

The crypto market is worth over $2.5 trillion. SYNC’s entire market cap is less than 0.0001% of that. It’s not just small - it’s irrelevant. Even among micro-cap tokens, it’s near the bottom. Of the 10,000+ cryptocurrencies tracked, SYNC ranks between #2846 and #7732 depending on the platform. That’s not just low - it’s invisible.

And while DeFi as a whole grew 50-60% in 2025, SYNC dropped 77% in the same period. From $0.002182 in November 2024 to $0.000503 in November 2025. That’s not a correction. That’s a collapse.

Can You Buy SYNC?

You can - technically. Some decentralized exchanges might list it. MetaMask lets you add it manually. But here’s what you need to know: if you buy SYNC, you’re not investing. You’re speculating on a ghost. There’s no liquidity. No support. No roadmap. No team. No future.

If you’re thinking of buying SYNC because you saw a price prediction online - don’t. Those numbers are based on nothing. They’re not forecasts. They’re wishful thinking. Real crypto projects don’t need AI-generated price charts. They need users, volume, and code updates. SYNC has none of those.

Final Verdict: Is SYNC Network Worth It?

No.

SYNC Network isn’t broken. It’s dead. Or at least, it’s been abandoned. The technology behind CryptoBonds might have been interesting. But without adoption, without trading, without transparency, it’s just code sitting on a blockchain with no one using it.

If you’re looking for stable yield in DeFi, look at protocols with real volume, audits, and active teams. SYNC isn’t one of them. It’s a cautionary tale - not a investment.

What is SYNC Network (SYNC)?

SYNC Network is a Layer 2 blockchain platform that creates interest-earning digital bonds called CryptoBonds, packaged as NFTs. These can be traded on secondary markets like OpenSea. The goal was to bring fixed-income stability to DeFi protocols like Uniswap. But as of late 2025, the project has near-zero trading volume, minimal adoption, and no active development.

Is SYNC Network a good investment?

No. SYNC has a market cap under $210,000, zero 24-hour trading volume, and only 3,420 holders. It’s one of the least liquid tokens in crypto. Any price predictions claiming it will rise thousands of percent are speculative and not based on real market activity. It’s far too risky - and likely abandoned.

Can I sell SYNC if I buy it?

Technically yes, but practically no. There’s no active market for SYNC. Exchanges don’t list it meaningfully, and trading volume is $0. Even if you find a buyer, slippage would be extreme, and you’d likely lose most of your investment. It’s not a liquid asset.

Why is SYNC’s price so different on different sites?

Because there’s no real trading. Prices on Bybit, CoinMarketCap, and Bitget vary wildly - from $0.00046 to $0.035. That’s not market data - it’s either outdated, incorrect, or from a different token variant (like SYNCN). Without real buyers and sellers, prices are meaningless.

Does SYNC Network have a team or roadmap?

No public information exists about the team, developers, or roadmap. No GitHub activity, no blog posts, no social media updates since 2024. This lack of transparency is a major red flag in crypto. Legitimate projects communicate openly. SYNC doesn’t.

How does SYNC compare to other DeFi yield protocols?

SYNC tries to compete with projects like Element Finance and Notional, which have real users, audits, and trading volume. But SYNC’s market cap is less than 0.0001% of theirs. It lacks audits, developer tools, and exchange listings. It’s not a competitor - it’s a footnote.

What happened to SYNC Network?

It appears to have been abandoned. After a brief launch, it never gained traction. Trading volume dropped to zero, holders stopped engaging, and development stopped. There’s no evidence of ongoing work. It’s likely a failed experiment or a pump-and-dump that faded.