Cryptocurrency Hub – Southeast Asia’s Blockchain & Crypto Resource Center

When working with cryptocurrency, digital money that uses cryptographic security on decentralized networks. Also called crypto, it lets anyone send value directly, bypassing traditional intermediaries, you instantly tap into a fast‑growing market. Cryptocurrency powers peer‑to‑peer payments, fuels new business models, and creates investment opportunities across the region. Understanding how it works is the first step before you dive into the tools and strategies we cover below.

Key Technologies and Trends

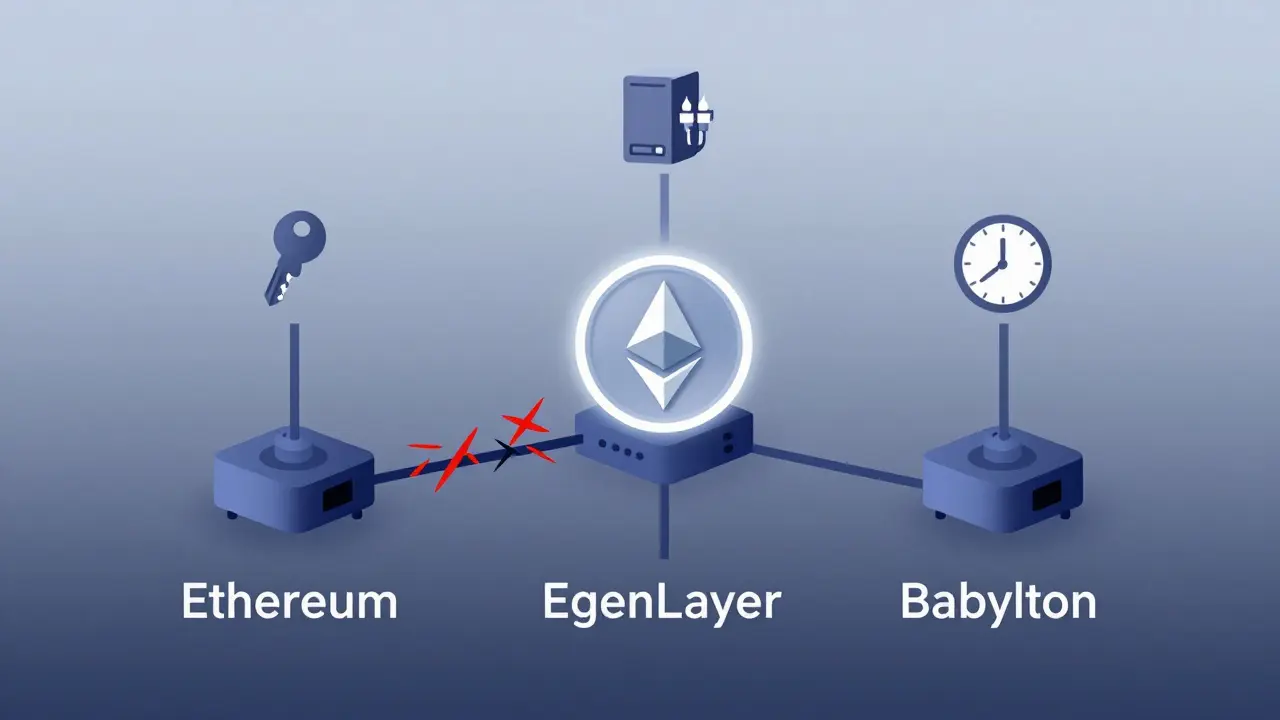

Underlying every blockchain, the distributed ledger that records all crypto transactions is a set of immutable blocks that keep data safe and transparent. Building on that, DeFi, decentralized finance apps that run on smart contracts lets users earn yield, borrow, or trade without banks. Meanwhile, crypto regulation in Southeast Asia shapes how exchanges operate, what taxes apply, and which projects can launch airdrops. These three forces—blockchain, DeFi, and regulation—interact to define market cycles, user adoption, and risk levels.

Our collection below reflects that mix: you’ll find adoption studies, flash‑loan walkthroughs, exchange safety checklists, airdrop step‑by‑step guides, and deep dives into regional policy shifts. Whether you’re a beginner curious about how crypto works or a pro looking for the latest DeFi tricks, the articles are organized to give you actionable insight fast. Dive in and discover the resources that can help you navigate the dynamic crypto landscape of Southeast Asia.