When you look at a cryptocurrency like Bitcoin or Ethereum, you’re not just seeing a price chart. You’re seeing a network, a community, a protocol, and a story - all wrapped in volatile market noise. If you’re trying to decide whether to buy, hold, or sell, relying only on candlesticks and moving averages is like trying to judge a car by its paint job. You need to dig deeper. That’s where fundamental analysis frameworks come in.

What Fundamental Analysis Really Means in Crypto

Fundamental analysis isn’t new. It started in 1934 with Benjamin Graham and David Dodd, who taught investors to look past stock prices and ask: What is this company actually worth? Today, that same logic applies to blockchain projects. Instead of earnings per share or balance sheets, you’re looking at tokenomics, network usage, developer activity, and on-chain metrics. The core idea hasn’t changed: Buy when the price is below intrinsic value, sell when it’s above. The difference? The data sources are new. You’re not reading 10-K filings - you’re checking GitHub commits, tracking wallet distributions on Etherscan, and monitoring transaction volume on Dune Analytics. Most crypto traders skip this step. They chase trends. But the people who make consistent returns - the ones who bought Bitcoin at $3,000 in 2020 and held through 2021’s crash - didn’t guess. They analyzed.The Three Frameworks: Top-Down, Bottom-Up, and Hybrid

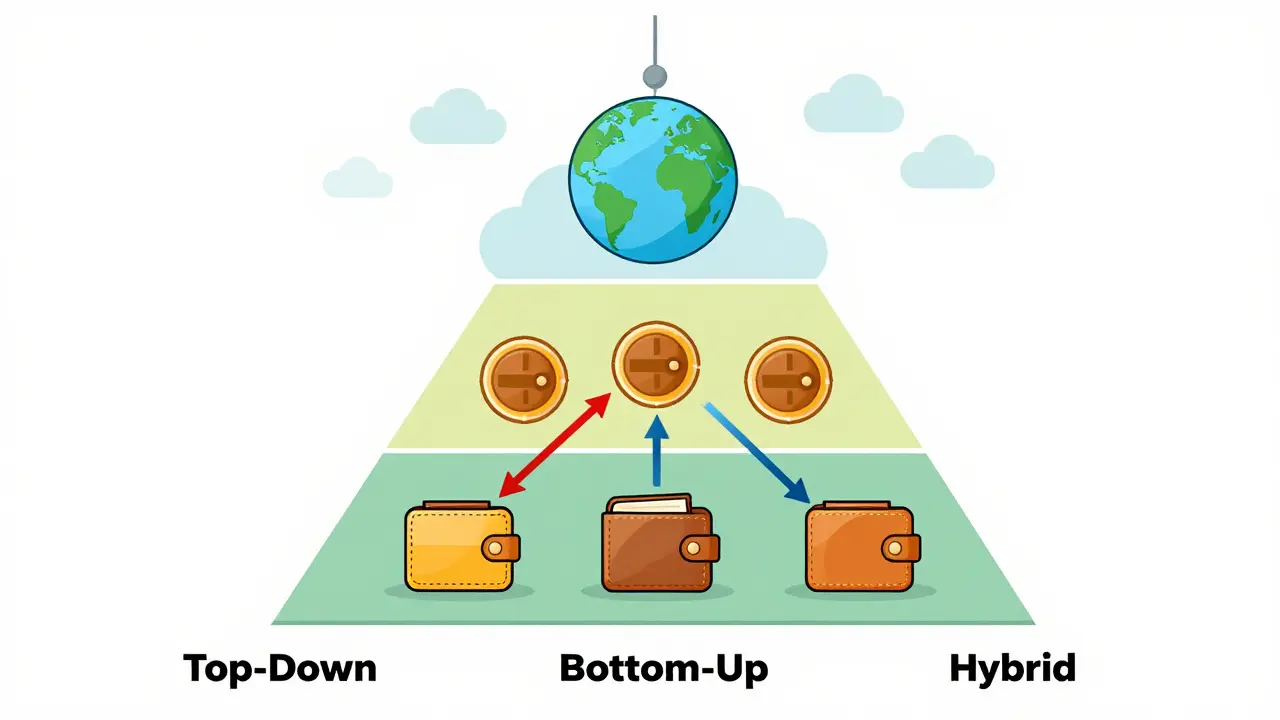

There are three main ways to approach fundamental analysis in crypto. Each has strengths, and the best investors use a mix. Top-down analysis starts with the big picture. What’s happening in the global economy? Are interest rates rising? Is inflation slowing? Are governments cracking down on crypto? These macro forces shape everything. For example, when the Fed raised rates in 2022, leveraged crypto projects collapsed - not because their tech failed, but because cheap money disappeared. If you’re investing in DeFi protocols, you need to know if the broader financial system is in expansion or contraction mode. Next, you look at the industry. Is blockchain adoption growing in payments? Is institutional interest rising? Are regulators creating clear rules? In 2023, the EU’s MiCA regulation gave legitimacy to crypto assets. That alone boosted investor confidence across the board - even for projects with weak fundamentals. Finally, you get to the project. But top-down investors don’t start there. They wait for the macro and industry trends to align before picking a coin. Bottom-up analysis flips the script. You start with the project. Look at the tokenomics: How many tokens are in circulation? What’s the inflation rate? Is there a vesting schedule for team tokens? Are more than 50% of tokens held by wallets with less than 1% of supply? That’s a sign of healthy distribution. Check the on-chain data. Is daily active address growth steady? Is the network fee revenue rising? Are smart contracts being used? For example, Chainlink’s success wasn’t just about being a “price oracle.” It was because over 80% of DeFi protocols relied on its data feed by 2023. That’s real utility. Then, look at the team. Are they transparent? Have they shipped updates consistently? GitHub commits per week, number of contributors, and public roadmap adherence matter more than flashy whitepapers. Hybrid frameworks combine both. You look at macro trends, then filter projects based on on-chain strength. A good hybrid investor in 2022 might have seen rising interest rates (macro) but still invested in Bitcoin because its network hash rate kept growing (on-chain), and its adoption by institutions like BlackRock was accelerating (industry). They didn’t ignore the macro - they used it to time entry, not avoid the asset.Key Metrics That Actually Matter

Forget P/E ratios. Crypto doesn’t have profits - not yet. So what do you measure?- Network Value to Transaction (NVT) Ratio: Think of it as the crypto version of P/E. Divide the market cap by daily on-chain transaction volume. A low NVT (below 50) often signals undervaluation. In early 2023, Bitcoin’s NVT hit 38 - a signal many long-term holders used to buy.

- Active Addresses: Are more people using the network? Ethereum hit 1.2 million daily active addresses in late 2023 - up from 400K in 2021. That’s adoption, not speculation.

- Dev Activity: Check GitHub. Are there 50+ commits per month? Are there new contributors? A project with 5 developers pushing code daily is more promising than one with 100,000 followers but zero commits.

- Token Distribution: If the top 10 wallets hold more than 30% of supply, you’re at risk of a dump. Look for projects where supply is spread across thousands of wallets.

- Revenue Generation: For DeFi protocols, check protocol revenue. Uniswap generated $2.1 billion in fees in 2023. That’s real economic value being captured.

Why Fundamental Analysis Beats Technicals in Crypto

Technical analysis works for day traders. It’s fast. It’s visual. But in crypto, it’s dangerous if used alone. In 2021, Ethereum hit $4,800 on hype. Technical indicators were screaming “overbought.” But fundamental metrics showed something else: L2 adoption was exploding, staking yields were rising, and institutional custody was improving. Those who sold based on RSI missed the next 150% rally. Fundamental analysis gives you context. It tells you why the price is moving - not just that it is. It helps you stay calm during panic. When TerraUSD collapsed in May 2022, technical traders ran. Fundamental investors asked: Was this a systemic flaw in the algorithmic stablecoin design? Or just a liquidity crisis? The answer was the former. Those who understood the mechanism knew it was doomed - and avoided the trap. The downside? It takes time. Reading a whitepaper, analyzing tokenomics, checking GitHub, tracking on-chain data - that’s not a 10-minute task. It’s 10 hours. But if you’re holding for years, isn’t that worth it?The Hidden Blind Spots

Even the best frameworks have gaps. One big one? ESG and regulatory risk. A project might have perfect tokenomics, but if it’s built on a proof-of-work chain with high energy use, and new regulations are coming, that’s a red flag. The EU’s MiCA rules now require environmental impact disclosures. Projects that ignored this in 2022 are struggling in 2025. Another? Over-reliance on historical data. Crypto moves fast. A project that had 10,000 daily users last year might be dead now. You need real-time data. Tools like Nansen and Arkham help, but you still need to interpret them. And then there’s the “narrative trap.” Some projects aren’t valuable because of tech - they’re valuable because of story. Solana’s rise in 2021 wasn’t just because it was fast. It was because the community believed it could beat Ethereum. That narrative drove adoption - even when the network kept crashing. Fundamental analysis doesn’t measure belief. That’s where it can fail.

How to Start - A Simple 5-Step Plan

You don’t need a finance degree. You don’t need a $10,000 subscription. Here’s how to begin:- Pick one project you’re curious about. Not 10. One.

- Find its on-chain data on Etherscan (for Ethereum), SolanaFM (for Solana), or Bitcoin.com Explorer (for BTC).

- Check GitHub. How many commits in the last 30 days? Who’s contributing?

- Look at tokenomics. Go to the project’s website. How many tokens are there? Who holds them?

- Ask: Is this solving a real problem? If the answer is “it’s faster than Ethereum,” that’s not enough. If the answer is “it enables cross-border payments without banks,” that’s real.

What the Experts Say

Warren Buffett didn’t invest in crypto. But his principles do. He said, “Never invest in a business you can’t understand.” That’s the same rule. If you can’t explain how a blockchain project makes money - or why people use it - don’t buy it. Aswath Damodaran, the valuation guru at NYU, says: “The most dangerous thing in investing is pretending you know the value of something you haven’t properly measured.” That’s why he uses multiple valuation models. In crypto, that means combining NVT, revenue multiples, and network growth forecasts - not just one. The CFA Institute now includes blockchain fundamentals in its curriculum. Why? Because institutions are waking up. BlackRock, Fidelity, and VanEck now have crypto teams running fundamental analysis. They’re not trading based on tweets. They’re building models.Final Thought: It’s Not About Timing the Market - It’s About Understanding the Asset

Crypto is still young. The rules are still being written. But the core truth hasn’t changed: Price is what you pay. Value is what you get. Fundamental analysis frameworks give you the tools to see what you’re really getting. They turn speculation into strategy. They turn noise into clarity. You don’t need to be a genius. You just need to be consistent. One project. One week. One metric at a time.Is fundamental analysis useful for short-term crypto trading?

Not really. Fundamental analysis works best over months or years. Short-term price moves are driven by sentiment, news, and liquidity - not financial metrics. Day traders should use technical analysis, but they should still understand fundamentals to avoid buying projects with fatal flaws.

Can you use fundamental analysis on meme coins like Dogecoin or Shiba Inu?

You can, but it’s mostly for risk management. Meme coins have no revenue, no utility, and no clear roadmap. Their value comes from community and hype. Fundamental analysis won’t tell you when to buy - but it can tell you when to get out. If a meme coin’s wallet distribution becomes concentrated, or if social volume drops sharply, those are red flags - even for a meme.

What’s the best free tool for crypto fundamental analysis?

Start with Etherscan for Ethereum-based projects, CoinGecko for market data, and GitHub for developer activity. For deeper metrics, Dune Analytics lets you build custom dashboards using on-chain data - all for free. You don’t need paid tools to get started.

How do ESG factors affect crypto fundamental analysis?

Increasingly, they matter. Projects on proof-of-work blockchains face regulatory risk as governments push for lower emissions. Ethereum’s shift to proof-of-stake in 2022 made it 99.95% more energy efficient - a huge fundamental upgrade. Investors now factor in carbon footprint when evaluating long-term viability.

Do I need to understand accounting to do fundamental analysis in crypto?

Not traditional accounting. Crypto projects don’t issue GAAP-compliant financials. Instead, you need to understand tokenomics: supply, distribution, inflation, and revenue models. Think of it as accounting for digital assets - not corporations. Free resources like CoinGecko’s tokenomics guides and CryptoSlate’s breakdowns are enough to get started.