Babu Pepe Risk Calculator

Babu Pepe ($BABU) is a high-risk meme coin with extreme volatility and minimal liquidity. This calculator shows potential losses based on its historical performance and market characteristics.

Babu Pepe ($BABU) isn't a serious investment. It's a meme coin built on jokes, hype, and the hope that someone else will pay more for it tomorrow. If you're wondering whether it's worth your time or money, the answer is simple: it's not. This token exists because someone made a funny image of a cartoon frog and slapped a blockchain on it. There's no team, no roadmap, no utility-just a contract address, a massive supply, and a handful of people trying to cash out before the price crashes.

What exactly is Babu Pepe ($BABU)?

Babu Pepe is a cryptocurrency token that launched on the Binance Smart Chain (BSC). It uses the BEP-20 standard, which means it works with wallets like MetaMask and trades on decentralized exchanges like PancakeSwap. Its entire identity is built around a meme character-no different from Dogecoin’s Shiba Inu or Pepe the Frog. But unlike those coins, Babu Pepe has no history, no community, and no development. It doesn't power any app, pay for any service, or offer rewards. It’s just a number on a screen.

The token’s total supply is 311.25 trillion coins, with a max cap of 420.69 trillion. That’s an insane amount-far more than Bitcoin’s 21 million. Why? So the price can stay microscopic. Each $BABU token is worth about $0.0000000102. You can buy trillions of them for a few dollars. But that doesn’t mean you’re getting rich. It just means the value of each coin is practically zero.

Market performance: Tiny, volatile, and risky

As of November 2025, Babu Pepe’s market cap sits at around $7,640. That’s less than the cost of a decent smartphone. For comparison, Pepe ($PEPE), another meme coin, has a market cap of over $2 billion. Babu Pepe is 260,000 times smaller. It ranks #8,715 out of all cryptocurrencies. Most of the top 1,000 coins have market caps in the billions. Babu Pepe isn’t even in the same league.

Its price moves wildly. Over 30 days, it jumped 78%-then dropped 19% in a single day. That kind of rollercoaster is typical for micro-cap tokens. The 24-hour trading volume? Just $15.19. That means if you tried to sell more than $5 worth of $BABU, you’d likely crash the price. Liquidity is so low that exchanges struggle to match buyers and sellers. Many users report being unable to sell their tokens after buying them.

Who’s holding it? Almost no one

There are only about 2,190 unique wallet addresses holding Babu Pepe. That’s fewer people than live in a small town. Most of them are either speculators who bought during a pump or scammers trying to dump their coins. There’s no official community on Discord or Telegram with active members. No developers post updates. No announcements. No whitepaper. No roadmap. Just silence.

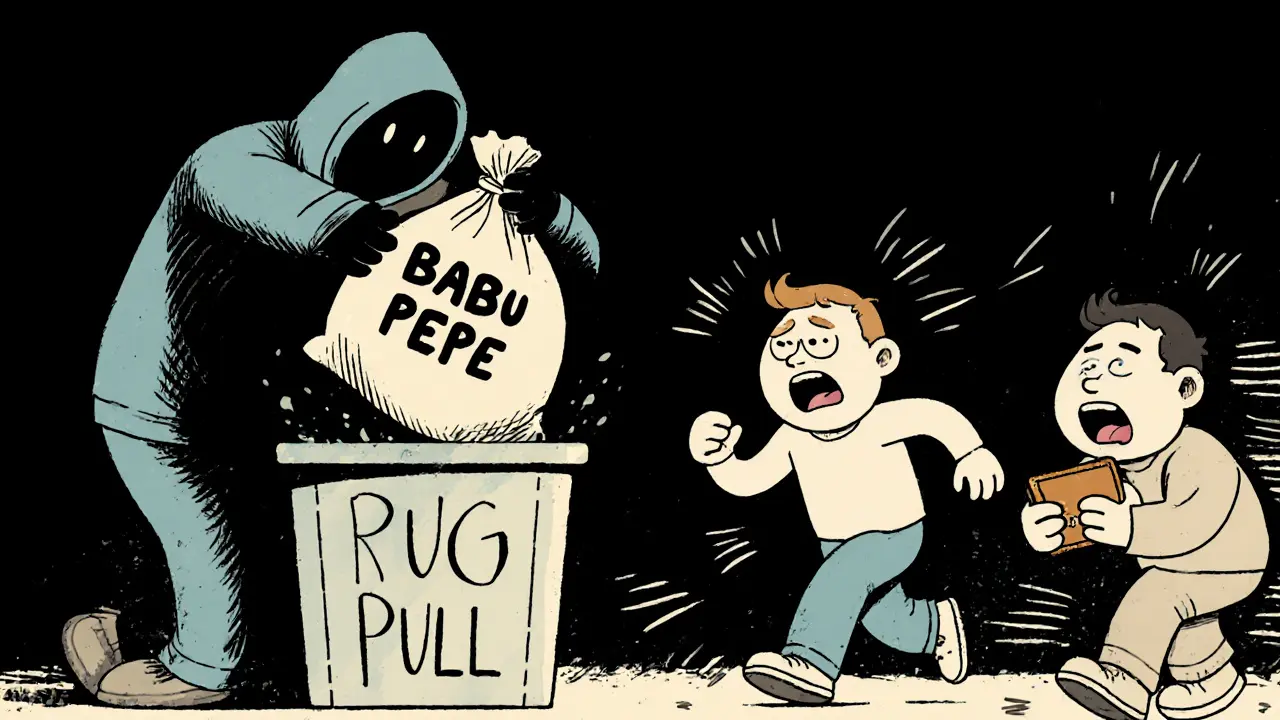

On Reddit, users openly call it a rug pull. One person wrote: “Bought 50 trillion for $5. Now it’s worth $0.50. Classic.” Trustpilot reviews average 1.2 out of 5 stars. Complaints? “Can’t sell.” “Gas fees ate my money.” “No one responds.” These aren’t isolated stories-they’re the norm.

How do you buy Babu Pepe? (And why you shouldn’t)

If you still want to try, here’s how: connect a Web3 wallet like MetaMask to PancakeSwap, swap BNB for $BABU, and pray the transaction goes through. But you need to set slippage tolerance to 10-25% because the market is so thin. Even then, you might get stuck with coins you can’t sell.

Here’s the brutal truth: this isn’t investing. It’s gambling. You’re not betting on a project-you’re betting on someone else being dumber than you. And statistically, you’re almost always wrong. According to Chainalysis, 97% of tokens like this lose over 90% of their value within six months if there’s no development activity. Babu Pepe has none.

Why does it even exist?

Babu Pepe exists because the crypto space is full of people chasing quick, unrealistic gains. Meme coins thrive on FOMO-fear of missing out. A viral post, a TikTok trend, or a Reddit thread can send a token like this soaring overnight. Then, the original buyers cash out. The rest are left holding worthless tokens.

There’s no innovation here. No smart contracts. No staking. No NFTs. No utility. It’s not even trying to be more than a joke. Even other meme coins like Dogecoin have merchant acceptance. Shiba Inu has its own exchange. Babu Pepe has nothing. Not even a logo that’s consistent across platforms.

Expert analysis: A red flag on every level

CoinCodex gives Babu Pepe a “Bearish” sentiment and a volatility risk rating of 89 out of 100-classified as “Extreme Risk.” Their price prediction says it will drop another 25% by early December. No major crypto news site, analyst, or research firm has written a serious piece on it. Why? Because there’s nothing to analyze. It’s a ghost coin.

Even CoinDesk’s 2025 Meme Coin Sustainability Index labeled Babu Pepe as “Critical Risk.” That’s the worst category. Tokens in this group typically vanish within months. The only people who profit are the ones who created it and sold early.

The bottom line: Don’t touch it

Babu Pepe ($BABU) is not a cryptocurrency you should own. It’s not an investment. It’s not even a fun experiment. It’s a high-risk gamble with near-zero chance of success. The price might spike tomorrow, and you might make a dollar. But more likely, you’ll lose everything you put in.

If you’re new to crypto, stay away from tokens like this. Stick to projects with real teams, transparent roadmaps, and measurable use cases. If you’re experienced and still tempted, ask yourself: why would anyone build a $7,640 coin? The answer is simple-they didn’t. They just dumped a meme on a blockchain and walked away.

There’s no future in Babu Pepe. Only noise.