WenX Pro Fee Calculator

Trade Calculator

Fee Comparison

WenX Pro has daily volume under $50M. Large trades may experience up to 1.8% slippage on less popular pairs as noted in the article.

Enter trade amount to see fee comparison

Looking for a crypto exchange that puts security front‑and‑center? WenX Pro review breaks down whether the platform lives up to its hype, how its fees stack up, and if its liquidity can handle real‑world trading.

What Is WenX Pro?

WenX Pro Crypto Exchange is a digital‑assets trading platform launched as part of the broader WEN ecosystem. The service markets itself as a "world‑leading" exchange with a focus on enhanced security and low transaction costs. While the exact founding date isn’t widely public, the platform has been live since early‑2024 and targets users who value asset protection over a massive coin roster.

The exchange’s UI is web‑based, accessible through standard browsers. Mobile apps exist, but documentation is sparse, and the API is still in beta, limiting integration with third‑party bots for most traders.

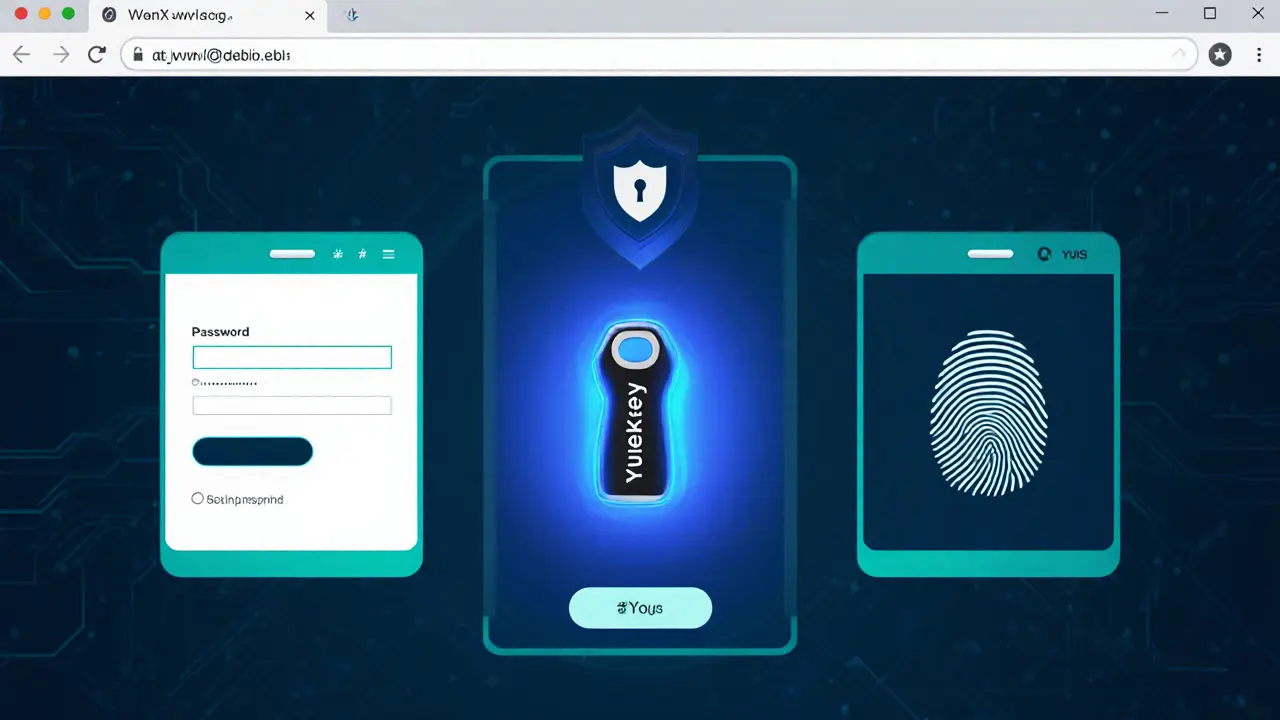

Security Focus - 3FA and Wallet Architecture

The headline security claim is Three‑Factor Authentication (3FA). Three‑Factor Authentication combines something you know (password), something you have (hardware token), and something you are (biometric). This pushes protection beyond the typical Two‑Factor Authentication (2FA) used by 92% of the top‑20 exchanges, according to Chainalysis 2025 data.

In practice, 3FA means a hacker would need to steal your password, hijack your physical token, and spoof your fingerprint or face scan - a combo that security researchers estimate reduces account‑takeover risk by roughly 99.9% compared to single‑factor logins.

Beyond login protection, WenX Pro employs a dual‑wallet system. Cold Storage holds the bulk of user funds offline, while Hot Wallet reserves a smaller portion for instant trades.

Exact percentages aren’t disclosed, but industry best practice keeps 95‑98% of assets cold. Without an independent audit, the exact cold‑storage allocation remains a question mark.

Compliance is another pillar - the platform enforces strict KYC (Know Your Customer) and AML (Anti‑Money Laundering) checks during onboarding. Users must submit ID, proof of address, and a selfie for facial verification.

Trading Features - Contracts and the Lucky 8 Bot

WenX Pro isn’t just a spot‑trading venue. It offers perpetual contracts, allowing traders to hold leveraged positions without expiry dates. This aligns it with major players like Binance Futures, though the number of contract pairs is limited.

For automation fans, there’s the proprietary Lucky 8 Trading Bot. The bot claims to execute high‑frequency strategies based on market‑making algorithms. Documentation is thin, and the bot is only available to users who opt‑in after passing the 3FA setup.

Overall, the feature set caters to intermediate traders who want derivatives and some automation without diving into fully‑custom API development.

Fee Structure and Cost Comparison

The exchange markets “low deposit fees,” but concrete percentages are missing. In the absence of published maker/taker rates, we can only benchmark against known fees:

- Binance: 0.10% standard taker, 0.02% maker.

- Coinbase: 0.50% flat on most trades.

- Kraken: 0.16% maker, 0.26% taker.

Users on community forums report that WenX Pro’s fees feel “around 0.08%‑0.12%” for spot trades, but that’s anecdotal. Deposit fees for fiat are reportedly free for most currencies, while withdrawal fees follow a coin‑specific schedule similar to Binance.

Because fee transparency is limited, traders should test with a small amount before committing large capital.

Liquidity and Coin Selection

Liquidity is the lifeblood of any exchange. WenX Pro currently lists “hundreds of cryptocurrencies,” but exact numbers aren’t published. By contrast:

- Binance supports over 350 coins.

- Coinbase offers 250+.

- KuCoin lists around 700.

Reddit users have complained about slippage on less‑popular pairs - one trader noted that an ETH trade suffered a 1.8% price impact because order‑book depth was thin. Daily trading volume stays below $50 million, a fraction of Binance’s $35 billion.

If you need deep liquidity for large swaps or want to trade obscure altcoins, WenX Pro may feel restrictive.

User Experience, Support & Community

The platform advertises a “clean” UI. First‑time users report a moderate learning curve - the 3FA setup adds a few minutes, and the help center offers step‑by‑step guides. However, live‑chat and direct email support details are hard to locate, and the only contact form is nested inside the help portal.

Community feedback is scarce. TrustFinance shows a single user review with a 2.6/5 TrustScore, and Reddit mentions number only a handful of times. No reviews appear on Trustpilot or Capterra, indicating a very small user base compared to Coinbase’s millions of ratings.

The lack of a vibrant community makes it harder to find third‑party tutorials or troubleshooting tips.

Pros, Cons & Bottom Line

Pros

- Three‑Factor Authentication offers a strong security edge.

- Dual‑wallet storage separates hot and cold funds.

- Perpetual contracts and a proprietary bot add advanced trading tools.

- Low‑fee claim (if true) could benefit cost‑sensitive traders.

Cons

- Liquidity is thin; large orders suffer slippage.

- Coin selection is limited compared to top exchanges.

- Fee schedule isn’t fully disclosed; lack of transparency.

- No public security audit; trust gaps remain.

- Customer support channels are vague.

Bottom line: WenX Pro shines for security‑conscious traders who don’t need a massive coin roster or ultra‑high volume. If you trade modest amounts and value a 3FA login, it’s worth a small trial. For high‑frequency or large‑scale investors, established exchanges with proven liquidity and audit‑backed security still have the edge.

Comparison Table

| Feature | WenX Pro | Binance | Coinbase |

|---|---|---|---|

| Security Login | Three‑Factor Authentication (3FA) | Two‑Factor Authentication (2FA) | Two‑Factor Authentication (2FA) |

| Cold‑Storage Ratio | Undisclosed (dual‑wallet) | ~98% of funds | ~95% of funds |

| Spot Coins | Hundreds (exact unknown) | 350+ | 250+ |

| Derivatives | Perpetual contracts (limited pairs) | Futures, perpetuals, options | No native futures (via Coinbase Pro only) |

| Trading Fees (spot) | ~0.08‑0.12% (unverified) | 0.10% taker / 0.02% maker | 0.50% flat |

| Daily Volume | < $50 M | $35 B | $5 B |

| Customer Support | Help center, no live chat | 24/7 live chat, phone | Phone & chat for premium tiers |

Frequently Asked Questions

Is WenX Pro safe to use without a third‑party audit?

The platform’s 3FA and dual‑wallet design add layers of protection, but without an independent security audit you can’t verify how much of the funds are truly cold‑stored or how the backend handles breaches. Treat it like a semi‑trusted service and avoid storing large balances on the exchange.

How do I enable Three‑Factor Authentication?

After logging in, go to Settings → Security → Three‑Factor Authentication. You’ll set a password, link a hardware token (e.g., YubiKey), and enrol a biometric (fingerprint or facial scan) via your device’s native sensor.

Can I trade Bitcoin with leverage on WenX Pro?

Yes, the platform offers perpetual contracts on major pairs like BTC/USD with up to 10× leverage. Liquidity is lower than on Binance Futures, so you may see higher slippage on large positions.

What are the withdrawal fees?

Withdrawal fees follow a coin‑specific schedule similar to other exchanges - for example, Bitcoin withdrawal is 0.0005 BTC and Ethereum is 0.005 ETH. Exact numbers are listed on the fees page after you log in.

Is there a mobile app?

A basic Android and iOS app exists, but features lag behind the web version. The app supports spot trading, 3FA login, and viewing balances, but perpetual contracts and the Lucky 8 bot are web‑only for now.

Ready to give WenX Pro a spin? Start with a small deposit, lock in 3FA, and test the liquidity on a low‑risk pair. If the experience feels solid, you can gradually increase exposure. If you hit slippage or need more coins, consider switching to a larger exchange for those specific needs.

Comments (7)