Real Estate Transaction Cost Calculator

How Smart Contracts Reduce Real Estate Costs

Traditional real estate transactions involve multiple intermediaries and paperwork. Smart contracts automate these processes, potentially cutting transaction fees by up to 70%. Enter your property details to see the potential savings.

Estimated Costs

How This Works

Traditional real estate transactions typically involve 5-10% in fees for title searches, escrow, attorney fees, and other intermediaries. Smart contracts automate these processes, reducing costs to just a few hundred dollars for blockchain transactions and oracle fees.

When people hear smart contract use cases, they instantly think of buying Bitcoin or trading tokens. But the reality is far richer - smart contracts are reshaping everyday industries by removing middlemen, cutting paperwork, and guaranteeing that rules run exactly as programmed.

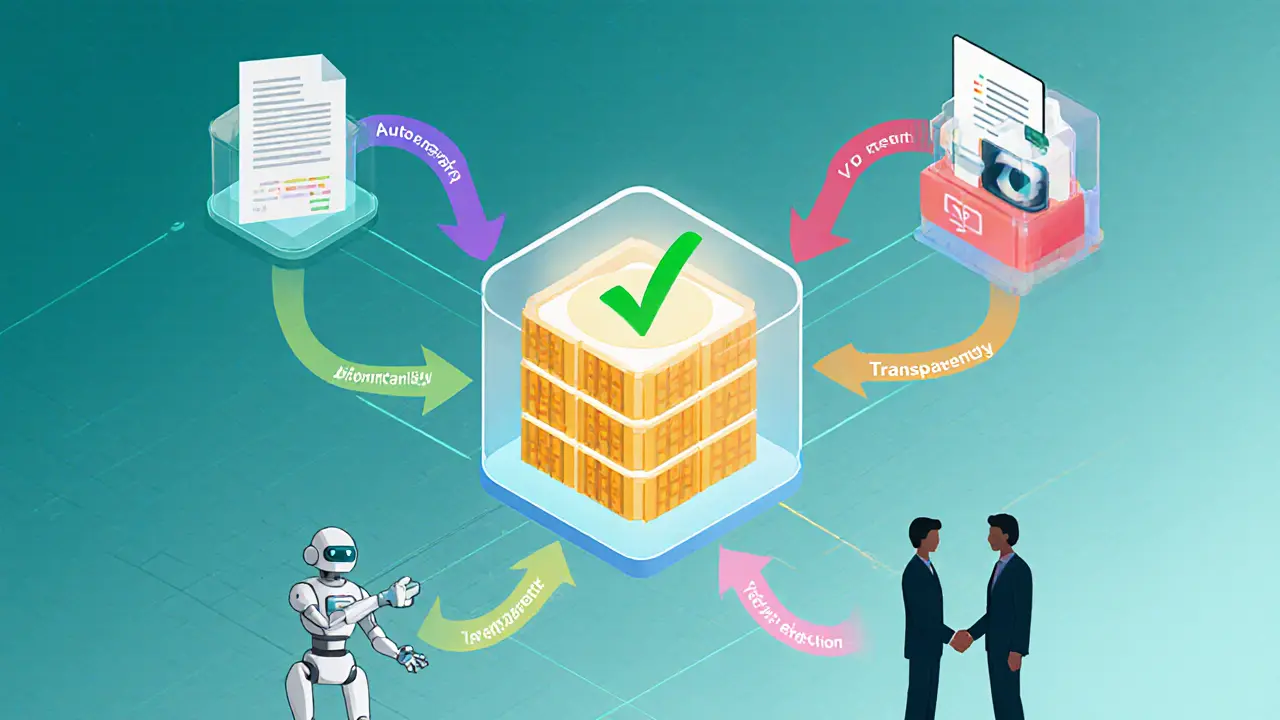

Smart contracts are self‑executing code stored on a blockchain that automatically enforces the terms of an agreement without a trusted intermediary. Once the predefined conditions are met, the contract runs its logic and updates the ledger, making the outcome immutable and transparent.Why Smart Contracts Matter Outside Crypto

Traditional agreements rely on lawyers, banks, and paper trails. Those steps add cost, delay, and opportunities for error or fraud. By moving the logic onto a decentralized ledger, smart contracts provide three core benefits that apply to any sector:

- Automation - actions happen automatically when conditions are satisfied.

- Transparency - every participant can view the same immutable record.

- Trustless execution - parties don’t need to trust each other, only the code.

Real Estate: Faster, Safer Property Deals

Buying a house usually means juggling title searches, escrow agents, and endless paperwork. Smart contracts streamline the whole flow:

- Seller uploads the deed to a blockchain‑based registry.

- Buyer deposits funds into a smart escrow contract.

- When a title‑search oracle confirms clear ownership and inspections pass, the contract releases the money and updates the on‑chain title.

Platforms like Propy and Real have already recorded dozens of property sales, cutting closing time from weeks to hours and slashing transaction fees by up to 70 %.

Parametric Insurance: Payouts Triggered by Data, Not Claims

Traditional insurers spend weeks processing claims, often disputing whether a loss meets policy criteria. A parametric contract embeds an external data feed - an oracle - and pays out automatically when a pre‑agreed metric is hit.

Examples:

- Crop insurance: If NOAA reports rainfall below a threshold, the contract releases funds to farmers.

- Flight delay coverage: Chainlink oracles pull flight status; any delay over two hours triggers an immediate payout to the passenger.

Companies like Arbol and Etherisc have launched production‑ready products, giving farmers in remote regions a reliable safety net without lengthy paperwork.

Supply Chain Transparency: From Factory to Fork

Consumers increasingly demand proof that products are genuine and ethically sourced. Smart contracts record each handoff on a shared ledger, creating an auditable trail:

- Manufacturer stamps a digital token on the product.

- Each logistics partner updates the token with location, temperature, and custody data.

- Retailer scans the token; the contract verifies compliance before the item reaches shelves.

This approach helped a major food brand quickly locate the source of a contamination outbreak, limiting recall costs by 40 %.

Healthcare & Digital Identity: Secure Records That Patients Control

Medical records are fragmented across hospitals, labs, and insurers. A smart‑contract‑based identity system lets patients own a single digital ID that references encrypted health data. When a doctor needs access, the patient grants a time‑limited permission via the contract, and the blockchain logs the request for audit.

Projects such as MyEarth ID demonstrate how this model can protect privacy while still enabling credit checks, insurance underwriting, and telemedicine services.

Energy Trading: Peer‑to‑Peer Power Markets

Households with rooftop solar can sell excess kilowatts directly to neighbors. A smart contract matches supply and demand in real time, settles payments in cryptocurrency or local fiat, and records the trade on‑chain.

Platforms like Power Ledger have facilitated millions of kWh of peer‑to‑peer trades, encouraging more households to install solar panels and reducing reliance on centralized utilities.

Gaming & Digital Asset Management: True Ownership in Virtual Worlds

In Web3 games, every in‑game item - swords, skins, virtual land - is an NFT backed by a smart contract. The contract enforces scarcity, royalties, and transfer rules without a central server.

Axie Infinity’s play‑to‑earn model let players earn a living wage in several countries, while Illuvium shows how decentralized economies can fund game development through token sales.

Voting & Governance: Tamper‑Proof Elections

Smart‑contract‑based voting systems record each encrypted vote on a public ledger. Because the data is immutable, any attempt to alter results would be instantly visible to all auditors.

Pilot projects in local municipalities have reported higher voter participation when remote, blockchain‑secured voting was offered, though regulatory hurdles remain a significant barrier.

DeFi & Real‑World Asset Tokenization: Finance Without Borders

Decentralized finance platforms like Aave and Compound already lend crypto without banks. The next wave is tokenizing real assets - real estate, invoices, carbon credits - and using smart contracts to manage loans, dividends, and secondary markets.

Centrifuge’s invoice‑backed tokens let small businesses obtain working capital instantly, while platforms such as RealT enable fractional ownership of rental properties, democratizing access to traditionally illiquid markets.

Challenges to Widespread Adoption

Despite the hype, several hurdles still need attention:

- Technical complexity: Writing secure contracts requires specialized developers.

- Scalability: Public blockchains can process only a few dozen transactions per second, prompting the rise of layer‑2 solutions.

- Regulatory uncertainty: Governments are still drafting rules around tokenized assets and cross‑border data sharing.

- User experience: Average consumers struggle with wallet management and key recovery.

Industry consortia, such as the Enterprise Ethereum Alliance, are building standards to address these pain points, and many enterprises are already running private‑permissioned chains for internal use.

Quick Checklist for Starting a Smart‑Contract Project

- Define the exact business rule you want to automate.

- Choose a blockchain (public vs. permissioned) that meets throughput and privacy needs.

- Integrate reliable oracles for any off‑chain data.

- Run a professional security audit before deployment.

- Plan a user‑friendly interface - wallets, key recovery, and support.

Frequently Asked Questions

Can smart contracts replace lawyers?

They can automate many routine clauses - escrow, payments, deadlines - but complex negotiations, liability judgments, and regulatory compliance still need human expertise.

What happens if a smart contract has a bug?

If the contract is immutable, the bug stays forever. The usual fix is to deploy a new contract and migrate assets, which is why thorough audits and upgradable proxy patterns are recommended.

Do I need to own cryptocurrency to use a smart‑contract solution?

Public blockchains typically require gas fees paid in the network’s native token. Permissioned or hybrid solutions can be built to accept fiat or stablecoins, removing that barrier.

How secure are oracle data feeds?

Oracles like Chainlink aggregate multiple sources, apply cryptographic proofs, and provide reputation scores, making them far more reliable than a single API.

Is there a regulatory framework for tokenized real‑world assets?

Regulators are drafting guidance; in many jurisdictions tokenized securities must comply with existing securities law, meaning issuers need a prospectus and AML/KYC processes.

| Use Case | Key Benefit | Typical Industry |

|---|---|---|

| Automated Escrow & Title Transfer | Instant settlement, lower fees | Real Estate |

| Parametric Payouts | Claims paid in minutes | Insurance |

| Supply‑Chain Traceability | Full product provenance | Manufacturing & Food |

| Peer‑to‑Peer Energy Trading | Monetize excess solar | Energy |

| In‑Game Asset Ownership | True scarcity, resale rights | Gaming |

| Digital Identity Verification | Privacy‑preserving KYC | Finance & Healthcare |

Comments (9)