Elk Finance isn't another big-name crypto exchange. You won't find it on mainstream news or hear it mentioned in casual crypto chats. But if you're tired of paying $10+ in gas fees to move USDC from Polygon to Avalanche, or you're tired of waiting 15 minutes for a bridge to confirm, then Elk Finance might actually be worth a look. It's not for everyone. It's not even for most people. But for a small group of DeFi users who live in the gaps between blockchains, Elk Finance offers something rare: a simple, cheap way to move tokens without jumping through hoops.

What Elk Finance Actually Does

Elk Finance isn't a traditional exchange where you buy Bitcoin with fiat. It doesn't have order books, spot trading, or margin trading. What it does is simpler, and honestly, more useful for a niche crowd: it moves tokens between blockchains. Think of it like a tunnel connecting different highways. You get on at Polygon, drive through the ElkNet bridge, and exit on Solana or Avalanche. No swaps. No conversions. Just moving your assets from one chain to another.

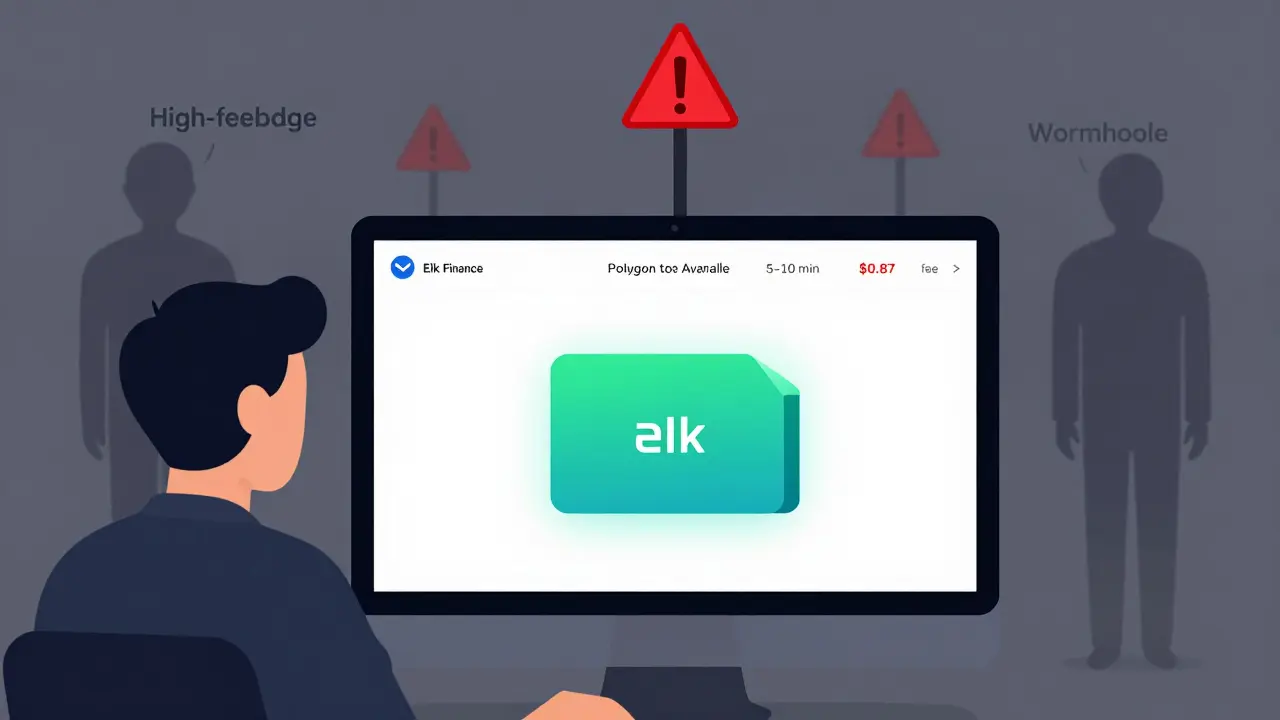

The core tech here is the ElkNet bridge. It supports 14 blockchains, including Ethereum, Polygon, BSC, Avalanche, Arbitrum, Optimism, and Solana. That’s more than most cross-chain tools. And unlike some bridges that charge high fees during congestion, Elk Finance claims to keep costs low even when Polygon is jammed. One Reddit user reported moving $1,000 worth of USDC from Polygon to Avalanche for just $0.87 in gas - a fraction of what you’d pay using Polygon’s native bridge during peak hours.

The platform runs on its own token, ELK. It’s not just a governance token. It’s used for staking, earning yield, and paying reduced bridge fees. You can hold ELK on Ethereum (ERC-20), Polygon (MATIC), or BSC (BEP-20). As of late 2023, the circulating supply was around 11.99 million tokens, with a market cap of roughly $274,000. That’s tiny compared to Uniswap’s $1.2 billion market cap, but it’s enough to keep the ecosystem alive for now.

How It Works: Step by Step

Using Elk Finance is straightforward - if you’ve used MetaMask before. Here’s how:

- Go to app.elk.finance (yes, that’s the real URL - no scams here, but double-check the domain).

- Connect your wallet: MetaMask, TrustWallet, or SafePal work best.

- Select your source chain (e.g., Polygon) and destination chain (e.g., Solana).

- Enter the amount you want to move. The interface shows you the estimated fee and time.

- Approve the token transfer (first time only).

- Confirm the bridge transaction. Wait 5-10 minutes.

That’s it. No KYC. No sign-up. No email. You own your keys, and you’re responsible for everything. The interface is clean but basic. No fancy charts. No news feed. Just the bridge. That’s intentional. Elk Finance isn’t trying to be a one-stop shop. It’s trying to be a fast, cheap tunnel.

Pros: Why Some People Love It

- Low fees on cross-chain moves - Especially during Polygon congestion, ElkNet often costs less than half of the native bridge.

- 14 supported chains - More than Wault Finance, more than Carbon Protocol. If you’re juggling multiple chains, this saves time.

- Non-custodial - Your funds never leave your wallet. No centralized exchange risk.

- Protection against impermanent loss - Liquidity providers on Elk Finance get fee rebates and insurance against price swings in pools.

- Active development - They added Base (Coinbase’s L2) in September 2023 and are building "Bridge-as-a-Service" for devs.

Cons: The Real Risks

- Extremely low trading volume - Only $19,930 in 24-hour volume as of October 2023. Compare that to Uniswap’s $1.2 billion. Low volume means slippage, illiquidity, and price manipulation risk.

- Only 2 coins listed - ELK and one other (usually USDC or MATIC). No ETH, no SOL, no BTC. You can’t trade them. You can only move them.

- No regulation - FxVerify confirms Elk Finance has no license from any government. That means no recourse if something goes wrong.

- Low traffic - Only 1,041 monthly visits according to SimilarWeb. That’s less than a small blog. If the team disappears, so does the bridge.

- Technical issues - Some users report transaction failures during high congestion. The platform advises monitoring gas prices - which means you need to understand blockchain mechanics.

How It Stacks Up Against the Competition

Elk Finance doesn’t compete with Binance or Coinbase. It competes with other cross-chain bridges: Multichain, Synapse, Wormhole, and Across Protocol.

| Feature | Elk Finance | Multichain | Synapse | Wormhole |

|---|---|---|---|---|

| Chains Supported | 14 | 30+ | 25+ | 20+ |

| 24-Hour Volume | $19.9K | $42M | $28M | $15M |

| Regulated? | No | No | No | No |

| Bridge Fee (Avg) | $0.50-$1.20 | $1.50-$4.00 | $1.00-$3.00 | $1.00-$5.00 |

| Time to Confirm | 5-10 min | 5-15 min | 7-20 min | 10-30 min |

| Wallet Support | MetaMask, TrustWallet, SafePal | Most major wallets | Most major wallets | Most major wallets |

Elk Finance wins on cost and simplicity. It loses on volume, trust, and features. If you’re moving small amounts ($100-$1,000) occasionally, Elk is a good pick. If you’re moving $10,000+ daily, you’re better off with Multichain or Synapse - even if they cost more.

Is It Safe? The Big Question

No bridge is 100% safe. Wormhole got hacked for $320 million in 2022. Multichain lost $600 million in 2023. Elk Finance has never been hacked - but it’s also never been tested at scale.

The real risk isn’t the code. It’s the team. Elk Finance’s founders are anonymous. There’s no public roadmap beyond "Bridge-as-a-Service." No team page. No LinkedIn profiles. No audits published on CertiK or Hacken. The only proof of legitimacy is that the smart contracts are live, the bridge works, and users are using it.

That’s not enough for most investors. But for experienced DeFi users who treat every bridge like a risky bet - and only use what they can afford to lose - it’s acceptable. The rule here is simple: never deposit more than you’re willing to lose. And never use your life savings.

Who Is This For?

Elk Finance isn’t for beginners. It’s not for people who want to buy Bitcoin with a credit card. It’s not for traders looking for leverage or yield on stablecoins.

It’s for:

- DeFi power users who move tokens between chains daily.

- Users tired of high Polygon gas fees.

- People who already use MetaMask and understand wallet security.

- Those who value speed and low cost over brand recognition.

If you’re in this group, Elk Finance is one of the few tools that actually delivers on its promise. If you’re not? Skip it. There are better places to start.

Final Verdict: Worth It?

Elk Finance is not a revolution. It’s not going to replace Uniswap or Binance. But it solves a real problem: expensive, slow cross-chain transfers. For a small group of users, it’s the cheapest, fastest option available.

Its biggest weakness isn’t tech - it’s scale. Without more users, it won’t attract more liquidity. Without more liquidity, it won’t become more reliable. It’s a chicken-and-egg problem.

If you’re a niche DeFi user and you’re already on Polygon, Avalanche, or Solana - try it with $10. See how fast it is. See how cheap it is. If it works, you’ll know. If it breaks? You lost $10. Not your house. Not your retirement.

That’s the real test. Not the price predictions. Not the market cap. Not the Reddit hype. Just whether it works when you need it to.

Is Elk Finance safe to use?

Elk Finance is non-custodial, so your funds stay in your wallet. But it’s unregulated, anonymous, and has never been audited publicly. It’s as safe as any small DeFi bridge - meaning it works for now, but carries risk. Never deposit more than you can afford to lose.

Can I trade other coins on Elk Finance?

No. Elk Finance is not a trading exchange. It only allows you to bridge tokens between blockchains. You can’t buy or sell ETH, SOL, or BTC on the platform. You can only move them.

How do I get ELK tokens?

You can buy ELK on decentralized exchanges like QuickSwap (Polygon) or PancakeSwap (BSC). You can also earn it by providing liquidity on Elk Finance’s yield pools. The token is available on Ethereum, Polygon, and BSC.

Does Elk Finance have a mobile app?

No. Elk Finance is a web-based platform only. You need to use it through your browser on desktop or mobile. Make sure you’re using a trusted wallet like MetaMask or TrustWallet on your phone.

What happens if Elk Finance shuts down?

If the team disappears, the bridge could stop working. But your tokens won’t vanish. They’ll remain on the original chain you sent them from. You can still access them with your wallet. The only thing lost is the convenience of the bridge. You’d need to find another way to move your assets.

Is Elk Finance better than the Polygon bridge?

Only if you’re moving to a chain other than Ethereum. The native Polygon bridge is free and fast for moving between Polygon and Ethereum. But if you want to go to Solana, Avalanche, or Base, Elk Finance is cheaper and faster - especially during Polygon congestion.

Elk Finance isn’t glamorous. It doesn’t have a celebrity CEO or a viral TikTok campaign. But in the quiet corners of DeFi, where users care more about gas fees than hype, it’s quietly doing the job it was built for. If you need to move tokens fast and cheap - and you know what you’re doing - it’s one of the few tools that actually delivers.