Managing liquidity pool positions isn’t just about depositing tokens and waiting for fees to roll in. If you’re treating it like a savings account, you’re leaving money on the table-or worse, losing it. In 2025, successful liquidity providers treat their positions like active trading strategies, not passive income streams. The difference between making 8% and 22% APY isn’t luck. It’s control.

What Exactly Is a Liquidity Pool Position?

A liquidity pool position is your share of a smart contract that holds two crypto tokens-like ETH and USDC-so traders can swap between them on decentralized exchanges (DEXs). You don’t own the tokens outright; you own a percentage of the pool. In return, you earn a cut of every trade that happens in that pool-usually 0.3% per swap on Uniswap, or as low as 0.01% on Curve for stablecoins.Back in 2021, people made 100%+ APY from liquidity mining rewards. Those days are gone. Today, most of your return comes from trading fees alone. That means your success depends on how well you manage price movements, gas costs, and risk-not just how much you deposit.

Impermanent Loss Is Your Biggest Enemy

Impermanent loss sounds technical, but it’s simple: it’s when the value of your deposited tokens drops compared to just holding them outside the pool. If ETH rises 50% while USDC stays flat, your pool gets rebalanced to maintain a 50/50 value split. You end up with less ETH than if you’d just held it.On volatile pairs like ETH/USDC, impermanent loss can hit 15-25% during big moves. On stablecoin pairs like USDC/DAI? It’s under 1.5%. That’s why 65% of new liquidity providers in 2025 started with stablecoin pools. They’re boring, but they protect your capital.

Here’s the math: If you deposit $1,000 in ETH/USDC and ETH jumps 40%, your position might be worth $1,180 after impermanent loss. But if you’d just held the ETH, it’d be worth $1,400. That’s a $220 opportunity cost. Monitoring your position’s price range is not optional-it’s survival.

Uniswap V3 Changed Everything

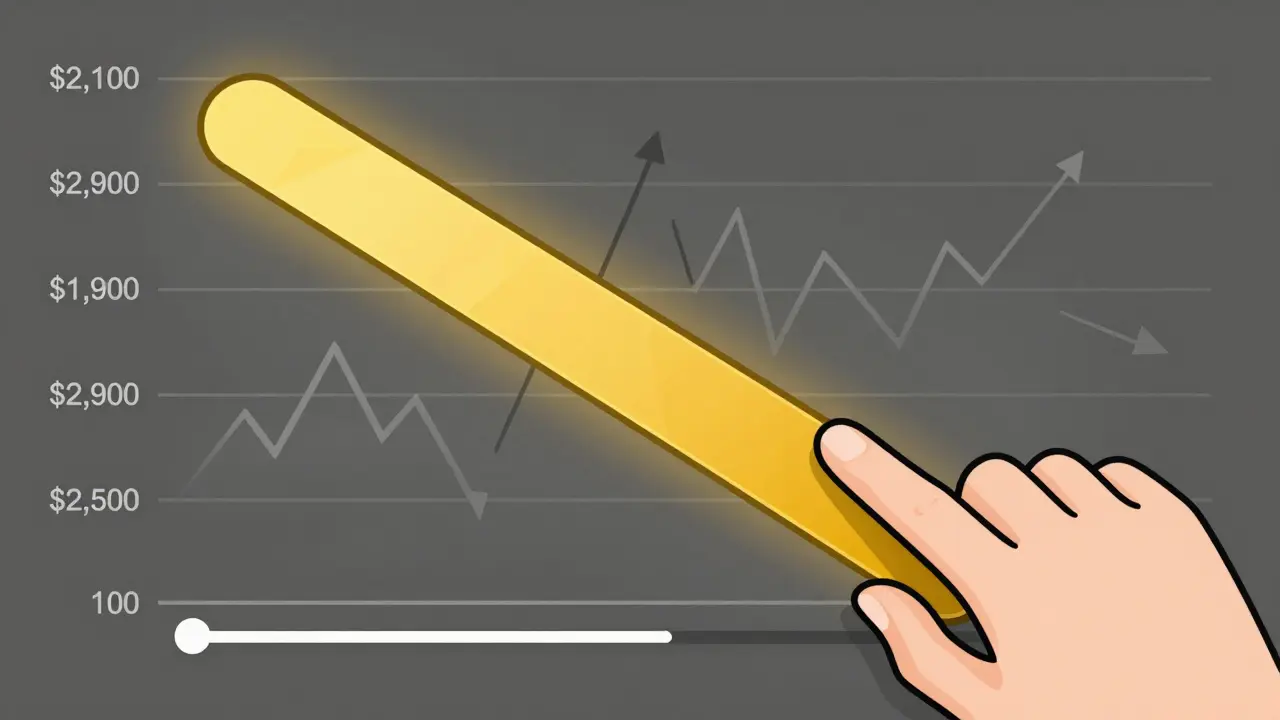

Before Uniswap V3, you had to spread your money across the full price range-from $0 to $100,000 for ETH. That meant your capital was diluted. Now, you can concentrate your liquidity between two prices-say, $1,900 and $2,100 for ETH/USDC if ETH is trading at $2,000.This is called concentrated liquidity. And it’s powerful. You can earn up to 4,000x more fees per dollar than traditional pools-if you stay in range. But if ETH moves outside your range, you earn zero fees until it comes back. That’s why 65-80% of fee income is lost when positions are left unadjusted for more than 30 days.

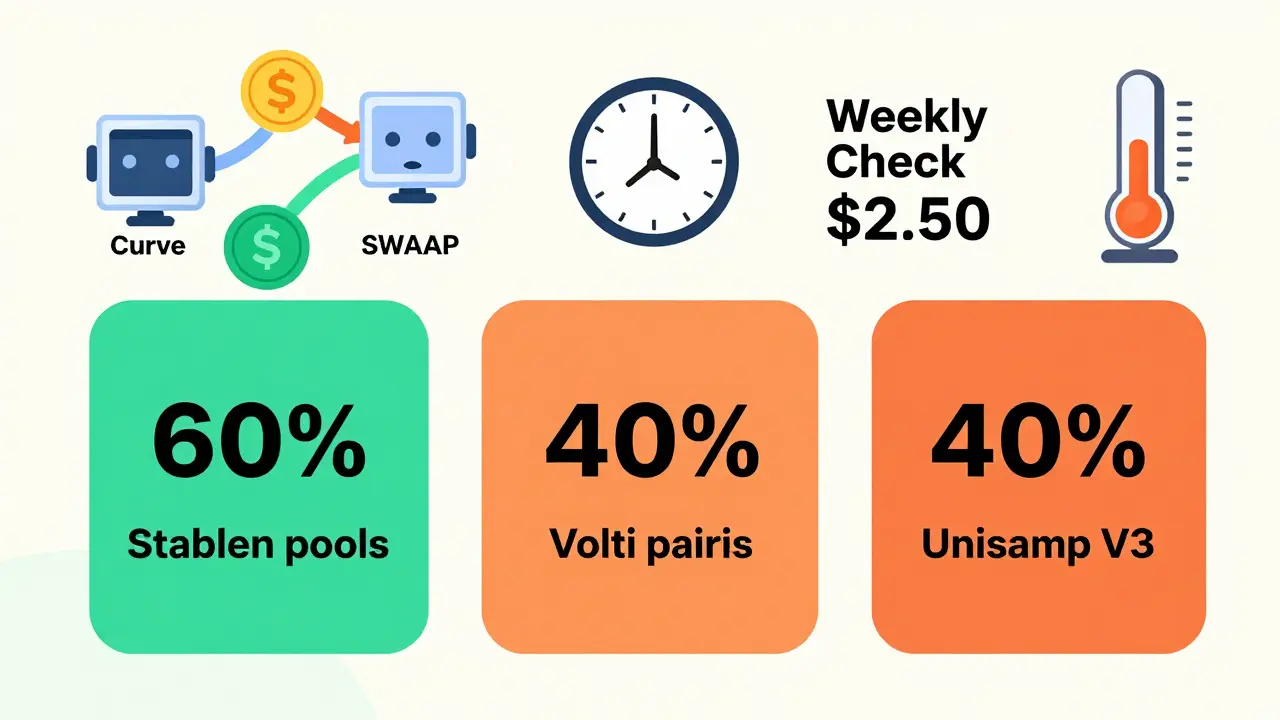

Top performers adjust their ranges every time the price moves 15-20%. That means checking your position weekly, sometimes daily. Tools like Zapper.fi and SWAAP’s Autopilot help automate this, but they’re not perfect. Gas fees on Ethereum can spike from $2 to $50 in hours. Waiting for the right moment to rebalance saves money and keeps you in range.

Stablecoin Pools Are the Safe Bet

Curve Finance dominates stablecoin liquidity. Its algorithm is built for minimal slippage and low impermanent loss. USDC/DAI, USDT/USDC, and DAI/USDT pools on Curve consistently deliver 2-4% APY with almost no volatility risk.Compare that to ETH/USDC on Uniswap V3: you might earn 8-15% APY, but you’re exposed to massive price swings. The smart move? Split your capital. Delphi Digital’s 2025 research shows the optimal portfolio is 60% stablecoin pools, 40% volatile pairs. That way, you get steady income from stablecoins and higher returns from volatile ones-without blowing up your portfolio.

Other Platforms: Curve, Balancer, and When to Use Them

Not all pools are created equal. Here’s how they stack up:| Platform | Best For | APY Range | Impermanent Loss Risk | Management Effort |

|---|---|---|---|---|

| Curve Finance | Stablecoin pairs (USDC/DAI) | 2-4% | Low (0.5-1.5%) | Low |

| Uniswap V3 | Volatile pairs (ETH/USDC) | 5-15% | High (15-25%) | High |

| Balancer | Multi-token pools (e.g., 80/20 ETH/USDC) | 4-10% | Medium | Medium |

Balancer lets you build pools with custom weights-like 80% ETH and 20% USDC. That’s great for reducing exposure to one asset, but thin liquidity means you might not get filled on big trades. Use it if you’re comfortable managing complexity. For most people, stick to Curve for stablecoins and Uniswap V3 for ETH or BTC pairs.

Gas Fees and Timing Matter More Than You Think

Every time you adjust a position, add liquidity, or withdraw, you pay gas. On Ethereum, that’s $1.50-$5 during quiet times. During a market crash or a big announcement? It jumps to $15-$50.One user on Reddit lost $1,200 in gas fees trying to rebalance during the May 2024 crash. He was frantic. He didn’t wait. He just kept clicking. That’s a mistake.

Wait for off-peak hours-late at night UTC, or early Sunday morning. Use Etherscan’s Gas Now tool. Set alerts. If you’re only adjusting every 2-3 weeks, you don’t need to rush. Patience saves money.

Security: Don’t Get Hacked Because You Were Lazy

DeFi hacks cost $2.3 billion through Q3 2024. Most weren’t smart contract flaws. They were user errors.Never approve unlimited token allowances. Always set a specific amount-like $500 for a deposit. Use a hardware wallet like Ledger or Trezor for any action over $1,000. Double-check contract addresses. A fake Uniswap pool with a slightly misspelled name has stolen millions.

Verify contracts on Etherscan. Look for audits from reputable firms like CertiK or Trail of Bits. If a pool has no audit, walk away. No exceptions.

How to Start (Step-by-Step for Beginners)

If you’re new, here’s how to get started without losing your shirt:- Start small. Deposit 0.1-0.5 ETH equivalent. Don’t go all-in.

- Use Curve for your first pool. Deposit USDC/DAI. It’s safe and teaches you how the interface works.

- Check DefiLlama. Only use pools with over $10 million TVL and $1 million daily volume. Thin pools are death traps.

- Use Zapper.fi or DeBank to track your positions. They show real-time impermanent loss and fee earnings.

- Set weekly reminders to check if your Uniswap V3 ranges are still active. If ETH moved 15%+, adjust it.

- Never use unlimited approvals. Always set exact amounts.

- Withdraw in tranches. Don’t pull everything out at once during a crash. Let some stay in to earn fees while you wait for the market to settle.

What the Top 10% Do Differently

The best liquidity providers don’t just react-they plan. They:- Diversify across at least three protocols (Curve, Uniswap, Balancer)

- Use automated tools to rebalance when price moves 10-15%

- Track their breakeven point: how many fees they need to earn to cover impermanent loss

- Rebalance their portfolio quarterly, not monthly

- Keep 15-20 hours a month on position management

Chainalysis data shows these users earn 22-37% more than passive holders. They don’t work harder. They work smarter.

What’s Next? Automation and Regulation

In 2025, automation is no longer a luxury-it’s a necessity. Uniswap’s Position Manager (launched Jan 2025) and SWAAP’s Autopilot use AI to adjust ranges automatically. They’re not perfect, but they cut management time by 60%.Regulation is catching up. The SEC’s February 2025 guidance classified some LP tokens as securities. That’s why 43% of protocols now require KYC for deposits over $10,000. It’s slowing retail adoption, but it’s making DeFi more institutional. That’s a good thing long-term.

By 2026, most liquidity management tools will be built into DEXs. You won’t need Zapper.fi or DeBank-you’ll manage everything inside Uniswap or Curve. But until then, staying informed and active is your edge.

Final Thought: It’s Not Passive Income. It’s Active Management.

Liquidity provision isn’t about earning free crypto. It’s about being a market maker. You’re providing the glue that keeps decentralized trading alive. And like any professional market maker, you need rules, discipline, and constant attention.Forget the hype. Forget the 100% APY memes. In 2025, the winners are the ones who treat liquidity like a business-not a lottery ticket.

What’s the safest liquidity pool for beginners?

Start with stablecoin pools on Curve Finance, like USDC/DAI. These have minimal impermanent loss (under 1.5%), low slippage, and consistent 2-4% APY. They’re boring, but they protect your capital while you learn how the system works.

How often should I rebalance my Uniswap V3 position?

Rebalance every time the price moves 15-20% outside your set range. For ETH/USDC, that could mean checking weekly. If ETH jumps from $2,000 to $2,300 and your range is $1,900-$2,100, you’re earning zero fees. Adjust your range to $2,100-$2,500 to stay in the action.

Can I lose more than I deposited in a liquidity pool?

No, you can’t lose more than you deposited. But you can lose value compared to just holding the tokens. This is called impermanent loss. If ETH surges 50% and you’re in an ETH/USDC pool, you’ll have less ETH than if you’d held it outside the pool. You still have your original deposit, but you missed out on the upside.

Is Uniswap V3 better than traditional pools?

It’s better if you’re willing to manage it. Uniswap V3 can generate 4,000x more fees per dollar than traditional pools-but only if you stay in range. If you ignore it, you earn nothing. Traditional pools are simpler, safer, and require no active management, but they yield 60-75% less per dollar deployed.

What gas fees should I expect when managing liquidity?

On Ethereum, expect $1.50-$5 during quiet hours (late night UTC or Sunday morning). During market volatility, gas spikes to $15-$50. Always wait for low gas periods to adjust positions. Use Etherscan’s Gas Now tool to track real-time fees.

Should I use automated tools for liquidity management?

Yes-if you’re doing more than one position. Tools like SWAAP Autopilot and Uniswap’s Position Manager automate range adjustments and save 15-20 hours a month. They’re not perfect, but they reduce human error. Never fully trust them-always check the settings before they execute.

How do I know if a liquidity pool is safe?

Check three things: 1) TVL over $10 million on DefiLlama, 2) Daily volume over $1 million, 3) Audit from CertiK, Trail of Bits, or OpenZeppelin. Avoid pools with no audit, low volume, or unknown teams. If the contract address looks weird, don’t deposit.

What’s the best way to exit a liquidity position?

Withdraw in tranches. Don’t pull everything out at once during a crash. Keep 30-50% in the pool to keep earning fees while you wait for prices to recover. This reduces emotional decisions and lets you capture more fee income over time.