Bird Finance Airdrop Eligibility Checker

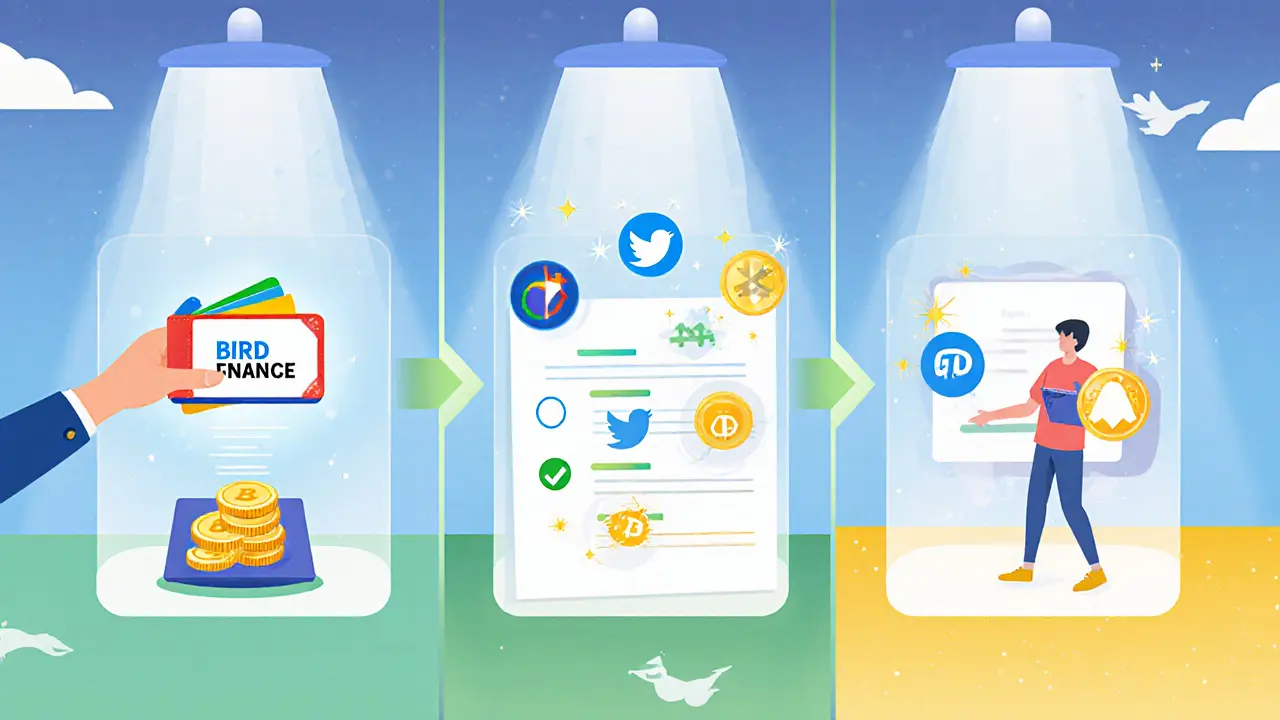

Check if you meet the basic eligibility requirements for the Bird Finance BIRD token airdrop. This tool provides a simplified assessment based on publicly known criteria.

Important: This is a simplified eligibility check only. Actual airdrop eligibility requires:

- 100+ BIRD tokens at snapshot time

- Completed community tasks (Twitter, Telegram, Discord)

- Official verification through Bird Finance portal

Always verify the official Bird Finance website: birdfinance.io

Wondering whether the Bird Finance airdrop is still on and how you can actually claim the BIRD tokens? The hype around BIRD has been clouded by mixed dates, similar project names, and a complex token model. This guide cuts through the noise, lays out the real eligibility criteria, walks you through the sign‑up process, and flags the biggest pitfalls you should watch out for.

Quick Takeaways

- Bird Finance’s airdrop timeline shifted from late 2024 to an uncertain Q1 2025 window; as of October 2025 no official distribution has been confirmed.

- Eligibility typically requires a minimum BIRD‑token holding (often 100 BIRD), wallet connection, and completing community tasks on Twitter, Telegram and Discord.

- The BIRD token has a 6 % transaction fee: 2 % to liquidity, 2 % to the DAO, 2 % redistributed to holders.

- Beware of similarly named projects-Birdchain and the Sui‑based “Birds” game-each runs its own unrelated airdrop.

- Before you submit any info, verify the official URL (birdfinance.io) and check for a recent audit report.

What is Bird Finance and the BIRD Token?

Bird Finance is a decentralized finance (DeFi) platform that offers a smart‑pool system designed to auto‑compound yield farming across multiple chains. Its native governance token, BIRD, functions as both a utility and voting asset within the ecosystem. Launched with a hyper‑deflationary model, 50 % of the total supply was burned to a black‑hole address, creating upward pressure on price with every transaction.

Airdrop Timeline and Current Status

Initial announcements slated the airdrop for 30 Nov 2024, then moved it to Q1 2025. As of today, October 2025, the project has not posted a definitive distribution date. The last official tweet (early September 2025) simply said “Airdrop rollout pending regulatory review.” This uncertainty means you should treat any claim of a live airdrop with skepticism until the official channel confirms it.

Eligibility Criteria - Who Can Actually Get BIRD?

Based on the most recent snapshot shared by Bird Finance, participants must meet three core requirements:

- Connect a compatible wallet (MetaMask, Trust Wallet, or Ledger) to the official airdrop portal.

- Hold at least 100 BIRD tokens at the snapshot date (usually the day before the airdrop launch).

- Complete community tasks: follow @BirdFinance on Twitter, join the Telegram group, retweet the pinned announcement, and fill out the short registration form.

Failing any of these steps disqualifies you, and the platform will automatically reject the claim.

Step‑By‑Step: How to Register for the Airdrop

- Step 1 - Verify the URL: Go to birdfinance.io and look for the “Airdrop” banner.

- Step 2 - Connect your wallet: Click “Connect Wallet,” approve the connection in your wallet app, and ensure you are on the Ethereum, Solana, HECO, or OKExChain network you plan to use.

- Step 3 - Complete social tasks: Follow the official Twitter, join Telegram, and like the pinned announcement. Paste the links to your profiles in the registration form.

- Step 4 - Confirm token holdings: The portal will read your balance; if you have less than 100 BIRD, you’ll see a warning.

- Step 5 - Submit and await confirmation: After submitting, you’ll receive an email with a tracking ID. Expect a review period of 7‑10 days.

Tokenomics - Why the 6 % Transaction Fee Matters

The BIRD token imposes a flat 6 % fee on every transfer. The fee is allocated as follows:

| Fee Portion | Destination | Purpose |

|---|---|---|

| 2 % | Liquidity Pool | Maintain market depth on DEXes |

| 2 % | DAO Treasury | Fund governance proposals |

| 2 % | Holder Redistribution | Reward existing BIRD holders |

This structure constantly burns tokens (the black‑hole address never releases its share) while rewarding active participants. However, the fee can deter small‑scale traders who prefer low‑cost swaps.

Confusion with Similar Projects

Three projects use the “BIRD” name, and each runs its own drop:

- Birdchain - a decentralized messaging app that airdropped 1 000 000 BIRD to early users. Requirements were simply joining their Telegram and following a Twitter account.

- Birds (Sui blockchain) - a mini‑game where players reach level 10 and link a Sui wallet to receive a token reward.

- Bird Finance - the DeFi platform we’re discussing, with a more complex eligibility set.

Always double‑check the token symbol and contract address before signing any transaction. The legitimate Bird Finance contract on Ethereum is 0xB1rdF1n4nce… (truncated for brevity).

Cross‑Chain Smart Pool Overview

Bird Finance’s core advantage is its auto‑compounding smart pool, which operates on four major chains: Solana, Ethereum, HECO, and OKExChain. The workflow looks like this:

- Stake base assets (e.g., USDC) to earn Btoken rewards.

- Stake Btoken into liquidity pools to harvest BIRD tokens.

- Use Btoken to mint NFT cards that can be staked for extra yields.

- Stake the NFT‑backed Btoken for a final layer of BIRD rewards.

This layered approach aims to maximize APY while spreading risk across chains. Yet, the bridge mechanisms linking these networks are still considered “high‑risk” by many auditors, so only allocate funds you can afford to lose.

Risks You Must Know Before Joining

- Regulatory uncertainty: DeFi projects face possible bans in major jurisdictions, which could freeze or delist the token.

- Smart‑contract bugs: Bird Finance’s code has not undergone a public audit from a top‑tier firm, increasing exploit risk.

- Market volatility: BIRD’s deflationary design can cause price spikes, but also sharp corrections when large holders sell.

- Name‑confusion scams: Fake “Bird Finance” sites mimic the UI to phish private keys; always verify the HTTPS certificate and URL.

Do a personal risk assessment and never share your seed phrase.

Comparison Table: Bird Finance vs. Similar Airdrops

| Project | Token Symbol | Main Requirement | Status (Oct 2025) |

|---|---|---|---|

| Bird Finance | BIRD | 100 BIRD + social tasks | Pending - no official date |

| Birdchain | BIRD | Telegram join & Twitter follow | Completed - tokens distributed |

| Birds (Sui) | BIRD | Level 10 in game + Sui wallet | Scheduled Dec 2024 - delayed |

Mini‑FAQ

Is the Bird Finance airdrop still active?

As of October 2025 the official channel has not announced a firm launch date. Treat any claim of a live airdrop as unverified until Bird Finance posts on its verified Twitter or blog.

Do I need to hold BIRD tokens before the airdrop?

Yes, the snapshot requires a minimum of 100 BIRD in your wallet at the time of the snapshot. Holding less will disqualify you.

What chains does Bird Finance support?

The platform operates on Ethereum, Solana, HECO (Huobi Eco Chain) and OKExChain, with plans to add additional EVM‑compatible networks in the future.

How can I avoid phishing scams related to the BIRD airdrop?

Always access the portal via birdfinance.io, check the SSL certificate, and never share your private key or seed phrase. Official communications come from the verified @BirdFinance Twitter account.

Should I participate if I’m new to DeFi?

If you’re unfamiliar with wallets, token swaps, and the inherent risks of DeFi, start with small test amounts on a testnet first. Only invest money you can afford to lose.

Bottom line: Bird Finance’s BIRD airdrop holds promise but remains shrouded in uncertainty. Verify every detail, meet the eligibility thresholds, and weigh the deflationary tokenomics against the security risks before you commit.

Comments (16)