International Money Transfer Cost Calculator

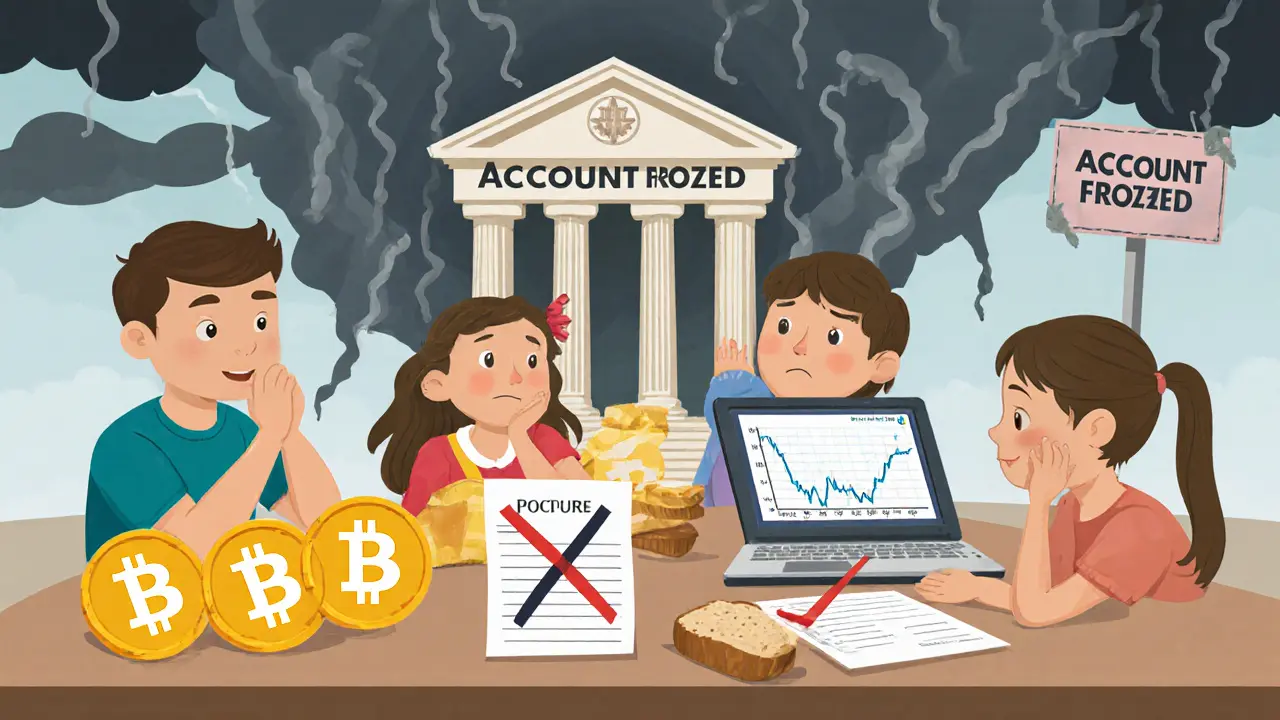

Think about the last time you paid for coffee, sent money to a friend overseas, or saved up for something big. If you used cash, a card, or a bank transfer, you were using fiat currency. If you used Bitcoin, Ethereum, or another digital coin, you were using cryptocurrency. Both systems have big flaws - but they’re completely different kinds of flaws.

Fiat Currency: Built to Fail Over Time

Fiat money isn’t backed by gold, silver, or anything physical. It’s backed by government promise. That sounds safe - until you realize that promise can be broken anytime. The biggest problem? Inflation.When governments print more money, the value of every dollar, euro, or Australian dollar drops. It’s not magic. It’s math. More supply = less value. In 2022, Zimbabwe’s currency lost 76% of its value in just one year. That’s not a historical footnote - it’s what happens when there are no real limits on money creation.

Central banks control how much money flows into the economy. They raise or lower interest rates, buy bonds, tweak reserves - all to manage inflation. But these decisions aren’t made by algorithms. They’re made by politicians and bureaucrats who answer to voters, not markets. When elections come around, it’s easier to print money than to raise taxes. The result? Your savings slowly lose power.

Send money to family in another country? Forget instant transfers. International bank wires can take 2 to 99 business days. Fees? Often 5% to 10% of the amount sent. For someone sending $500 home, that’s $25 to $50 just to get it there. And if your bank freezes your account? You’re stuck. No appeal. No blockchain ledger to prove you own your money.

Cryptocurrency: Too Wild to Use Daily

Cryptocurrency promised freedom from banks. But instead of solving money’s problems, it created new ones - ones that make it useless for buying groceries or paying rent.Bitcoin dropped 22% in a single day after the FTX collapse. Ethereum spiked 40% in a week because a celebrity tweeted about it. That’s not investing. That’s gambling with your rent money. If your paycheck arrives in crypto, you could wake up to a 30% pay cut overnight. No one can plan a budget like that.

And yet, most stores still won’t take it. Even in El Salvador, where Bitcoin is legal tender, most people convert it to USD right after getting paid. Why? Because you can’t buy milk with a volatile coin. You need something that holds its value.

Transaction speed? It’s not faster. Bitcoin can take 10 minutes to confirm. Ethereum? During peak hours, it can take over an hour. And gas fees? They spike to $50 or more just to send a simple transfer. That’s more than your bank charges for a wire. The promise of low-cost payments? Broken.

Security? Neither Side Is Safe

Fiat money is safe from hackers - until your bank gets hacked. Or your identity is stolen. Or someone tricks you into giving them your login. Banks have layers of protection, but they’re also targets. In 2023, over $2 billion was stolen from financial institutions globally through phishing, social engineering, and insider fraud.Cryptocurrency doesn’t have banks. It has wallets. And if you lose your private key? Gone forever. No customer service. No reset button. No refund. People have lost millions because they clicked a fake link or wrote their seed phrase on a sticky note. There’s no FDIC insurance. No government backstop. Your money is only as safe as your ability to keep secrets.

Energy Waste and Environmental Cost

Bitcoin mining uses more electricity than most countries. In 2024, the Bitcoin network consumed over 150 terawatt-hours - enough to power the entire country of Argentina. That’s not just inefficient. It’s unsustainable.Some argue that proof-of-stake coins like Ethereum 2.0 cut energy use by 99%. That’s true - but most crypto projects still rely on proof-of-work. And even proof-of-stake needs powerful computers running 24/7. The environmental cost isn’t zero. It’s just hidden behind cleaner marketing.

Fiat doesn’t burn power to exist. But it does require physical infrastructure: printing plants, armored trucks, ATMs, vaults, and bank branches. It’s less visible, but it’s still a carbon footprint. The difference? Fiat’s footprint is spread out. Crypto’s is concentrated in massive data centers burning coal in Kazakhstan or hydro in China.

Regulation: The Invisible Hand

Fiat currency is regulated - tightly. Every transaction above $10,000 is reported. Your bank must verify your identity. Your movements are tracked. That’s privacy? No. But it’s stability. Governments know who has what. That helps prevent terrorism, fraud, and money laundering.Crypto? It’s the wild west. Some countries ban it. Others tax it. A few, like the U.S., regulate it inconsistently. One day you’re a taxpayer. The next, you’re a criminal for using an unlicensed exchange. If you’re a business, you can’t accept crypto without hiring lawyers to keep up with changing rules. That’s not innovation. It’s legal chaos.

Who Wins? Neither.

Fiat currency is slow, inflationary, and controlled by a few. But it works. You can pay for a bus ticket, buy a house, or get a mortgage. It’s the backbone of the global economy.Cryptocurrency is fast, borderless, and decentralized. But it’s too volatile, too complex, and too unreliable for daily life. You can’t use it to pay your electricity bill. You can’t use it to rent an apartment. Most people don’t even know how to set up a wallet.

The real answer isn’t choosing one over the other. It’s understanding that both are broken in different ways. Fiat fails over decades. Crypto fails every hour.

Stablecoins - digital coins pegged to the dollar - try to bridge the gap. But they’re just crypto with a bank account. And if the bank fails? So does the stablecoin. Tether lost its peg in 2022. USDC did too in 2023. They’re not immune. They’re just hiding the risk behind a promise.

What Should You Do?

If you’re saving for retirement? Stick to assets that hold value: property, stocks, gold. Don’t let your savings sit in fiat that loses 3% a year to inflation - but don’t put it in Bitcoin either. The swings are too wild.If you’re sending money overseas? Use a crypto service like Ripple or Stellar. They’re faster and cheaper than Western Union. Just convert back to fiat immediately.

If you’re curious about crypto? Learn how wallets work. Never share your seed phrase. Use hardware wallets. Treat it like a risky investment - not a currency.

There’s no perfect system. But knowing the flaws helps you avoid the traps.

Is fiat currency safer than cryptocurrency?

Fiat currency is safer for daily use because it’s backed by governments and institutions. If your bank fails, deposit insurance often protects your money. Cryptocurrency has no safety net - if you lose your private key or get hacked, your funds are gone forever. But fiat is vulnerable to inflation and government mismanagement, which slowly erodes your purchasing power over time.

Why is cryptocurrency so volatile?

Cryptocurrency prices move based on speculation, news, and hype - not real-world economic factors. There’s no central authority to stabilize prices. A single tweet, regulatory announcement, or exchange hack can cause a 20% swing in minutes. Unlike stocks or bonds, crypto has no earnings, dividends, or physical assets to anchor its value.

Can cryptocurrency replace fiat money?

Not anytime soon. Fiat money is accepted everywhere - from street vendors to governments. Cryptocurrency isn’t. Most people don’t understand how to use it. Transactions are too slow or expensive during peak times. And without price stability, you can’t reliably use it to pay bills or buy groceries. Stablecoins help, but they’re still tied to fiat systems and carry their own risks.

Does cryptocurrency have a bigger environmental impact than fiat?

Yes, for proof-of-work coins like Bitcoin. Mining requires massive amounts of electricity - often from fossil fuels. A single Bitcoin transaction can use as much power as an average household does in a week. Fiat money has environmental costs too - printing, transporting, and maintaining physical cash and bank infrastructure - but they’re spread out and less visible. Proof-of-stake cryptocurrencies use far less energy, but they’re not yet the majority.

Are there any countries that have abandoned fiat currency?

No country has fully abandoned fiat. El Salvador made Bitcoin legal tender in 2021, but most people still use the U.S. dollar. The dollar is still used for 80% of transactions. Other countries like Venezuela and Argentina have seen people turn to crypto to escape hyperinflation - but they haven’t replaced their national currencies. Fiat remains the foundation of every modern economy.

What’s the biggest risk of holding cryptocurrency?

The biggest risk isn’t hacking - it’s losing your private key or seed phrase. If you forget it, misplace it, or give it to someone by accident, your crypto is gone. No one can recover it. There’s no password reset. No customer support. Thousands of people have lost millions this way. Most don’t even realize it until it’s too late.

Can you protect your savings from inflation without crypto?

Absolutely. Real assets like property, gold, or diversified stocks have historically outpaced inflation. Treasury Inflation-Protected Securities (TIPS) are designed to adjust with inflation. Even high-yield savings accounts can beat low inflation rates. You don’t need crypto to protect your money - just better financial habits and diversified assets.