Coinbase Country Restrictions Checker

Check if your country has access to Coinbase's App (with fiat deposits) or Wallet (crypto-only). Enter your country name to see the current restrictions based on the latest available data.

Enter a country name to see if you can use Coinbase's App (fiat deposits) or Wallet (crypto only).

Ever tried to buy Bitcoin on Coinbase only to see a mysterious "Service not available in your country" message? You’re not alone. Coinbase’s geographic crypto restrictions shape who can trade, deposit, or even hold assets, and the rules change as fast as regulators move. This guide breaks down why certain nations are blocked, where partial access exists, and how you can still use the platform without breaking any laws.

What’s actually restricted?

Coinbase offers two distinct products that face different rules:

- Coinbase App - the full‑featured exchange with fiat on‑ramps, debit/credit card deposits, and bank transfers.

- Coinbase Wallet - a non‑custodial, self‑hosted Ethereum‑based wallet that lets you interact with dApps but never handles fiat.

Most users only care about the App because that’s where you turn dollars (or euros) into crypto. The Wallet, however, works in nearly every country except those on the U.S. Treasury’s sanctions list.

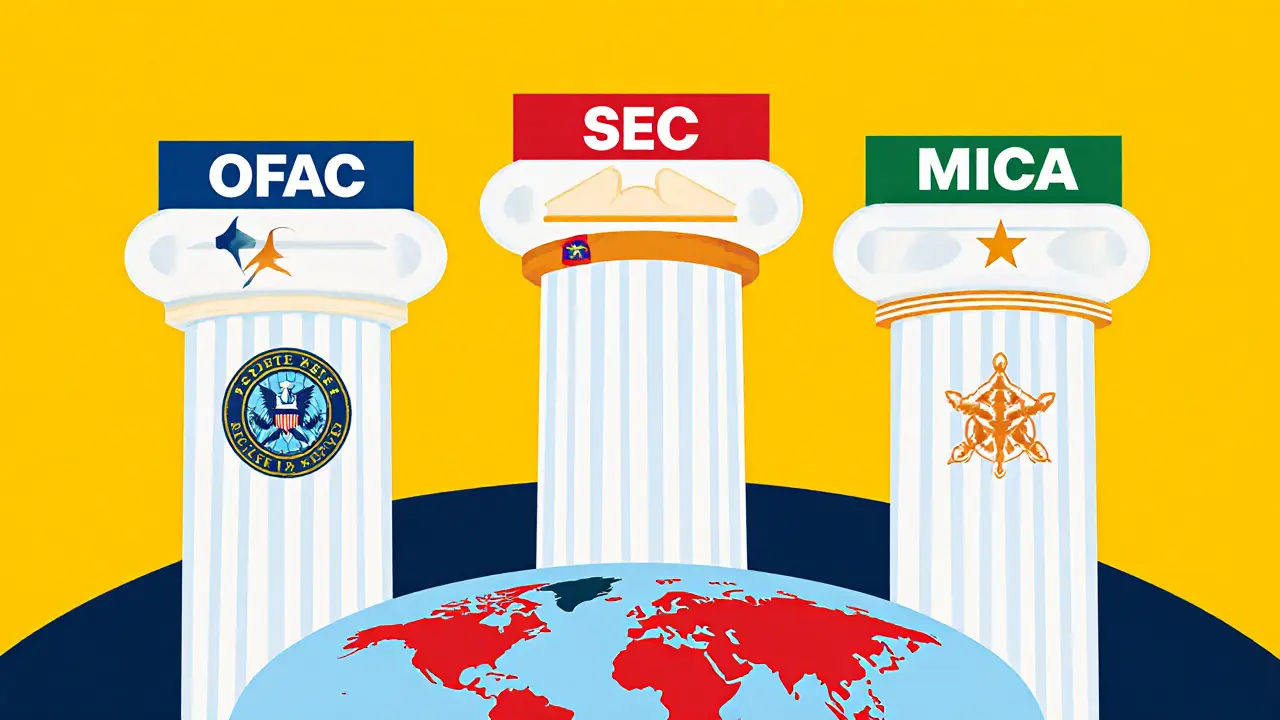

Regulatory engines behind the blocks

Three major legal frameworks drive Coinbase’s country‑by‑country decisions:

OFAC (Office of Foreign Assets Control) maintains the United States’ sanctions lists. Coinbase must automatically deny any service that would violate OFAC rules, which means countries like Russia, Iran, North Korea, and Crimea are off‑limits for both fiat and wallet functions.

SEC (U.S. Securities and Exchange Commission) treats many crypto assets as securities. Ongoing litigation (since June 2023) forces Coinbase to pull or limit trading of tokens that the SEC deems unregistered securities, especially in jurisdictions that adopt U.S. securities law by reference.

MiCA (Markets in Crypto‑Assets Regulation) is the EU’s new framework. From July 2024 onward, Coinbase had to secure a European licence, which opened most EEA nations for full App access but also introduced asset‑specific bans - for example, Cardano staking is barred in twelve EU states until the MiCA transitional period ends.

Local regulators add another layer. India’s RBI, the Philippines’ BSP, and the UAE’s central bank each have their own licensing requirements that Coinbase has either not met yet or has chosen to avoid.

How Coinbase enforces geographic limits

The platform uses a three‑step verification chain:

- IP geolocation at the moment you open the app or website.

- KYC information (government‑issued ID and proof of address) that must match the IP country.

- Real‑time checks against OFAC’s SDN List, the SEC’s token‑status database, and each region’s licensing registry.

If any step fails, the user sees a generic “Service not available” notice. New accounts in high‑risk jurisdictions-like Colombia, Pakistan, or the Philippines-also face a 24‑ to 72‑hour hold before any fiat move can happen.

Country‑level availability as of October 2025

| Country | App (fiat) | Wallet (crypto only) | Notes |

|---|---|---|---|

| United States | Full | Full | SEC‑registered broker‑dealer |

| Germany | Full (SEPA) | Full | BaFin licence, MiCA compliant |

| United Kingdom | Full | Full | FCA‑approved |

| India | Blocked (pending RBI licence) | Full | Wallet works, App blocked since 2023 |

| Pakistan | Blocked | Full | Wallet works, no fiat on‑ramps |

| UAE | Partial (Apple Pay only) | Full | Bank transfers denied |

| Russia | Blocked (OFAC) | Blocked (OFAC) | All services disabled since 2022 sanctions |

| Philippines | Blocked | Full | App blocked despite 83 % local demand for fiat |

| Brazil | Full | Full | Supports local bank transfers (PIX) |

In total, the Coinbase App offers fiat services in 48 countries, the Wallet works in over 5,500 jurisdictions, and 63 nations remain completely blocked for both products.

Why the gaps matter to everyday users

For a user in Pakistan, the wallet is a lifeline: you can still hold ETH, USDC, or even trade on decentralized exchanges. But without a fiat gateway, you must rely on peer‑to‑peer platforms (like Binance P2P) that charge 8‑10 % premiums. In the Philippines, users report paying 3.5 % to local exchanges just to move money in and out, while a Coinbase‑based solution would be under 0.5 %-if it were available.

Emerging markets also face higher unbanked rates. MIT’s Digital Currency Initiative found that Coinbase’s geo‑blocking reduces illicit activity by 78 % in sanctioned zones, but it also locks out 12.7 million unbanked citizens who could otherwise gain a first‑step into digital finance.

Conversely, regulated markets such as Germany enjoy seamless SEPA deposits, sub‑$10,000 daily limits for fully verified accounts, and 24/7 in‑app support. The contrast illustrates how regulatory compliance can be both a safety net and a growth barrier.

How to check if your country is supported

Coinbase’s Help Center now features a live “Country Restrictions” checker. Here’s a quick step‑by‑step:

- Open the Coinbase App or go to coinbase.com (no login required).

- Scroll to the footer and click “Supported Countries”.

- Enter your country name; the page instantly shows whether the App, the Wallet, or both are available.

- If you see a red “Not supported” badge, you can still sign up for the Wallet-but remember you’ll need a separate fiat on‑ramp.

For developers, the same data is available via Coinbase’s public API endpoint /v2/countries, which returns a JSON payload with service flags.

Workarounds: staying legal while accessing crypto

If you live in a blocked jurisdiction, you have three safe options:

- Use the Coinbase Wallet for pure crypto storage and DeFi activity. Pair it with a reputable on‑ramp like Moonpay or Transak that supports your local payment method.

- Switch to a compliant exchange that offers fiat in your country (e.g., Binance, Kraken, or local platforms like PDAX in the Philippines).

- Leverage peer‑to‑peer markets - but only with escrow and verified counterparties to avoid scams.

Never use VPNs or proxy services to mask your IP. Coinbase’s terms explicitly prohibit it, and a mismatch between IP and KYC can trigger account termination and loss of funds.

Future outlook: will the list change?

Two big forces will shape the next wave of restrictions:

- U.S. regulatory settlement - The SEC case expected to resolve by Q3 2025 could force Coinbase to cease offering certain tokens globally, which would translate into more “partial” blocks.

- MiCA full rollout - By the end of 2025 the EU will lift transitional bans, potentially reopening staking services in the twelve EU states where they’re currently disabled.

Additionally, India’s RBI is in late‑stage talks about a crypto‑friendly licensing regime. If approved, a full‑service Coinbase App could launch there by early 2026, instantly adding 400 million potential users.

Quick recap

In a nutshell, Coinbase crypto restrictions are driven by:

- U.S. sanctions (OFAC) - full block for both services.

- U.S. securities law (SEC) - token‑specific limits.

- Regional frameworks (MiCA, local licenses) - partial or full access depending on compliance.

- Technical enforcement - IP, KYC, real‑time list checks.

If you’re in a supported country, you get fiat deposits, SEPA or ACH transfers, and 24/7 support. If not, the Wallet remains your gateway to crypto, but you’ll need a separate on‑ramp.

Which countries can use the Coinbase App for fiat deposits?

As of October 2025 the App supports fiat on‑ramps in 48 countries, including the United States, United Kingdom, Germany, France, Singapore, Brazil, and most EU members that have a MiCA licence. Full lists are available on Coinbase’s website under “Supported Countries”.

Can I use Coinbase Wallet if my country is blocked for the App?

Yes. The Wallet is non‑custodial and works in every jurisdiction except those on the OFAC sanctions list (e.g., Russia, Iran, North Korea). It does not provide fiat on‑ramps, so you’ll need a separate service to move money in or out.

Why is the App blocked in India but the Wallet works?

India’s central bank (RBI) requires a specific crypto‑exchange licence. Coinbase has not secured it yet, so the fiat‑enabled App is blocked. The Wallet, being self‑custodial, does not need RBI approval and therefore remains accessible.

How does Coinbase enforce country restrictions technically?

First, the platform checks your IP address against a geolocation database. Then it verifies the address on your government ID during KYC. Finally, it cross‑references your location with OFAC’s SDN List, the SEC’s token register, and any local licensing databases. A mismatch at any step denies service.

What are the risks of using a VPN to bypass restrictions?

Coinbase’s terms forbid masking your IP. If the system detects an IP‑address that doesn’t match your KYC‑provided residence, it can freeze or close your account, leading to permanent loss of funds. Legal consequences also vary by jurisdiction.

Comments (8)