Bitcoin payments aren’t just a trend-they’re becoming a practical tool for businesses and individuals around the world. In 2025, transaction volumes jumped 45% compared to 2024, with over $12.5 billion in corporate Bitcoin inflows recorded between January and August alone. That’s more than the entire previous year. What used to be a fringe experiment is now a real payment system used by small businesses, freelancers, and even Fortune 500 companies.

Why Businesses Are Accepting Bitcoin

Small and medium businesses (SMEs) are the biggest drivers of this shift. According to CoinLaw’s 2025 analysis, half of all SMEs now accept Bitcoin or stablecoins. Why? Because it cuts out the middleman. Traditional payment processors charge 2.5% to 3.5% per transaction. With Bitcoin, fees average just $1.27 per on-chain transaction-often less than 1% for larger payments. For businesses operating on thin margins, that adds up fast.

Another big reason? Chargeback fraud. In traditional systems, credit card chargebacks cost merchants an estimated $12 billion annually. Bitcoin transactions are final. Once confirmed, they can’t be reversed. That’s a huge win for service providers, digital sellers, and anyone who’s been burned by fake refunds or disputed purchases. One café owner on Reddit said their chargeback rate dropped from 4% to zero after switching to Bitcoin. No more fake claims. No more lost revenue.

Borderless Payments Without the Fees

Send money across borders using a bank? It can take 3 to 5 days and cost 6.3% in fees, according to the World Bank. With Bitcoin? Settlement happens in under an hour, and the cost drops to 3.5%. That’s why remittances to countries like the Philippines, Nigeria, and Venezuela are booming. Workers abroad send money home faster and keep more of it. In one case, a worker in the U.S. saved 82% on fees sending $500 to his family in Venezuela-using Bitcoin instead of Western Union.

It’s not just individuals. Companies like MicroStrategy now hold over 214,000 BTC in their treasury. That’s not speculation-it’s a strategic move. Between January and September 2025, MicroStrategy’s Bitcoin holdings gained $1.2 billion in value. Other non-crypto firms are following suit, using Bitcoin as a hedge against inflation and currency devaluation.

The Lightning Network Changed Everything

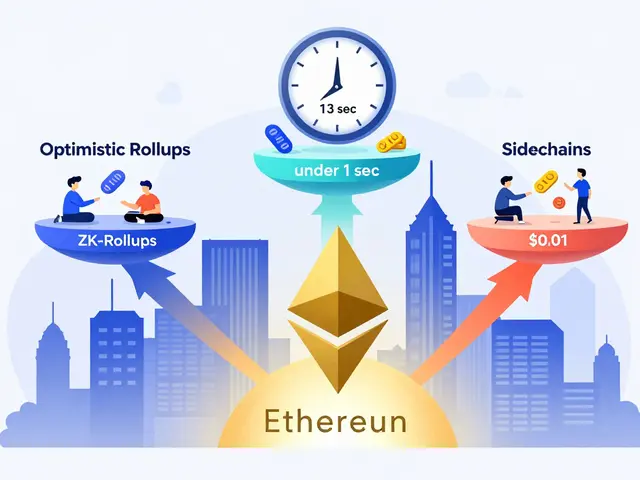

Early Bitcoin was too slow for everyday use. On-chain transactions took 10 to 60 minutes. Fees spiked during peak times. That’s why many dismissed it as impractical.

Then came the Lightning Network. Launched in 2018, it’s now processing 1.2 million transactions daily across 65,000 active nodes. Fees? As low as $0.0003 per payment. That’s cheaper than a stamp. It’s perfect for coffee, tips, subscriptions, or even buying a song online. Merchants using Lightning don’t even need to touch the blockchain-they settle instantly through off-chain channels.

The Taproot upgrade in 2021 made these payments more private and flexible. Then in 2024, BIP-325 cut processing times by 37%. By late 2025, the new SIGHASH_NOINPUT soft fork improved Lightning routing efficiency by 29%. These aren’t theoretical upgrades-they’re live, working, and being used daily.

How Easy Is It to Start Accepting Bitcoin?

Five years ago, setting up Bitcoin payments meant learning about private keys, wallet addresses, and blockchain explorers. Today? You can do it in under two hours.

Platforms like Coinbase Commerce, BitPay, and Strike offer plug-and-play integration with Shopify, WooCommerce, and Square. No coding required. You choose whether to hold Bitcoin or convert it to USD instantly. Over 92% of modern payment processors handle volatility for you. A bakery in Austin, Texas, started accepting Bitcoin in March 2025. They didn’t hire a developer. They clicked “enable” in their POS system. Now, 18% of their sales come from crypto customers.

Implementation costs have dropped too. For e-commerce stores, it’s now $187 on average. For brick-and-mortar shops, $325. That’s less than the cost of a new credit card terminal.

Who’s Using Bitcoin Payments?

The biggest users? People aged 25 to 34. In urban areas, 80% of Bitcoin payment users fall into this group. They’re digital natives. They’ve seen crypto crash and recover. They trust the technology more than banks.

Geographically, the U.S. and India lead adoption. But the fastest growth? South Asia and North Africa. Even where governments ban crypto, people find ways to use Bitcoin. In Pakistan, local traders use it to bypass currency controls. In Nigeria, it’s how freelancers get paid by clients in Europe and the U.S.

According to the Triple-A 2025 survey, 67% of current Bitcoin owners plan to use it more for payments in 2025. Another 14% of non-owners say they’ll start. That’s not a niche group-that’s a growing market.

The Challenges Still Exist

It’s not perfect. Price volatility is still the biggest complaint. One merchant, Overstock, paused Bitcoin payments in April 2025 after BTC swung 22% in four hours. They came back within three days, but it showed the risk. That’s why most now auto-convert to fiat immediately.

Tax reporting is another hurdle. In the U.S., every Bitcoin transaction is a taxable event. That means tracking cost basis, gains, and losses. For small businesses, that’s a nightmare. But tools are improving. Platforms now auto-generate tax reports. The IRS hasn’t changed its stance, but software is catching up.

And yes, Bitcoin’s base layer still only handles 7 transactions per second. That’s nothing compared to Visa’s 24,000. But Lightning fixes that. For retail, it’s not about raw speed-it’s about reliability, cost, and finality. And Bitcoin delivers.

What’s Next?

By the end of 2025, Bitcoin payments are projected to hit $1.2 trillion in annual volume. Ark Invest predicts Bitcoin could reach $140,000 by year-end. That’s not just speculation-it’s built on real usage.

Upgrades like MAST (coming in Q2 2026) will shrink payment sizes by 35%, making transactions cheaper and faster. The ‘Graffiti’ protocol, launching late in 2026, will let merchants embed custom data into payments-think invoice numbers, product IDs, or loyalty points-all without touching the blockchain.

More than 50% of Fortune 500 companies are now exploring blockchain integration. Not to replace banks. But to complement them. Bitcoin isn’t replacing PayPal or Stripe. It’s giving businesses a new tool-one that works when traditional systems fail.

Final Thoughts

Bitcoin payments are popular because they solve real problems: high fees, slow settlements, chargeback fraud, and financial exclusion. The technology matured. The infrastructure is here. The users are ready.

You don’t need to believe in Bitcoin as an investment to use it as a payment tool. You just need to see what it does better than anything else: send value across borders, instantly, cheaply, and without permission.

Businesses that ignore it are leaving money on the table. Customers who use it are saving time, money, and stress. The shift isn’t coming. It’s already here.

Are Bitcoin payments safe?

Yes, when used correctly. Bitcoin transactions are secured by SHA-256 hashing and Proof-of-Work consensus, making them nearly impossible to alter. Over 99.98% of transactions since 2020 have confirmed successfully. Most businesses use multi-signature wallets (used by 63% of processors) and hardware wallets (adopted by 41%) to prevent theft. The biggest risk isn’t hacking-it’s losing private keys or falling for phishing scams.

Can I use Bitcoin to pay for everyday things like groceries?

Absolutely. With the Lightning Network, Bitcoin works for micropayments. Coffee shops in Berlin, restaurants in Tokyo, and even vending machines in Toronto now accept Bitcoin. Fees are fractions of a cent, and payments settle in under a second. You don’t need to hold Bitcoin-you can pay with it and instantly convert to local currency.

Why not just use stablecoins instead?

Stablecoins like USDC are great for merchants because they’re pegged to the dollar. But Bitcoin has advantages: it’s decentralized, censorship-resistant, and not controlled by any company. Tether, the biggest stablecoin issuer, holds reserves in banks and commercial paper. Bitcoin’s network runs on thousands of independent nodes across 120 countries. If you care about financial sovereignty, Bitcoin is the only option.

Do I need to be tech-savvy to accept Bitcoin?

No. Most payment processors today work like PayPal. You sign up, connect your store, and start accepting payments. You don’t need to understand blockchain, addresses, or mining. Over 92% of processors offer one-click integration. The learning curve has dropped from weeks to minutes.

Is Bitcoin payments legal everywhere?

As of August 2025, 68 countries have clear legal frameworks for crypto payments, including the U.S., Canada, Germany, Japan, and India. Some countries ban it outright, but enforcement is patchy. In places like Nigeria and Pakistan, people use Bitcoin anyway-because it works when banks don’t. Regulation is catching up to usage, not the other way around.