Imagine sending a payment on Ethereum and waiting 10 minutes while paying $5 in fees-just to buy a digital sticker. That was real in 2017, during the CryptoKitties craze. Today, you can do the same thing in under a second for less than a penny. That’s the power of Layer 2 solutions. They’re not magic. They’re not replacing Ethereum. They’re fixing its biggest problem: speed and cost.

Why Layer 2 Solutions Exist

Ethereum was never built to handle millions of users. Its base layer, called Layer 1, can process about 15 to 30 transactions per second. That’s fine for early adopters, but not for a global financial system. When demand spiked, fees shot up. People couldn’t afford to interact with DeFi apps. NFTs became a luxury. Gaming? Forget it. Layer 2 solutions were created to fix this without breaking Ethereum’s security. Instead of making Ethereum bigger, they move work off-chain-like handling thousands of transactions in a private room, then summarizing them and posting one proof back to Ethereum. It’s like sending a single email that says, “Here’s what 1,000 people paid today,” instead of sending 1,000 separate emails.The Three Main Types of Layer 2 Solutions

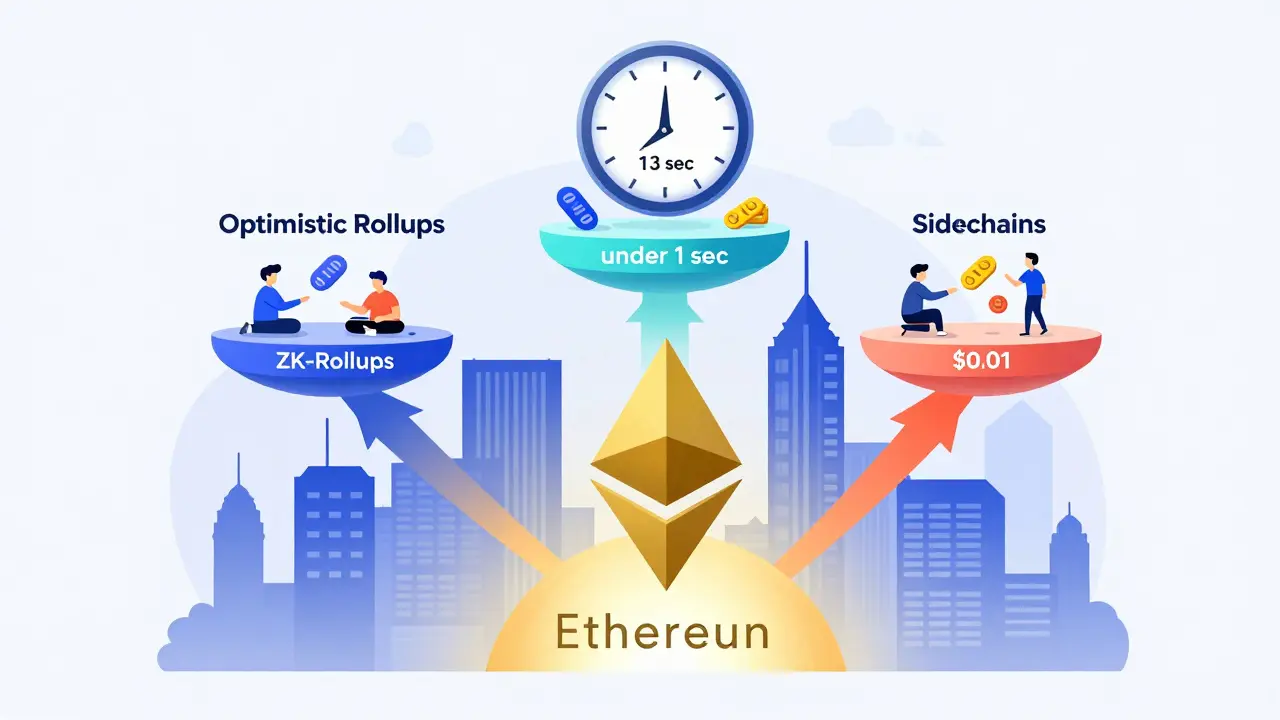

Not all Layer 2s work the same way. There are three main designs, each with trade-offs.- Rollups-The most popular today. They bundle hundreds of transactions into one and submit them to Ethereum as a single data packet. There are two kinds: Optimistic Rollups and ZK-Rollups.

- State Channels-Think of them like a private game of poker between two people. You play many rounds without telling anyone else, then settle the final score on the blockchain. Used mostly for micropayments, like Bitcoin’s Lightning Network.

- Sidechains-These are separate blockchains connected to Ethereum. They’re faster but don’t inherit Ethereum’s security. Polygon PoS is the biggest example.

Rollups dominate the market. In 2023, they handled over 80% of all Layer 2 activity on Ethereum. Sidechains like Polygon are popular too, but they’re a different kind of scaling-more like a cousin than a sibling.

Optimistic Rollups: Trust, But Verify

Optimistic Rollups, like Arbitrum and Optimism, assume transactions are valid unless someone proves otherwise. They use something called a “fraud proof.” If someone tries to cheat, they have a 7-day window for others to challenge the transaction. If the challenge succeeds, the bad actor loses their deposit.This design is great for compatibility. Most Ethereum apps-like Uniswap or OpenSea-can run on Optimistic Rollups with almost no changes. That’s why 65% of all Layer 2 transactions happen here.

But there’s a catch: withdrawals take up to 7 days. If you need your funds fast, you’ll have to pay a premium to a liquidity provider who gives you instant access (a service called “fast withdrawal” or “bridging”). It’s convenient, but adds complexity.

ZK-Rollups: Math, Not Trust

ZK-Rollups, like StarkNet and zkSync Era, use zero-knowledge proofs. These are mathematical certificates that prove a set of transactions is valid without revealing the details. Think of it like proving you know a secret password without saying the password.Because the proof is mathematically verified, ZK-Rollups don’t need a 7-day waiting period. Transactions are final in minutes. They’re also more efficient with data, which means lower fees-sometimes as low as $0.0005 per transaction.

The downside? They’re harder to build for. Most existing Ethereum apps can’t run on them without rewriting parts of their code. That’s changing fast, though. zkSync and StarkNet now support 90% of popular DeFi apps. By 2025, ZK-Rollups could overtake Optimistic Rollups in usage.

State Channels and Sidechains: Niche Players

State channels are perfect for repeated, small payments. The Lightning Network on Bitcoin handles about 10,000 transactions per day. It’s fast, cheap, and private-but only works between two connected users. You can’t use it to swap tokens on a DEX. It’s not meant for that.Sidechains like Polygon PoS are faster-processing 7,000 transactions per second-but they have their own validators. That means they’re not as secure as rollups. If Polygon’s validators get hacked, your funds are at risk. That’s exactly what happened in 2022, when the Ronin sidechain lost $625 million due to compromised keys.

So sidechains are useful for apps that don’t need bank-level security-like casual games or social platforms. But for DeFi or large-value transfers, rollups are safer.

Performance: Speed, Cost, and Capacity

Here’s how they stack up:| Layer 2 Type | Avg. Fee (USD) | TPS | Finality Time | Security |

|---|---|---|---|---|

| Ethereum (Layer 1) | $1.20 | 15-30 | 13 seconds | Full Ethereum security |

| Optimistic Rollups (Arbitrum, Optimism) | $0.005 - $0.02 | 2,000 - 4,000 | 1 - 2 hours | High (with 7-day challenge) |

| ZK-Rollups (StarkNet, zkSync) | $0.0005 - $0.01 | 2,000 - 100,000 (testnet) | 10 - 15 minutes | Very High (cryptographic proof) |

| Polygon PoS (Sidechain) | $0.001 - $0.005 | 7,000 | 2 seconds | Medium (independent validators) |

| Lightning Network (State Channel) | $0.00001 - $0.0001 | 100 - 1,000 per channel | Instant | High (but limited to two users) |

For most users, the difference is clear: Layer 2s are 100x cheaper and 100x faster than Ethereum’s base layer. Uniswap processes 85% of its trades on Layer 2. OpenSea does 73% of its NFT sales there. These aren’t experiments-they’re the new normal.

What You Need to Use Layer 2

You don’t need to be a coder to use Layer 2. Here’s what you actually need:- A wallet that supports Layer 2 networks. MetaMask works with 97% of them.

- To bridge your ETH or tokens from Ethereum to the Layer 2 network. This is where most users get stuck. Bridges can be confusing, slow, or risky.

- To understand that different Layer 2s have different tokens. You can’t use your Arbitrum ETH on StarkNet.

Most wallets now let you switch networks with one click. But if you send ETH to the wrong chain, you can lose it. Always double-check the network before sending.

The Biggest Problems

Layer 2s aren’t perfect. Three big issues stand out:- Bridging is a mess. There are over 17 different bridges. Users report 68% of their frustration comes from losing funds or waiting days to move money. Some bridges have been hacked, costing users over $1.2 billion since 2021.

- Fragmentation. Your money is split across Arbitrum, Optimism, zkSync, Polygon, and others. Managing balances is like juggling five bank accounts.

- Centralization risks. Most rollups rely on a single “sequencer” to order transactions. In 2023, 87% of Optimism transactions were processed by just one company. If that company goes down, so does your access.

These aren’t theoretical. Real people lost money. Real apps got hacked. But the fixes are coming. Projects like Across Protocol now let you bridge funds in under 30 minutes. Ethereum’s upcoming Dencun upgrade will cut Layer 2 fees by 90% by making data storage cheaper.

Who’s Using Layer 2-and Why

Layer 2s aren’t just for traders. They’re enabling new kinds of apps:- DeFi-Uniswap, Aave, and Curve moved 80%+ of their volume off Ethereum because fees were killing margins.

- NFTs-OpenSea, Blur, and LooksRare process most sales on Layer 2. Minting an NFT used to cost $50. Now it’s 10 cents.

- Gaming-Axie Infinity moved to its own sidechain (Ronin) to handle 1.5 million daily transactions. But after the $625M hack, many are moving back to secure rollups.

- Enterprise-JPMorgan uses its own Ethereum-based Layer 2 to settle $1 billion in daily institutional payments.

By 2025, experts predict 75% of all Ethereum activity will happen on Layer 2. That’s not a guess-it’s based on how fast users are leaving the main chain.

What’s Next?

The future is converging. Ethereum’s Dencun upgrade in early 2024 introduced proto-danksharding, which lets Layer 2s store data cheaper. That means even lower fees. Meanwhile, Optimism is building a “Superchain”-a network of interconnected Layer 2s that share security. StarkNet is hitting 100,000 TPS in tests. ZK-Rollups are getting easier to code for.By 2026, there might be only 3 or 4 dominant Layer 2s. Right now, there are dozens. The market is cleaning up. The winners will be the ones that are secure, cheap, and easy to use.

For now, if you’re using Ethereum for anything beyond holding ETH, you’re already on a Layer 2. You just might not realize it. The future isn’t Ethereum alone. It’s Ethereum plus a dozen faster, cheaper layers working together.

Are Layer 2 solutions safe?

Rollups (Optimistic and ZK) are very safe because they inherit Ethereum’s security. Sidechains are less secure because they have their own validators. The biggest risks come from bridges-third-party tools that move money between chains. Over $1.2 billion has been lost in bridge hacks since 2021. Always use well-audited bridges like Across or Synapse, and never send large amounts until you’ve tested with a small one.

Can I use Layer 2 without knowing how it works?

Yes. Wallets like MetaMask, Phantom, and Coinbase Wallet now let you switch networks with one click. You can swap tokens, stake, or mint NFTs on Layer 2 just like you would on Ethereum. The only thing you need to know is: don’t send funds to the wrong chain. Always check the network name before confirming a transaction.

Do I need to pay gas fees on Layer 2?

Yes, but they’re tiny. On Optimism or zkSync, a simple swap costs about $0.01. That’s 100 times cheaper than Ethereum. Some apps even cover your fees for you. You’ll still need ETH to pay for gas, but you’ll need far less of it.

What’s the difference between Arbitrum and Optimism?

Both are Optimistic Rollups with similar speeds and fees. Arbitrum has slightly lower fees and more dApps. Optimism is more focused on building a unified ecosystem called the Superchain. For users, the difference is minimal. Most apps work on both. Choose based on which one your favorite app supports.

Will Layer 2 make Ethereum obsolete?

No. Layer 2s depend on Ethereum. They use Ethereum as a secure anchor. Without Ethereum, they lose their security. Think of Ethereum as the foundation of a building, and Layer 2s as the floors built on top. You need the foundation to hold everything up. Ethereum is becoming the settlement layer-where finality happens. Layer 2s handle the day-to-day work.

How do I get started with Layer 2?

Install MetaMask, click the network dropdown, and select Arbitrum or Optimism. Then, use a bridge like Arbitrum Bridge or Optimism Bridge to move ETH or tokens from Ethereum. Start with $10 to test. Once you see how fast and cheap it is, you’ll wonder why you ever used Ethereum directly.

Layer 2 solutions didn’t just make blockchain usable-they made it practical. What was once a slow, expensive experiment is now a global infrastructure. The next billion users won’t come to Ethereum. They’ll come to the layers built on top of it.