Scalia Infrastructure (SCALE) is a cryptocurrency token that claims to power a platform for aggregating decentralized physical infrastructure - things like storage, computing power, wireless networks, and IoT devices - all running on blockchain. Sounds ambitious, right? But here’s the truth: SCALE isn’t a breakthrough project. It’s a micro-cap token with almost no activity, no community, and no signs of real development.

What SCALE is supposed to do

According to its official description, SCALE is meant to make it easier for regular people and businesses to use decentralized infrastructure without needing to be tech experts. It targets users interested in NFTs and digital ownership, promising tools that simplify access to resources like cloud storage or processing power from a network of distributed nodes.

The idea isn’t new. Other projects like Render Network (RNDR) and Filecoin (FIL) already do this - and they’ve been around for years. They have real users, active development teams, and market caps in the billions. SCALE says it’s doing the same thing, but there’s no evidence it’s actually doing it.

Technical details: Built on Ethereum

SCALE is an ERC-20 token on the Ethereum blockchain. Its contract address is 0x8A0a9b663693A22235B896f70a229C4A22597623. That means you can store it in any Ethereum wallet like MetaMask or Trust Wallet. You can trade it on decentralized exchanges, mainly Uniswap V2.

There are exactly 100 million SCALE tokens ever going to exist. As of January 30, 2026, about 98 million are in circulation. That’s a fixed supply - no more will be created. That’s a good thing, in theory. But having a fixed supply doesn’t matter if nobody wants to buy it.

Price and market data: A ghost town

SCALE’s price varies wildly across exchanges. On Binance, it was trading at $0.000883. On MEXC, it was $0.001016. On Bybit, it was $0.000945. These differences aren’t due to better pricing - they’re because there’s almost no trading happening anywhere.

The 24-hour trading volume on Uniswap, the most active exchange for SCALE, was $125.42. That’s less than the cost of a decent dinner. For comparison, Render Network trades over $100 million in volume daily. SCALE’s volume is so low that even buying $50 worth of SCALE could move the price dramatically - and you might not even get filled.

Its market cap hovered around $90,000 to $130,000 as of January 2026. That’s tiny. There are over 22,000 cryptocurrencies tracked by CoinGecko. SCALE ranks between #3,000 and #43,000 depending on the platform. It’s in the bottom 0.5% of all crypto projects by market size.

Historical performance: A crash from Historical performance: A crash from $0.75 to pennies

.75 to pennies

SCALE’s all-time high was $0.757733, according to LiveCoinWatch. That was likely during a pump driven by hype, not real demand. As of January 30, 2026, it was trading at less than $0.001 - a drop of 99.8% from its peak.

That kind of collapse is common in micro-cap tokens. Often, early investors or promoters sell off their holdings after creating artificial demand. When the buying stops, the price plummets. And with no community or development to support it, SCALE has no reason to recover.

No development, no community

This is the most alarming part. There are no GitHub repositories for Scalia Infrastructure. No official blog posts. No updates on Twitter, Telegram, or Reddit. No forum discussions. No comments from users. No developer activity. Nothing.

Compare that to Render Network, which releases weekly code updates, publishes developer documentation, and hosts community AMAs. SCALE doesn’t even have a website that loads properly on some browsers. The project’s official descriptions sound professional - but they’re likely copied from generic DePIN templates and never updated.

When a project has no code commits, no social media presence, and no user testimonials after more than a year, it’s not inactive - it’s dead. And when a token’s price has crashed 99.8% and its trading volume is under $130 per day, it’s not a coin. It’s a ghost.

Why people still talk about SCALE

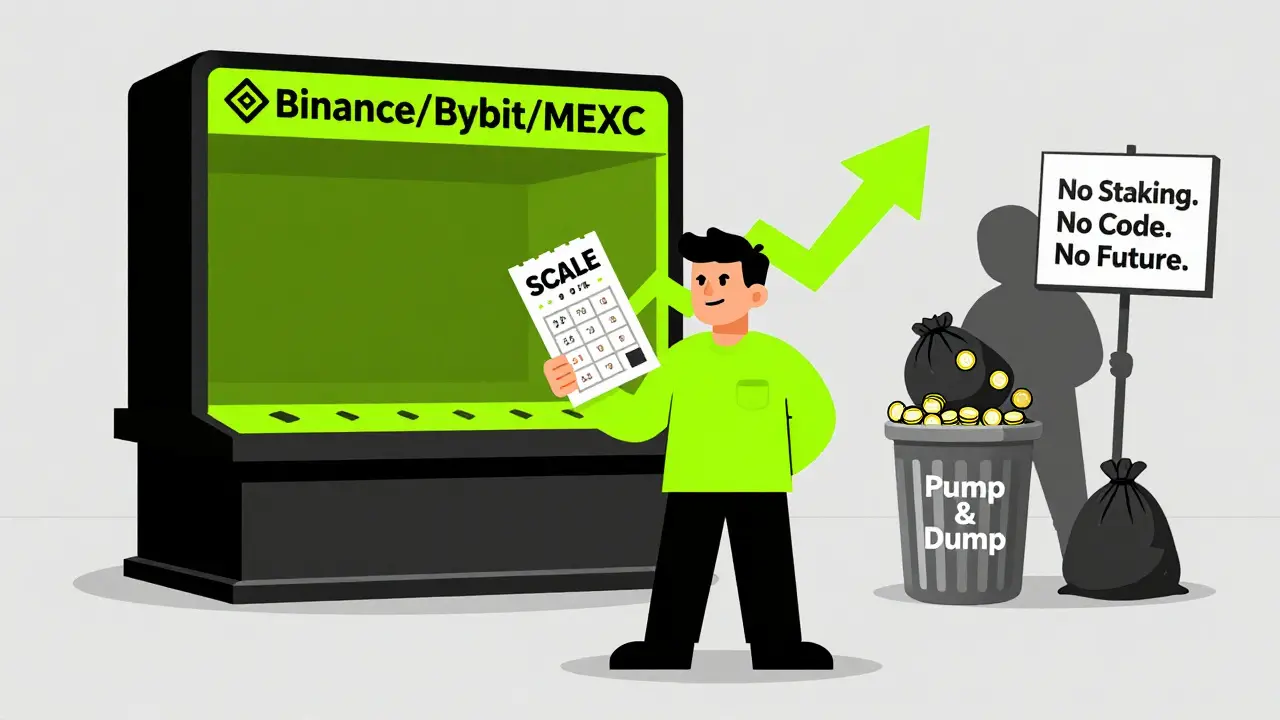

You’ll find SCALE listed on Binance, Bybit, and MEXC. That doesn’t mean it’s legitimate. Many centralized exchanges list hundreds of low-quality tokens to attract speculative traders. They don’t vet projects deeply. They just want trading volume - even if it’s fake.

Some traders buy SCALE hoping for a quick pump. They see the low price and think, “It can’t go lower.” But with zero liquidity, it’s nearly impossible to sell without losing most of your money. Slippage on Uniswap for even $20 trades can be over 15%.

There’s no fundamental reason to hold SCALE. It doesn’t offer staking rewards, governance rights, or utility beyond being a speculative asset. There’s no product to use. No API to integrate. No real-world application.

How SCALE compares to real DePIN projects

| Project | Market Cap | 24h Volume | Active Development | Community |

|---|---|---|---|---|

| Scalia Infrastructure (SCALE) | $90K-$130K | $125 | No | None |

| Render Network (RNDR) | $2.1B | $115M | Yes | Large, active |

| Filecoin (FIL) | $1.3B | $89M | Yes | Large, active |

| Helium (HNT) | $650M | $42M | Yes | Large, active |

The gap isn’t just big - it’s unbridgeable. SCALE doesn’t compete with these projects. It doesn’t even register on the same radar.

Should you buy SCALE?

If you’re looking for a long-term investment, the answer is no. If you’re looking to make a quick profit, the odds are against you. The chances of SCALE recovering are near zero. There’s no team rebuilding it. No new features coming. No investors stepping in.

Buying SCALE is like buying a lottery ticket with no drawing. You might get lucky - but you’re far more likely to lose everything.

The only people who benefit from SCALE are those who sold their tokens early - and the exchanges that collect trading fees on the tiny volume that still exists.

Final verdict

Scalia Infrastructure (SCALE) is not a crypto project. It’s a relic. A zombie token with no life, no purpose, and no future. Its technical specs are correct - it’s an ERC-20 token on Ethereum with a fixed supply. But that’s where the legitimacy ends.

There’s no evidence it was ever more than a marketing stunt. No developer activity. No user base. No roadmap. No updates. Just a price chart that crashed and never recovered.

If you see SCALE listed somewhere, treat it like a warning sign - not an opportunity. The crypto space is full of real innovation. Don’t waste your money on something that’s already dead.

Is SCALE a good investment?

No. SCALE has a market cap under $130,000, a 24-hour trading volume of under $130, and no development activity. It’s a micro-cap token with zero community support and a 99.8% price drop from its all-time high. Buying it is speculative at best and likely a loss at worst.

Where can I buy SCALE?

SCALE is listed on Binance, Bybit, MEXC, and Uniswap V2. But trading volume is extremely low - under $130 per day on Uniswap, the most active exchange. Even small trades can cause massive price swings due to lack of liquidity.

Is SCALE built on Ethereum?

Yes. SCALE is an ERC-20 token on the Ethereum blockchain. Its contract address is 0x8A0a9b663693A22235B896f70a229C4A22597623. You can store it in any Ethereum-compatible wallet like MetaMask.

Does SCALE have a whitepaper or official website?

There is no verifiable official website or whitepaper. The project descriptions found on CoinGecko and CoinMarketCap appear to be generic templates with no updates since 2025. No developer documentation, blog, or roadmap exists.

Why is SCALE still listed on major exchanges?

Exchanges like Binance and Bybit list hundreds of low-liquidity tokens to attract speculative traders. Listing doesn’t mean approval or legitimacy. Many of these tokens are abandoned after a short pump-and-dump cycle. SCALE fits that pattern exactly.

Can I stake or earn rewards with SCALE?

No. There are no staking programs, yield farms, or reward systems tied to SCALE. The token has no utility beyond being traded - and even trading it is risky due to near-zero liquidity.

Is SCALE a rug pull?

There’s no official confirmation of a rug pull, but the signs match: massive price drop, zero development activity, no community, and no updates. The project’s official claims contradict its real-world behavior. Most experts consider it abandoned or a dead project.

How does SCALE compare to other DePIN coins?

SCALE is negligible compared to real DePIN projects like Render Network (RNDR), Filecoin (FIL), or Helium (HNT). Those projects have billions in market cap, active development teams, and real-world use cases. SCALE has none of that. It’s a fraction of a percent of the DePIN market’s total value.