ELR Eligibility Calculator

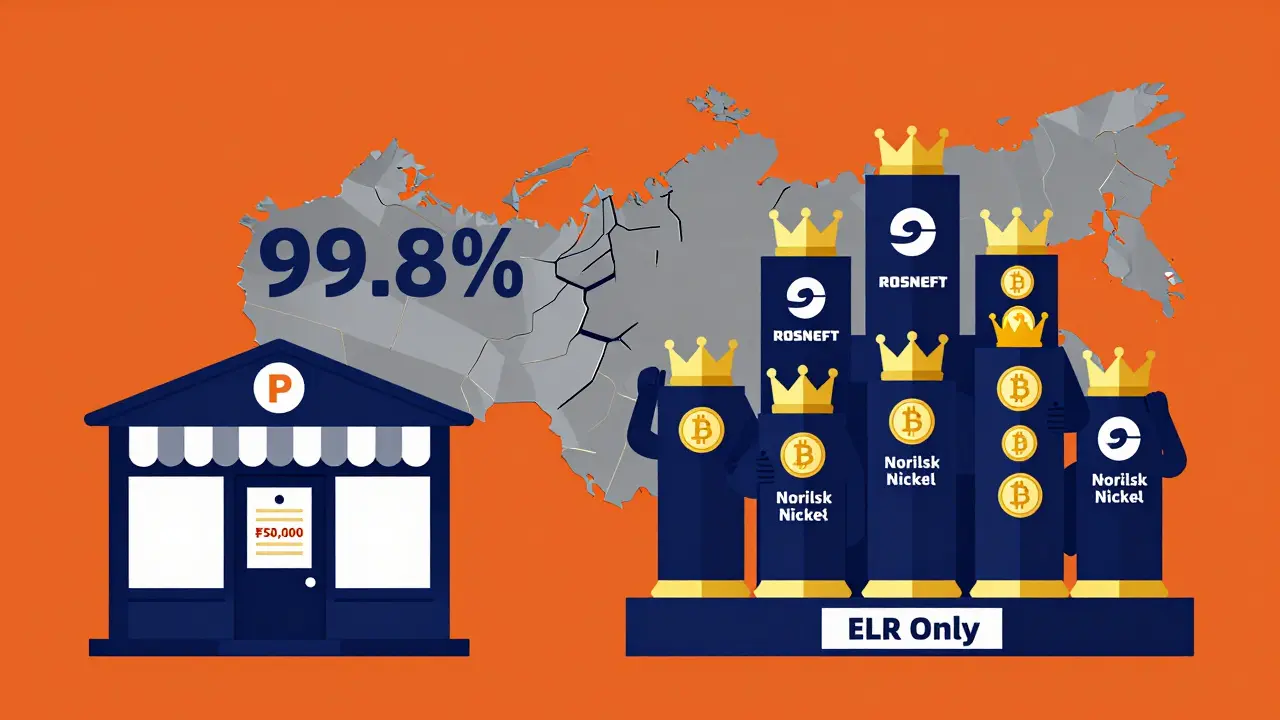

This tool determines if your business meets the strict requirements to legally accept cryptocurrency under Russia's Experimental Legal Regime (ELR). As of 2025, only 0.002% of Russian businesses qualify.

Can a small business in Moscow take Bitcoin for a laptop? Can a factory in Siberia get paid in Ethereum for its metal exports? The answer isn’t simple - and it depends entirely on who you are and where you’re selling.

Domestic Crypto Payments Are Illegal

In Russia, businesses cannot legally accept cryptocurrency as payment for goods or services inside the country. This isn’t a gray area - it’s a hard ban. The Bank of Russia has been clear since 2021: crypto isn’t money. It’s property. And property can’t be used to pay for coffee, rent, or a new delivery van.

Any business that tries to accept Bitcoin, Ethereum, or any other crypto for domestic transactions risks serious consequences. Accounts get frozen. Tax audits kick in. Fines range from 50,000 to 300,000 rubles ($620-$3,700) for even advertising that you take crypto. In June 2025, a Moscow electronics store called TechnoPoint had all its bank accounts locked for 45 days after a customer paid in Bitcoin. No trial. No warning. Just frozen.

This isn’t about controlling innovation. It’s about protecting the ruble. The Central Bank insists crypto can’t compete with the national currency. First Deputy Governor Vladimir Chistyukhin said it plainly in October 2025: “All crypto transactions between Russian residents outside the Experimental Legal Regime should carry criminal penalties.”

There’s One Big Exception: International Trade

But here’s the twist - if you’re selling to someone outside Russia, crypto is not just allowed, it’s becoming essential.

In 2024, Russia changed the rules to let businesses use cryptocurrency for cross-border payments. This wasn’t a tech experiment. It was a survival move. Western sanctions had cut off traditional banking channels. Companies couldn’t get paid by buyers in Asia, the Middle East, or Africa. Crypto became a lifeline.

Finance Minister Anton Siluanov confirmed this in October 2025: “This area must receive proper legislative regulation so we can restore order to the sector.” The goal? Keep exports flowing - especially for oil, gas, and metals.

Now, only a tiny fraction of businesses can use this loophole. To qualify, you need to enter the Experimental Legal Regime (ELR). It’s not a program for startups or local shops. It’s designed for giants.

Who Can Actually Use Crypto Legally? The ELR Requirements

To legally accept crypto for international sales, your business must meet brutal criteria:

- Be classified as a “qualified investor” with at least ₽100 million ($1.24 million) in securities or bank deposits

- Prove you earned at least ₽50 million ($620,000) in annual income

- Use only Central Bank-approved blockchain networks: Bitcoin, Ethereum, or Ripple

- Integrate with one of the 17 licensed wallet providers (like Finversity or BitRiver)

- Install mandatory blockchain monitoring software costing at least ₽1.2 million ($14,800) per year

- Report every transaction over 600,000 rubles ($7,400) to the Unified State Information System (ESIS) within five business days

And that’s just the start. You need dual-factor authentication, staff training, quarterly audits costing 350,000 rubles each, and full KYC checks verified against Rosfinmonitoring’s databases. Setup takes 112 days on average. Total cost? Between $47,000 and $89,000.

As of September 2025, only 247 companies were in the ELR program. That’s 0.002% of Russia’s 12 million registered businesses. Most are state-owned or politically connected. Rosneft, Norilsk Nickel, and other energy giants make up 82% of all legal crypto transactions.

What Happens If You’re Not in the ELR?

If you’re a restaurant, a tech startup, a clothing store, or a local service provider - you’re out of luck.

There’s no middle ground. No “small business exemption.” No “try it and see.” If you accept crypto domestically, you’re breaking the law. Banks automatically flag these transactions. Rosfinmonitoring’s system scans for crypto activity 24/7. Once detected, your account freezes. Tax authorities launch audits. You might be forced to repay the crypto as if it were income - with penalties on top.

A Moscow restaurant chain called Sakhalin lost 18 million rubles ($222,000) in July 2025 when its crypto payment processor got blocked. The reason? Incomplete documentation. No court case. No appeal. Just gone.

Reddit threads from Russian business owners show the same story: 92% of non-ELR respondents say trying crypto payments led to disaster. The rest? They never tried.

How Russia Compares to the Rest of the World

Russia’s approach is extreme - even compared to other countries with strict crypto rules.

China bans crypto payments for businesses too, but allows mining and trading. The U.S. lets businesses accept crypto with proper tax reporting. The EU fully legalized it in December 2024 under MiCA rules - no capital requirements, no elite access. Even India, once hostile, has moved toward regulated acceptance.

Russia’s model is unique: it’s not about banning crypto. It’s about controlling who gets to use it. The system benefits state-linked corporations that need to bypass sanctions. It hurts everyone else.

Professor Sergei Ignatyev, former Central Bank governor, called it a “compliance paradox.” The Ministry of Finance wants to loosen rules. The Central Bank refuses. The result? A fractured system where only the powerful can play.

What’s Changing in 2026?

There are signs the rules might shift - but not for small businesses.

In November 2025, Deputy Finance Minister Ivan Chebeskov hinted the “superqual” investor threshold (₽100 million) might be scrapped. A tiered system with lower entry levels could be coming. But no promises. The Central Bank still says crypto should be limited to “a very, very limited class of investors.”

Also in 2026, tax authorities will fully integrate with financial institutions. Every crypto transaction will be cross-checked against bank records. This could make compliance easier - or make it impossible for anyone who doesn’t have legal access.

Meanwhile, the Central Bank is considering adding more blockchain networks to the ELR list. That could help businesses that want to use newer or cheaper chains. But again - only if you’re already in the club.

Real Impact: Who Benefits and Who Gets Left Behind

The numbers tell the story:

- 247 companies in ELR - 0.002% of all Russian businesses

- $2.3 billion in monthly crypto trade - mostly oil, gas, metals

- 82% of legal crypto transactions from extractive industries

- 78% of ELR participants have government ties (Transparency International, Nov 2025)

- 99.8% of businesses excluded by design

For Rosneft, crypto cuts payment time from 14 days to 4 hours. For a bakery in Novosibirsk, it’s a 50,000-ruble fine and a frozen bank account.

The World Bank labeled Russia’s system “high risk” in October 2025. Why? Because it’s inconsistent, unclear, and creates a black market for crypto payments. Businesses that can’t join the ELR are forced underground. Some use intermediaries. Others pay in rubles and then convert. All of it carries legal risk.

Bottom Line: Can You Accept Crypto in Russia?

If you’re a small or medium business? No. Don’t try. The penalties aren’t worth it.

If you’re a large exporter in oil, gas, or mining? Yes - but only if you can afford the ELR. The cost, paperwork, and bureaucracy are massive. But for those who qualify, it’s a vital tool for surviving sanctions.

Right now, Russia’s crypto policy isn’t about technology. It’s about power. It’s about who gets to trade with the world - and who gets locked out. The system works for a handful of giants. For everyone else, it’s a trap.

The future? Unclear. But if the government ever opens crypto payments to regular businesses, it won’t be because of fairness. It’ll be because the current system breaks under its own weight.