Ever sent a Bitcoin transaction and watched it sit there for hours-maybe even days-while the network choked on congestion? You paid the fee, you hit send, but your transaction just... hangs. No error. No confirmation. Just silence. That’s where Replace-By-Fee (RBF) comes in. It’s not magic. It’s not a hack. It’s a built-in Bitcoin feature designed to give you control when things go slow.

What Exactly Is Replace-By-Fee (RBF)?

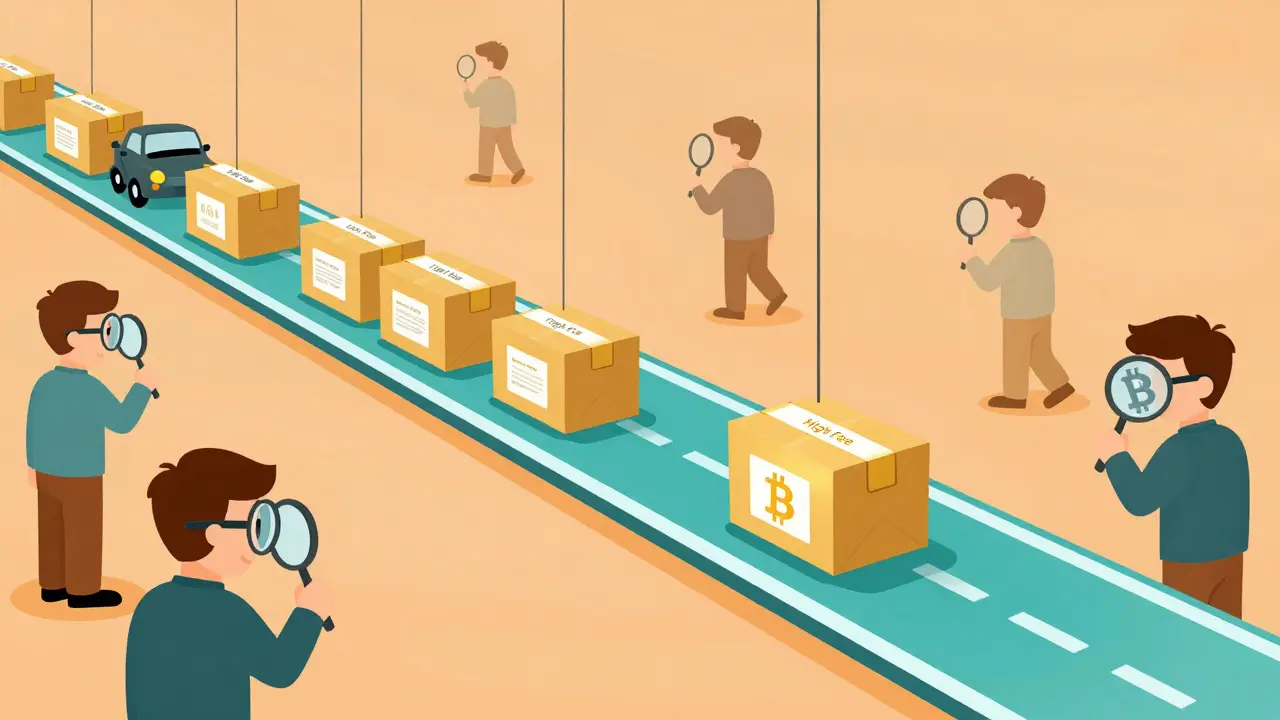

RBF lets you replace an unconfirmed Bitcoin transaction with a new one that pays a higher fee. Think of it like upgrading your shipping label after you’ve already mailed a package-only now you’re paying more to get it through the busy postal hub faster. The original transaction doesn’t vanish. It gets replaced in the mempool (the waiting room for unconfirmed transactions) by the new, higher-fee version. Miners pick the better-paying one, and your transaction gets confirmed.

This isn’t new. Bitcoin’s creator, Satoshi Nakamoto, originally had a version of RBF in mind. But it was turned off early on because of fears someone could spam the network by endlessly replacing transactions. In 2015, developer Peter Todd fixed that with BIP 125-the official spec for opt-in RBF. That’s the key word: opt-in. You have to choose it. Your wallet has to signal that your transaction is replaceable. If you didn’t opt in, your transaction is locked forever until it confirms or drops out of the mempool.

How RBF Actually Works (No Tech Jargon)

Here’s the simple version. When you create a transaction in a wallet that supports RBF, your wallet sets a special flag on the input. That flag tells the network: “Hey, this transaction can be replaced if someone pays more.”

When you want to bump the fee, your wallet creates a new transaction that spends the same coins-but with a higher fee. The rules are strict:

- The new fee must be at least 1 satoshi per virtual byte higher than the original.

- The absolute fee increase must be at least 1,000 satoshis (0.00001 BTC).

- The replacement transaction can’t change the output addresses or amounts-only the fee.

Miners follow these rules. If you break them, your replacement gets rejected. And once your transaction gets even one confirmation? Too late. RBF doesn’t work anymore. That’s by design. It stops people from double-spending after the fact.

When Does RBF Actually Help?

RBF shines during Bitcoin’s busiest moments. Take January 2024, right after the first Bitcoin ETFs got approved. The mempool exploded. Over 300,000 unconfirmed transactions piled up. Fees spiked from 20 sat/vB to over 200 sat/vB in a day. If you sent a transaction at 50 sat/vB during that rush, it could’ve taken 48 hours-or never confirmed.

But if you had RBF enabled? You could’ve bumped it to 150 sat/vB in under a minute. One user on Reddit reported: “Set my fee at 50 sat/vB in Trezor. Saw the backlog. Bumped to 150. Confirmed in the next block. Paid $3.27 extra. Saved hours.” That’s RBF doing its job.

It’s also useful for NFT mints, large transfers, or any time you’re competing with hundreds of other transactions. Without RBF, you’re stuck waiting-or paying way more upfront just to be safe.

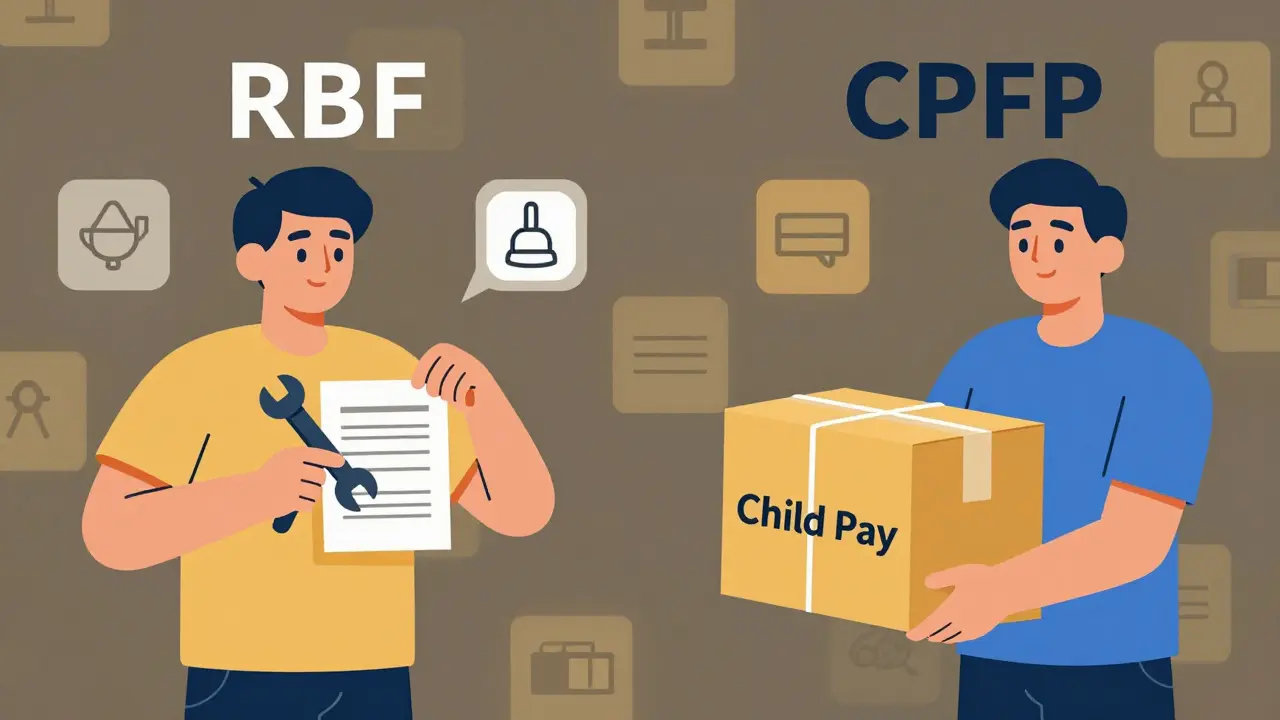

RBF vs. CPFP: What’s the Difference?

You might hear about another method: Child-Pays-For-Parent (CPFP). That’s when the recipient of your stuck transaction creates a new one that spends your unconfirmed output-and pays a high fee to speed up both.

Here’s the problem with CPFP: you need the receiver to cooperate. If you sent Bitcoin to a merchant, exchange, or wallet that doesn’t support CPFP? You’re out of luck. RBF doesn’t need anyone else. It’s entirely under your control.

CPFP also tends to cost more. BitGo’s 2022 analysis found CPFP transactions used 15-20% more in total fees than RBF bumps. Why? Because CPFP requires creating a whole new transaction on top of the stuck one. RBF just replaces it.

But CPFP has one advantage: it works even if you didn’t opt in to RBF. If you’re stuck and your wallet didn’t support RBF, CPFP is your only escape route-if the recipient helps.

Which Wallets Support RBF?

Most major wallets support RBF now. If you’re using one of these, you’re covered:

- Trezor Suite (version 21.2.2+)

- BitPay

- BitGo

- Electrum

- BlueWallet (6.5.2+)

- Blockstream Green

- Coinbase (institutional)

These wallets usually show a small icon or message when you’re sending: “This transaction can be replaced.” That’s your green light. If you don’t see it, RBF is off.

And yes-you need to have extra Bitcoin on hand to bump the fee. You’re not just changing the fee; you’re spending more Bitcoin to pay for it. Most wallets ask for at least 0.0005 BTC (about $30 as of 2025) in confirmed balance to make a bump. That’s because the replacement transaction needs to cover the higher fee, and your wallet needs to sign it.

Common Mistakes and How to Avoid Them

Even with good wallets, people mess up. Here are the top three errors:

- Trying to replace a confirmed transaction - RBF only works on unconfirmed ones. If you see “1 confirmation,” stop. You can’t bump it anymore.

- Not having enough Bitcoin to pay the higher fee - Your wallet needs spare funds to cover the bump. If you’re at 0.0001 BTC left, you won’t be able to bump anything.

- Confusing RBF with double-spending - RBF isn’t a hack. It’s a rule. Only you can replace your own transaction. You can’t use RBF to steal someone else’s Bitcoin. That’s impossible.

One big source of confusion? Merchants. BitPay, for example, still requires one confirmation before considering a payment final. That’s because RBF means your transaction could still be replaced-even if it looks confirmed on your screen. So if you’re paying a merchant and they say “payment received,” but you used RBF? They might not trust it yet. Always wait for one confirmation before assuming it’s done.

Is RBF Safe?

Yes-but with caveats. RBF doesn’t break Bitcoin. It was designed carefully. The opt-in requirement prevents accidental replacement. Non-RBF transactions are completely safe. Even if you’re sending to someone who uses RBF, your own transaction won’t be replaced unless you chose it.

The real risk? Misunderstanding it. Some people think RBF means “I can cancel and resend anytime.” No. It only works before confirmation. Others think it’s a loophole for fraud. It’s not. You can’t replace a transaction to send the same coins to two different people. The protocol blocks that.

But there’s one edge case: if you’re sending a large amount to someone who doesn’t wait for confirmations, and you use RBF, they might accept a payment that later gets replaced. That’s why institutions and exchanges still wait for one or more confirmations. RBF is powerful, but trust still matters.

What’s Next for RBF?

RBF usage is growing. In Q1 2024, 41% of all unconfirmed Bitcoin transactions used RBF-up from 29% the year before. That’s because fee estimation tools are getting smarter. BlueWallet now shows you a live graph of mempool congestion and suggests the best bump amount. Trezor and BitGo have one-click fee bump buttons.

There’s also new development. Bitcoin Core’s proposed BIP 322 (January 2024) could make RBF work better with Taproot transactions. And Lightning Labs is testing RBF-compatible channel management in LND 0.17.0-beta. That’s a big deal-if it works, RBF could help secure Lightning channels without needing full on-chain confirmations.

But some developers think RBF’s role may shrink. With Layer 2 solutions like Lightning gaining traction, fewer people will need to send transactions on-chain. RBF might become less common for small payments-but still essential for large, time-sensitive on-chain transfers.

Should You Use RBF?

If you send Bitcoin often, especially during volatile times? Yes. Turn it on. It’s free to enable. It gives you control. It saves you money in the long run.

If you’re a merchant or exchange? Don’t accept unconfirmed payments. Wait for at least one confirmation. RBF isn’t a flaw-it’s a feature. But it changes how you define “final.”

If you’re new to Bitcoin? Learn it. Don’t just send and hope. Know what happens when things slow down. RBF isn’t complicated. It’s just one more tool in your belt.

Bitcoin’s fee market is competitive. You’re not just paying for space-you’re bidding for it. RBF lets you adjust your bid after you’ve entered the auction. That’s not cheating. That’s smart.

Can I use RBF to cancel a Bitcoin transaction?

No. RBF doesn’t cancel transactions-it replaces them with a higher-fee version to speed up confirmation. You can’t undo a payment or send the same coins to someone else. The original transaction is only replaced if the new one pays more and follows the rules. Once confirmed, RBF no longer works.

Do I need extra Bitcoin to use RBF?

Yes. To bump the fee, your wallet needs to create a new transaction that pays more. That means you need spare Bitcoin in your wallet to cover the higher fee. Most wallets require at least 0.0005 BTC (around $30) in confirmed balance to perform a fee bump.

Why won’t my wallet let me use RBF?

Your wallet might not support RBF, or you may have disabled it. Check your wallet’s settings before sending. If you didn’t opt in when creating the transaction, RBF is not available. Also, some wallets only allow RBF for certain types of transactions-like those not involving multisig or Lightning channels.

Is RBF the same as Child-Pays-For-Parent (CPFP)?

No. RBF lets you replace your own transaction with a higher fee. CPFP lets someone else (like the recipient) create a new transaction that spends your unconfirmed output and pays a high fee to speed up both. RBF is sender-controlled; CPFP needs the receiver’s help.

Can RBF be used to double-spend Bitcoin?

No. RBF cannot be used to double-spend. The protocol requires that replacement transactions must spend the same inputs as the original. You can’t change the destination address or amount. Also, only the original sender can create a replacement. Miners and nodes reject any attempt to replace a transaction with a different output.

How long does it take for an RBF transaction to confirm?

After a successful fee bump, an RBF transaction typically confirms within 1 to 3 blocks (about 10-30 minutes) during moderate congestion. During extreme congestion, like in January 2024, it may take longer-but still far faster than a non-RBF transaction stuck for 24+ hours.