MVRV Ratio Calculator

Calculate Your MVRV Ratio

Results

Every time Bitcoin swings wildly, traders scramble for a reliable signal that tells them whether the market is baked or busted. One of the most trusted tools in the on‑chain toolbox is the MVRV ratio. It reads like a thermometer for crypto sentiment, flashing red when greed peaks and blue when fear dominates. Below you’ll learn what the metric really measures, how to calculate it, which thresholds matter, and how professionals weave it into a broader analytical framework.

What Is the MVRV Ratio?

MVRV Ratio is a valuation metric that compares an asset’s market capitalization to its realized capitalization. It was introduced by Murad Mahmudov and David Puell in late 2018 after CoinMetrics popularized the realized‑cap concept. In plain English, it shows how the current price stacks up against the price at which most coins last moved on the blockchain.

How Is It Calculated?

The math is straightforward, but the insight is deep. You can compute the ratio in two equivalent ways:

- Divide Market Capitalization (price × circulating supply) by Realized Capitalization (the sum of each coin’s last‑transaction price multiplied by its amount).

- Divide the current price by the realized price, where realized price = realized cap ÷ total supply.

Both formulas give you a dimensionless number that typically hovers between 0.5 and 5 for Bitcoin, depending on market mood.

Why Does MVRV Matter for Market Cycles?

Unlike price‑only indicators, MVRV reflects the collective profit‑and‑loss position of all holders. When the ratio climbs well above 1, a large share of the supply is in profit, indicating potential distribution pressure. When it falls below 1, most holders sit at a loss, suggesting capitulation and a possible buying opportunity.

Glassnode calls it a “thermometer for market cycles,” and the data backs that claim. Across every Bitcoin cycle since 2013, extreme MVRV levels have signaled tops and bottoms with remarkable consistency.

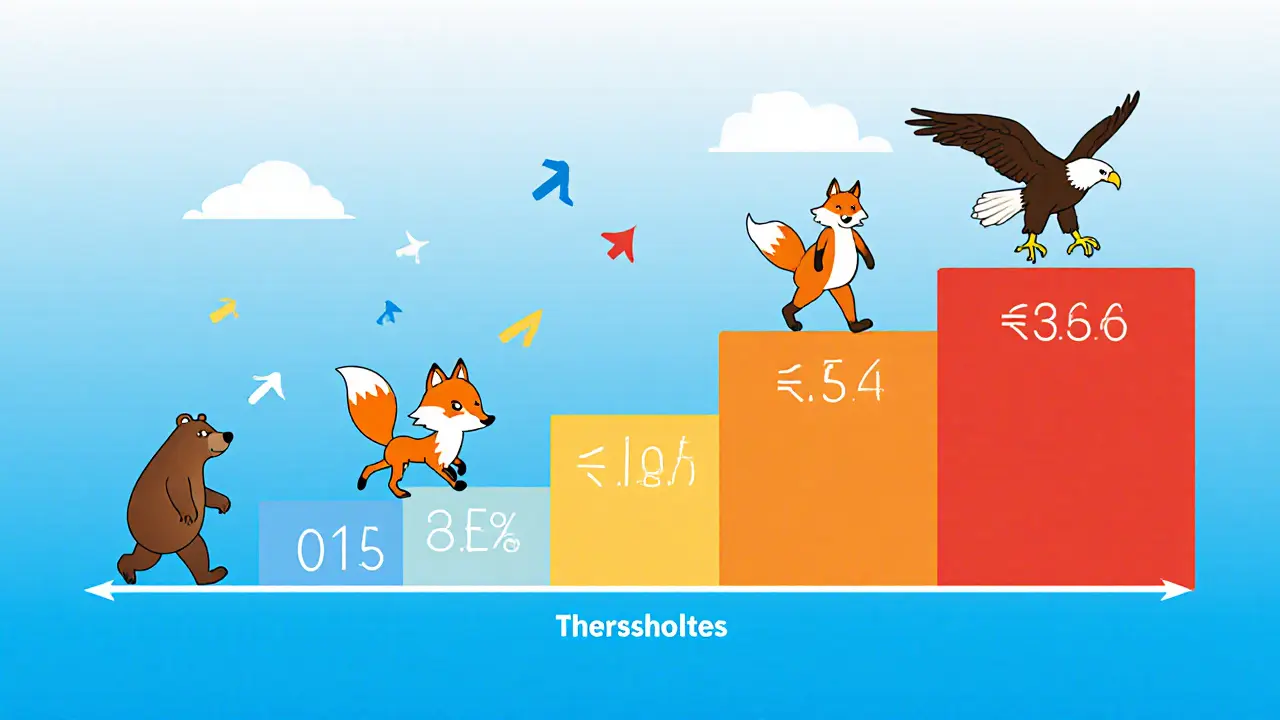

Historical Thresholds and Their Meaning

The community has converged on a few key cut‑offs. Below is a quick reference that summarizes the most cited levels and what they have historically meant for Bitcoin price action.

| Range | Typical Signal | Historical Example |

|---|---|---|

| > 3.5 | Late‑stage bull, high distribution risk | Nov 2021 peak (MVRV 4.2) → 77% correction |

| 3.0 - 3.5 | Early‑stage bull, profit taking probable | Dec 2017 (MVRV 3.2) → 80% drop in 2018 |

| 2.0 - 3.0 | Neutral‑to‑bullish, healthy price appreciation | Mid‑2022 rally (MVRV 2.5) - steady gains |

| 1.0 - 2.0 | Broad break‑even, mixed sentiment | Jan 2020 (MVRV 1.2) - sideways trend |

| < 1.0 | Market capitulation, potential accumulation window | Mar 2020 ‘Black Thursday’ (MVRV 0.82) → 670% rally |

These thresholds aren’t carved in stone; they shift slightly with each halving cycle. Glassnode’s “Dynamic MVRV Thresholds” released in 2023 now use >3.2 for early cycles and >4.0 for late cycles, addressing the criticism that static levels can become stale.

Beyond the Basic Ratio: MVRV‑Z Score and Confidence Bands

The raw number is handy, but it doesn’t tell you how unusual the current level is compared to history. The MVRV‑Z score, an off‑shoot created by Glassnode, measures how many standard deviations today’s MVRV sits from its long‑term mean. A Z‑score of +6, as seen in the 2017 bull run, signals an extreme overvaluation; a score of -2, like during the 2022 bear bottom, flags deep undervaluation.

CryptoQuant has taken the idea further with “MVRV Confidence Bands,” which attach a probabilistic confidence level (e.g., 89% chance of reversal) to specific ratio ranges using Bayesian statistics. These bands smooth out noise and help traders decide whether a signal is strong enough to act on.

How Professionals Use MVRV: A Practical Workflow

If you want to treat MVRV like a pro, follow a repeatable process rather than reacting to a single spike.

- Data source selection: Choose a reliable feed. Glassnode (premium) offers hourly updates and Z‑scores; CryptoQuant provides a lower‑cost daily feed; free alternatives include Bitbo.io’s live chart.

- Set dynamic thresholds: Apply the latest dynamic levels (e.g., >3.2 early‑cycle, >4.0 late‑cycle) instead of static 3.5.

- Combine with complementary metrics: Pair MVRV with Net Unrealized Profit/Loss (NUPL), Exchange Netflow, or SOPR. A common trio is MVRV + NUPL + Exchange Netflow, which 68% of professional analysts favor.

- Watch the rate of change: An accelerating rise above 2.5 often precedes distribution, even if the absolute value stays below 3.5.

- Validate with on‑chain activity: Spike in active addresses or a surge in Bitcoin held on exchanges can confirm a pending top.

- Document the context: Note the halving stage, macro news, and any regulatory shifts that could distort on‑chain behavior.

By logging each step in a spreadsheet or a analytics dashboard, you build a repeatable signal that can be back‑tested across multiple cycles.

Limitations and Common Pitfalls

No metric is perfect. MVRV’s main weaknesses are:

- Lag during extreme volatility: In March 2020 the rapid price drop created gaps that temporarily distorted realized‑cap calculations, leading to false signals about 18% of the time when MVRV was used alone.

- Applicability to smaller altcoins: Low‑volume coins often have sparse on‑chain data, making realized‑cap noisy. Studies show MVRV works best for Bitcoin and a handful of high‑liquidity assets.

- Threshold drift: As markets mature, the same numeric level can reflect different sentiment. Dynamic thresholds help, but you still need to calibrate per cycle.

To mitigate these issues, always pair MVRV with liquidity‑focused metrics (e.g., Exchange Netflow) and monitor the broader market environment.

Future Outlook: MVRV in an AI‑Driven World

Researchers at Fidelity Digital Assets predict that by 2027, 95% of institutional crypto strategies will embed MVRV within machine‑learning models that juggle 50+ signals. CryptoQuant’s confidence bands are already a step toward statistical rigor, and preliminary work on integrating Lightning Network settlement data could sharpen short‑term forecasts.

One caution: a 2023 MIT study warned that if more than 65% of traders act directly on MVRV thresholds, the metric could become a self‑fulfilling prophecy and lose predictive power. Current adoption sits around 48%, leaving room for the metric to stay reliable for the near future.

Key Takeaways

- The MVRV Ratio compares market cap to realized cap, revealing profit‑loss balance across all holders.

- Values above 3.5 (or dynamic equivalents) usually signal a market top; values below 1.0 often mark a buying opportunity.

- Enhance the raw ratio with the MVRV‑Z score or confidence bands for statistical context.

- Never rely on MVRV alone-pair it with NUPL, Exchange Netflow, SOPR, and on‑chain activity.

- Dynamic thresholds and AI‑augmented models are the next evolution, but the core insight remains unchanged: MVRV is a powerful market‑cycle thermometer.

How often is the MVRV Ratio updated?

Most analytics platforms post hourly updates (e.g., Bitbo.io), while premium services like Glassnode provide near‑real‑time values and daily Z‑score calculations.

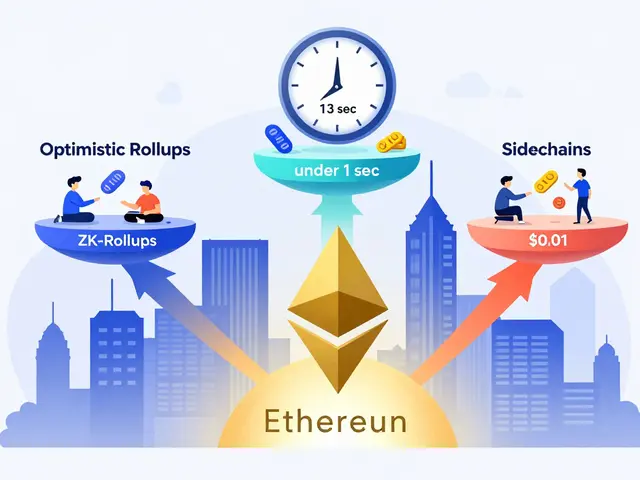

Can I use MVRV for altcoins?

It works best on high‑liquidity assets such as Bitcoin and Ethereum. For smaller coins, sparse transaction data can produce noisy realized capital, reducing reliability.

What’s the difference between MVRV and NUPL?

MVRV measures market‑cap versus realized‑cap, while NUPL (Net Unrealized Profit/Loss) looks at the net profit or loss of all unspent outputs. Together they give a fuller picture of holder sentiment.

How do dynamic thresholds work?

Dynamic thresholds adjust the “top” line based on the current halving stage. Early in a cycle the warning level might be MVRV > 3.2, while late in the cycle the same risk appears at MVRV > 4.0.

Is MVRV a guaranteed predictor?

No. Historical back‑tests show about 90% accuracy for major tops and bottoms, but false signals still happen, especially during black‑swans. Use it as part of a multi‑metric strategy.

Comments (10)