SUNI Airdrop Value Calculator

Calculate Your SUNI Airdrop Value

Estimate potential value of SUNI tokens based on expected future price

Crypto enthusiasts love a good free‑token drop, but not every airdrop lives up to the hype. The SUNI Token is a newly issued cryptocurrency that launched its first distribution through a partnered airdrop on CoinMarketCap. If you’ve seen the buzz about the SUNI airdrop and wonder whether it’s worth your time, this guide walks you through everything you need to know - from eligibility rules to token allocation, and the red flags you should watch for.

What the SUNI Airdrop Actually Is

In simple terms, an airdrop is a promotional giveaway where a project sends free tokens to a set of qualified wallets. The SUNI campaign is the project’s inaugural token distribution, and it is being run entirely through CoinMarketCap the leading crypto data platform that hosts verified airdrop programs. By using CMC’s built‑in verification system, SUNI hopes to avoid the usual bot‑flood and multi‑account farming that plague many free‑token events.

Key numbers from the official announcement are:

- Total supply allocated for the airdrop: 3,500,000 SUNI

- Number of participants selected: 850

- Average allocation per winner: ~4,118 SUNI

- Current market price at distribution: ≈$0 (tokens are not yet listed on exchanges)

The “environmental” angle mentioned in SUNI’s branding suggests the token could be tied to carbon‑offset or green‑energy initiatives, but the whitepaper and roadmap are still missing from public view.

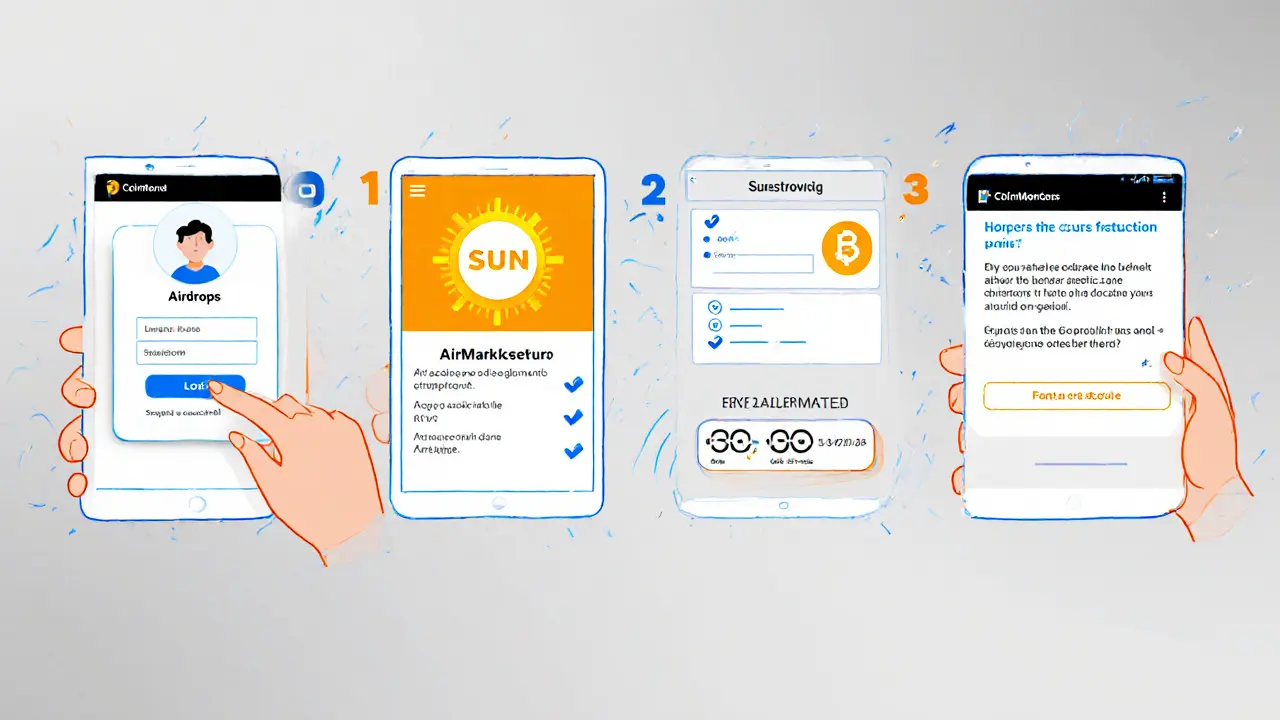

Step‑by‑Step: How to Claim the SUNI Airdrop

- Create a CoinMarketCap account or log in to your existing profile.

- Navigate to the “Airdrops” section and locate the SUNI campaign.

- Complete the required tasks - usually a short questionnaire about your crypto holdings and a KYC (Know‑Your‑Customer) verification. Do not provide private keys or pay any fee.

- Submit your wallet address (ERC‑20 compatible address is the safest bet unless SUNI specifies another blockchain).

- Watch for the claim window announcement; tokens are typically distributed within 2‑4 weeks after the final verification round.

Because the distribution runs through CMC, you will receive a notification directly on the platform, and the tokens will appear in the wallet you submitted once the on‑chain transfer is complete.

Token Allocation Details and What They Mean for You

The 3.5 million SUNI tokens are a tiny slice of the project’s total supply - the exact cap has not been disclosed, but most launch‑phase airdrops represent less than 5 % of total issuance. With only 850 wallets receiving tokens, the average allocation of around 4,118 SUNI is relatively generous compared to mass‑scale airdrops that hand out a few hundred tokens to thousands of users.

However, the valuation being listed as ≈$0 tells you two things:

- The tokens are not yet tradable on major exchanges, so you can’t immediately sell them for fiat or other crypto.

- Market demand is unknown - the price could stay at $0, rise if the project gains traction, or fall if the token never lists.

In practice, many participants treat such early airdrops as a speculative bet: hold the tokens, monitor project updates, and possibly sell once a reputable exchange lists SUNI.

Potential Risks and Red Flags

Even with CoinMarketCap’s vetting, the SUNI airdrop carries typical crypto‑airdrop hazards:

- Limited public information: No clear roadmap, team identities, or technical specs are publicly available.

- Zero market price: Tokens that never get listed are effectively worthless.

- KYC abuse: Some airdrops request excessive personal data. Stick to the basic information CMC asks for; never share passport scans unless you’re sure the project is regulated.

- Phishing attempts: Fake “SUNI claim” websites mimic CMC’s UI. Always verify the URL starts with https://coinmarketcap.com.

Doing your own due diligence - joining community channels, reading any available whitepaper drafts, and checking for third‑party audits - can help you decide whether the potential upside outweighs these uncertainties.

How SUNI Stacks Up Against Other 2025 Airdrops

2025 has been a busy year for token giveaways. Below is a quick side‑by‑side look at three notable airdrops, including SUNI.

| Project | Total Tokens Distributed | Participants | Avg Tokens per User | Initial Valuation |

|---|---|---|---|---|

| SUNI | 3,500,000 | 850 | ~4,118 | ≈$0 (non‑listed) |

| Sonic (S) | 190,500,000 | ≈30,000 | ≈6,350 | $0.02 (listed on major DEXes) |

| Midnight | 12,000,000 | 1,200 | 10,000 | $0.005 (limited CEX listings) |

While SUNI’s participant count is the smallest, its average allocation is comparable to larger campaigns. The biggest difference is the lack of immediate market listing, which makes SUNI a higher‑risk, higher‑potential‑reward play.

Security Best Practices for Any Airdrop

Whether you chase SUNI or any other free token, the following habits keep your crypto safe:

- Never share private keys. A legitimate airdrop only needs a public wallet address.

- Use a dedicated airdrop wallet. Isolate the address you give to campaigns; keep your main holdings separate.

- Verify URLs. Look for the official coinmarketcap.com domain and check the SSL certificate.

- Beware of upfront fees. Real airdrops never ask you to send crypto to receive tokens.

- Enable two‑factor authentication (2FA) on all accounts involved (CMC, email, wallet).

Following these steps dramatically reduces the chance of falling for a phishing scam or losing assets to a malicious “airdrop” operator.

Next Steps and How to Stay Informed

If you’ve completed the claim process, monitor two channels closely:

- The CoinMarketCap airdrop dashboard - it will post the exact distribution date and any token‑release updates.

- The SUNI project’s official communication lines (Telegram, Discord, or a dedicated website). Even if the current information is sparse, future announcements will likely detail token utility, roadmap, and potential exchange listings.

Keeping an eye on these sources lets you act quickly when the tokens become tradable or when a new partnership is announced that could boost SUNI’s price.

Final Thoughts

The SUNI airdrop is a classic example of a low‑scale, platform‑verified token giveaway. It offers a decent amount of free tokens per participant, but the lack of market value and scarce project details mean you should treat it as a speculative experiment rather than a guaranteed profit source. Follow the step‑by‑step claim guide, apply the security checklist, and stay alert for official updates - that’s the recipe for navigating any crypto airdrop safely.

What is the SUNI token and why does it have an airdrop?

The SUNI token is a newly created cryptocurrency that aims to support environmental initiatives, though its exact use‑case is still under development. The airdrop is the project’s first public token distribution, intended to seed a community of early supporters.

How can I verify that the SUNI airdrop is legitimate?

The campaign is hosted on CoinMarketCap, a reputable data platform that runs a verification process for each airdrop. Always access the program through the official coinmarketcap.com URL and avoid third‑party sites that ask for private keys or upfront payments.

When will I receive the SUNI tokens after I claim?

Tokens are typically distributed 2‑4 weeks after the final KYC verification round. CoinMarketCap will send a notification and the tokens will appear in the wallet address you submitted.

Can I trade SUNI tokens right after I receive them?

No. As of now the SUNI token is not listed on any exchange, so its market price is shown as $0. You’ll need to wait for an official listing announcement before you can trade.

What security measures should I follow when claiming an airdrop?

Never share private keys, use a dedicated wallet address for airdrops, enable 2FA on all accounts, and verify URLs end with coinmarketcap.com. Also, be wary of any request for payment or personal documents beyond basic KYC.

Comments (5)