By 2025, over 22 million Nigerians-more than one in ten people-owned cryptocurrency. Not because they were chasing get-rich-quick schemes, but because the naira had stopped working. Inflation hit 24%, the currency lost over 75% of its value against the dollar since 2016, and banks refused to touch crypto-related transactions. So people turned to Bitcoin, USDT, and other digital assets just to survive.

Why the Naira Keeps Losing Ground

The Central Bank of Nigeria (CBN) still controls the official exchange rate, but the real market price for the dollar is often twice as high. That gap isn’t accidental-it’s the result of artificial scarcity. The CBN limits how much foreign currency banks can sell, creating a black market where dollars cost more. When you can’t buy dollars legally, and your savings are evaporating every month, crypto becomes the only escape route. Between July 2023 and June 2024, Nigerians moved $59 billion through cryptocurrency networks. That’s more than any country except India. And 85% of those transactions were under $1 million. This isn’t Wall Street speculation. This is a mother sending money to her sister in Lagos. A student paying for online courses. A mechanic buying tools from China. All bypassing banks, all avoiding the naira.Stablecoins Are the Real Heroes

Bitcoin gets the headlines, but USDT (Tether) is what keeps Nigeria’s digital economy running. It’s not because people love Tether-it’s because USDT trades at nearly $1, no matter what’s happening to the naira. When the naira drops 10% in a week, USDT stays steady. That’s why 43% of all crypto transactions under $1 million use USDT. People aren’t betting on crypto prices-they’re using it as a digital dollar. This matters because every time someone buys USDT with naira, they’re pulling money out of the local financial system. That reduces demand for the naira. Less demand = lower value. It’s simple economics. And with over 36% of Nigerian adults unbanked, crypto isn’t just an alternative-it’s the only option for millions.How Crypto Bypasses the System

Traditional remittances cost up to 8% per transaction. Wire transfers take days. Banks demand paperwork. Crypto? Send $100 to a relative in Abuja in under 10 minutes. Pay less than 1% in fees. No bank account needed. Just a phone and a wallet app. And it’s not just Nigerians sending money home. The diaspora-Nigerians living in the U.S., UK, and Germany-are sending billions back using crypto. They don’t convert to naira. They send USDT directly to wallets. The recipient cashes out through local P2P traders. No naira ever touches the official banking system. That means the CBN loses control over how much currency circulates. It can’t track it. Can’t tax it. Can’t control it.

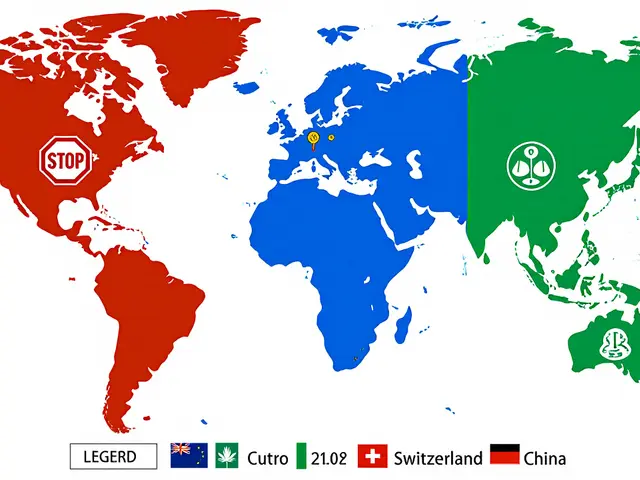

The Government’s Failed Crackdown

In 2017, the CBN told banks to stop serving crypto users. Accounts got frozen. Traders got scared. But the crackdown didn’t stop crypto-it made it stronger. People switched to peer-to-peer platforms like Paxful and Binance P2P. They met in cafes, parked cars, even churches to trade cash for Bitcoin. When the government cracked down harder in 2022, fining six banks ₦1.31 billion for dealing with crypto, traders just moved underground. The End SARS protests in 2020 were a turning point. When banks froze accounts of activists, people turned to Bitcoin to fund demonstrations. Bitcoin trended on Twitter. Wallets filled with donations. It proved crypto wasn’t just about money-it was about freedom from state control.Why Regulation Finally Came

By 2025, the CBN had no choice. You can’t ban something 22 million people use. So Nigeria passed the Nigerian Investment and Securities Act, recognizing digital assets as securities. That didn’t mean legalizing crypto. It meant regulating it. Exchanges now need licenses. Wallet providers must verify users. Taxes are coming. But here’s the truth: regulation didn’t kill crypto. It made it more legitimate. More people joined because they could now use regulated platforms without fear of arrest. Transaction volume jumped 25% in 2024 to $55.4 billion. User numbers are expected to hit 28.7 million by 2026.

The Ripple Effect

Every dollar sent via crypto is a dollar the naira doesn’t get. Every person using USDT instead of naira is a person not contributing to local economic demand. That’s why the currency keeps falling. The CBN prints more naira to cover budget shortfalls. People lose faith. They buy crypto. The cycle feeds itself. Even worse, young Nigerians-52% of crypto users are under 30-are building careers around crypto. They’re freelancers paid in USDT. They’re P2P traders earning commissions. They’re developers building local blockchain tools. If the naira collapses further, these jobs vanish. But if the government tries to shut down crypto, they lose their livelihoods.What Comes Next?

The naira won’t recover unless the underlying problems are fixed: inflation, currency controls, banking exclusion. Crypto isn’t the cause of Nigeria’s crisis-it’s the symptom. And until the government stops treating crypto as an enemy and starts treating it as a tool, the pressure on the naira will only grow. The data doesn’t lie. Crypto adoption is rising. Naira value is falling. And the people? They’ve already voted-with their wallets.Why are Nigerians turning to cryptocurrency instead of using the naira?

Nigerians use crypto because the naira has lost over 75% of its value since 2016, inflation is over 24%, and the government restricts access to foreign currency. Crypto offers a stable alternative-especially USDT, which holds its $1 value-allowing people to save, send money, and pay for goods without losing purchasing power.

How much crypto do Nigerians trade each year?

Nigerians traded $59 billion in cryptocurrency between July 2023 and June 2024, making Nigeria the second-largest crypto market in the world after India. In 2024 alone, transaction inflows reached $55.4 billion, up 25% from the previous year.

Is cryptocurrency legal in Nigeria?

Cryptocurrency isn’t banned, but it’s regulated. The Central Bank of Nigeria previously told banks to avoid crypto, but in 2025, the Nigerian Investment and Securities Act recognized digital assets as securities. Now, exchanges must be licensed, and users must be verified-making crypto legal under oversight.

What role do stablecoins like USDT play in Nigeria’s crypto market?

USDT accounts for 43% of all crypto transactions under $1 million in Nigeria. Because it’s pegged to the U.S. dollar, it acts as a stable store of value when the naira is crashing. People buy USDT to protect savings, pay for imports, or receive payments from abroad without converting to naira.

How has the Central Bank of Nigeria responded to crypto adoption?

The CBN first banned banks from serving crypto users in 2017, then fined six banks ₦1.31 billion in 2022 for non-compliance. But with 22 million users and $59 billion in annual volume, outright bans failed. In 2025, the CBN shifted to regulation under the Nigerian Investment and Securities Act, acknowledging crypto’s inevitability.

Does crypto trading directly cause the naira to weaken?

Yes. Every time someone buys USDT with naira, they’re reducing demand for the local currency. Since crypto transactions bypass the official banking system, the CBN loses control over money supply and foreign exchange flows. This capital flight and reduced naira usage directly contribute to its depreciation.

Who are the main users of cryptocurrency in Nigeria?

Over half of Nigerian crypto users are under 30. Many are students, freelancers, small business owners, and members of the diaspora. The unbanked and underbanked-about 36% of adults-rely on crypto because traditional banks are inaccessible or unreliable. It’s not speculation-it’s survival.

What’s the future of crypto and the naira in Nigeria?

Crypto use is projected to grow to 28.7 million users by 2026. As long as inflation stays high, the naira remains unstable, and banking access is limited, crypto will keep competing with the naira. The government can’t stop it-but it can manage it. The future lies in regulation, not prohibition.