Crypto Compliance Advisor

Check Your Country's Crypto Regulations

Enter your country to see which regulatory model applies and what compliance requirements you need to follow.

Compliance Results

Select your country to see results.

Key Requirements

- Select your country to see requirements

Tax Information

Select your country to see tax information

Licensing Information

Select your country to see licensing details

When navigating the legal landscape, cryptocurrency regulations are the set of rules that govern digital assets, blockchain services, and related financial activities within a specific jurisdiction. By 2025, more than three‑quarters of the world’s nations have adopted some form of crypto oversight, but the depth and tone of those rules vary wildly.

cryptocurrency regulations can feel like a maze, especially if you’re a trader, a developer, or a startup founder trying to stay compliant. This guide breaks down the biggest questions you’ll face, walks you through the main regulatory models, and gives you a checklist you can use right away.

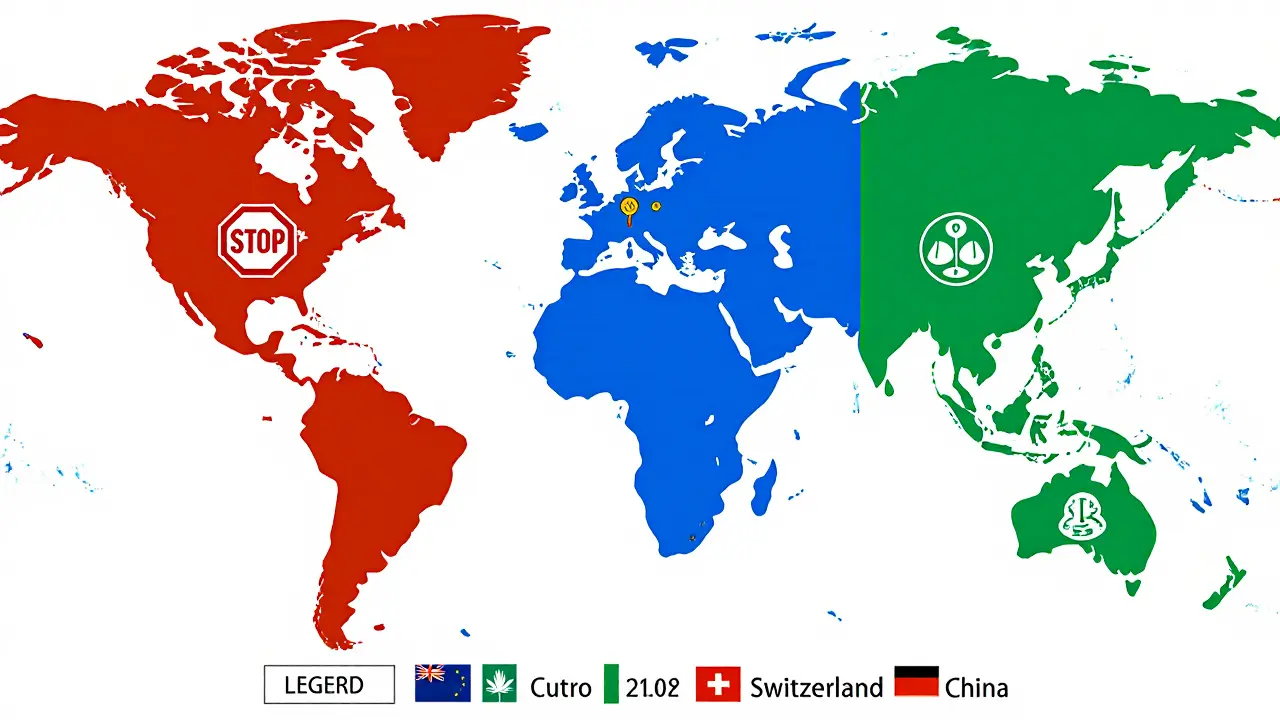

1. The Three Core Regulatory Models

Across 195+ jurisdictions, regulators have settled into three broad categories:

- Restrictive - bans or heavy limits on trading, mining, and token sales.

- Neutral - treats crypto like any other financial product, applying standard AML, tax, and licensing rules.

- Crypto‑friendly - creates tailored frameworks, often with tax incentives and sandbox programs.

Knowing which bucket your country falls into tells you whether you need a full‑blown license, just a simple AML registration, or possibly none at all.

2. Key Building Blocks of Crypto Regulation

Regardless of the model, most regimes share four components that you’ll encounter in any compliance plan:

- Licensing frameworks - formal approval to operate an exchange, wallet service, or custodial platform.

- AML/CFT requirements - Know‑Your‑Customer (KYC) and transaction monitoring rules, often aligned with the FATF Travel Rule.

- Tax treatment protocols - how capital gains, income, and stable‑coin earnings are reported.

- Stablecoin-specific rules - reserve‑backing, audit frequency, and disclosure obligations.

3. Spotlight on Major Jurisdictions

Below is a quick look at how the world’s most influential regulators apply those building blocks.

| Jurisdiction | Model | Key License Body | Stablecoin Rules | Tax Rate on Gains |

|---|---|---|---|---|

| European Union (MiCA) | Neutral / Crypto‑friendly | National Competent Authority | 1:1 reserves, monthly attestations | Varies by member state (0‑45%) |

| United States (GENIUS Act) | Neutral (fragmented) | SEC, CFTC, state regulators | 1:1 backing, quarterly audits | Capital gains tax (15‑37%) |

| Switzerland (FINMA) | Crypto‑friendly | FINMA | Reserve verification, no specific stablecoin law yet | Flat 15% on income, gains exempt if >1 yr |

| United Arab Emirates (ADGM/DIFC) | Crypto‑friendly | VARA | Full liquidity, annual audit | 0% capital gains tax |

| China | Restrictive | None (ban) | Prohibited | Not applicable |

4. How to Get Licensed: A Step‑by‑Step Checklist

If you fall into the licensing requirement, follow this universal roadmap. Adjust timelines and fees based on local tables above.

- Identify the appropriate regulator (e.g., FINMA, MAS, SEC).

- Prepare a detailed business plan covering tokenomics, AML policies, and IT security.

- Gather required capital - typically €150k‑€250k for EU services, CHF 15k‑50k for Swiss activities.

- Submit the application with supporting documents (KYC procedures, audit reports, reserve attestations).

- Undergo regulator review - expect 4‑9 months in most friendly jurisdictions, up to 14 months in the U.S.

- Pay licensing fees (EU €5‑25k, U.S. $750k total compliance cost, Swiss CHF 15‑50k).

- Launch a compliance program: appoint a dedicated officer, set up transaction monitoring per FATF guidelines, and schedule regular audits.

Success stories abound: an Australian DeFi startup saved AUD 220,000 by using the ASIC sandbox, while a European exchange avoided €1.9k in lost staking yields by quickly adapting to MiCA’s token‑listing rules.

5. Tax Essentials You Can’t Ignore

Tax treatment is the most varied part of crypto compliance.

- Germany: crypto held >1 year is tax‑free.

- Portugal: flat 28% on capital gains for individuals.

- India: 30% flat tax + 1% TDS on every transaction.

- U.S.: capital gains taxed as short‑term or long‑term rates, plus possible crypto‑income reporting.

Practical tip: keep a ledger that records acquisition date, cost basis, and disposal amount. Many providers now offer built‑in tax reports that align with local rules.

6. Common Pitfalls and How to Avoid Them

Even seasoned players slip up. Here are the top three mistakes and quick fixes.

- Missing the Travel Rule. If your VASP processes transactions above $3,000, you must capture beneficiary details and transmit them to the counterpart. Use a compliance‑as‑a‑service solution that auto‑fills the required fields.

- Assuming a license is universal. A EU MiCA license doesn’t automatically cover the UK or the U.S. Plan for parallel applications if you serve multiple regions.

- Ignoring stablecoin audit schedules. Missed quarterly reports can trigger fines or license suspension. Set calendar reminders and automate data pulls from custodial banks.

7. Looking Ahead: 2026 and Beyond

Regulators are already drafting the next wave of rules. Expect the EU’s MiCA II to target DeFi protocols and NFTs, while the U.S. Senate’s Clarity for Payment Stablecoins Act could bring a single federal charter for stable‑coin issuers. The Basel Committee may lower risk‑weight caps for tokenised assets, making them more attractive to traditional banks.

Staying ahead means monitoring official bulletins, joining industry groups, and treating compliance as a continuous process, not a one‑off filing.

Do I need a license to run a crypto wallet?

In most neutral and friendly jurisdictions, custodial wallets that hold users' private keys on their behalf are considered a crypto‑asset service and require a license. Non‑custodial wallets, where users retain full control, usually fall outside licensing rules but still must meet AML reporting if they facilitate fiat on‑ramps.

What is the FATF Travel Rule and why does it matter?

The Travel Rule, updated in February 2025, obliges virtual asset service providers (VASPs) to collect and share the sender’s and receiver’s name, address, and account numbers for transactions above $3,000. Failure to comply can lead to fines, license revocation, and black‑listing by international partners.

How are stablecoins regulated differently from other tokens?

Stablecoins are subject to reserve‑backing requirements, regular audits, and sometimes separate licensing (e.g., the U.S. GENIUS Act). Unlike utility tokens, regulators view them as quasi‑currency, so they must meet both securities and banking‑style oversight.

Can I operate a crypto exchange without a physical office?

Yes, many jurisdictions accept a virtual office model as long as you can demonstrate robust governance, AML controls, and a designated compliance officer. The EU’s MiCA and Singapore’s MAS both allow fully remote licensing, but you’ll need a local legal representative.

What are the biggest cost drivers for crypto compliance?

Licensing fees, legal counsel, audit services, and the salaries of dedicated compliance officers. In 2025, global compliance spending hit $14.7 billion, with the United States alone accounting for $5.3 billion.

Comments (10)