MATRIX Futures Profit Calculator

Trading Analysis

Key Takeaways

- Matrix Labs is a Canadian blockchain startup behind the MATRIX token and Matrixswap perpetual futures platform.

- The token has a 100 million max supply, with about 34 million circulating and a current price under $0.001.

- Matrixswap uses a virtual AMM (vAMM) to offer leveraged perpetual futures with on‑chain liquidity across Polygon, Polkadot and Cardano.

- Low trading volume (<$30 24‑hour) and a tiny market cap raise serious liquidity concerns.

- AI‑driven WORLD3 agents aim to simplify onboarding, but regulatory risk remains for leveraged trading.

When exploring new DeFi projects, Matrix Labs is a Canadian blockchain technology company founded in 2021 that created the MATRIX token and the Matrixswap protocol. The project markets itself as a bridge between AI‑powered user interfaces and decentralized finance, claiming to have onboarded more than 300,000 newcomers via its WORLD3 AI agent platform.

What Exactly Is the MATRIX Token?

The native currency of the ecosystem is the MATRIX token. It powers transaction fees on Matrixswap, serves as collateral for leveraged positions, and unlocks access to special features like the "Emergency Nuke Button" - a one‑click switch that converts all holdings to stablecoins during extreme volatility.

Key tokenomics (as of Oct 2023):

| Metric | MATRIX | Average DeFi Token |

|---|---|---|

| Max Supply | 100 million | ≈ 1 billion |

| Circulating Supply | 34 million | ≈ 300 million |

| Current Price (USD) | $0.0009 | $0.10‑$2.00 |

| Market Cap | $18,300 | $200 M‑$5 B |

| Fully Diluted Valuation | $54,100 | $500 M‑$10 B |

The vesting schedule is tightly controlled: private investors receive 10 % at token generation followed by 0.37 % daily unlocks; the team faces a 6‑month cliff and then 0.139 % daily releases. This structure is meant to curb dumping, but the low liquidity means any sizable sell order can still move the price dramatically.

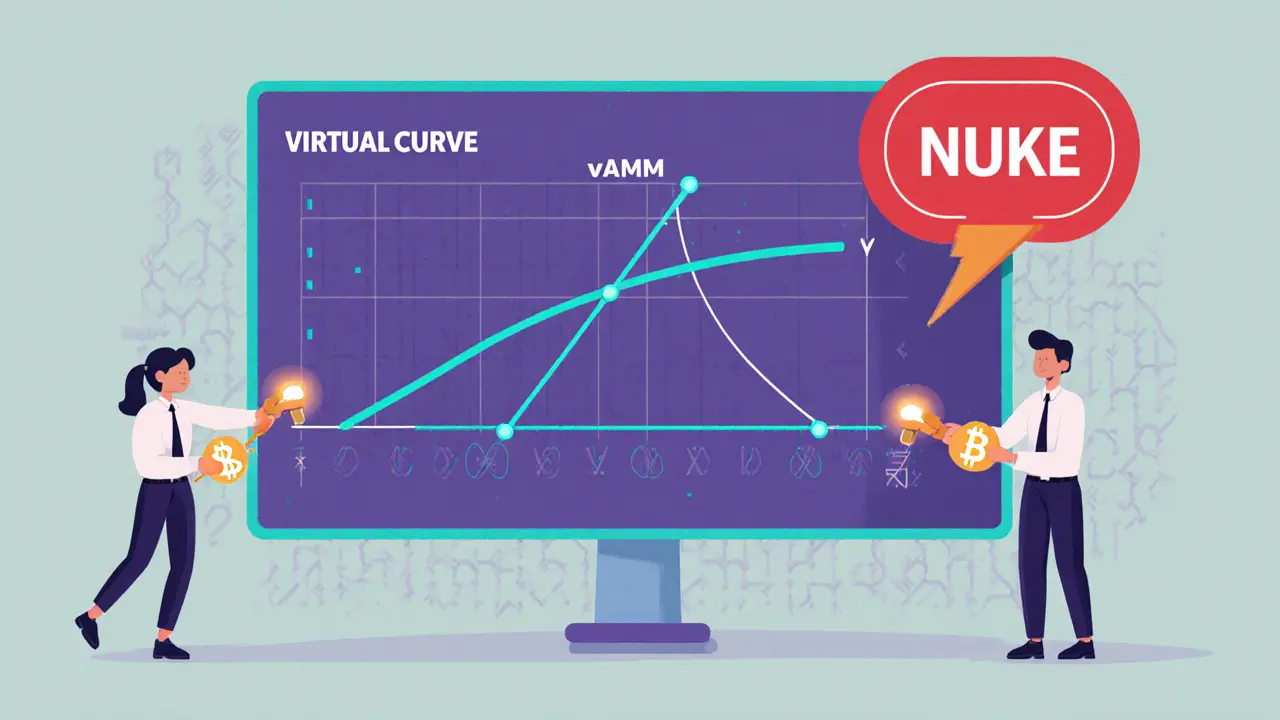

How Does Matrixswap’s Virtual AMM Work?

Traditional AMMs like Uniswap pool real tokens together, which makes it hard to offer leveraged futures without a counterparty. Matrixswap solves this with a virtual AMM (vAMM). The protocol keeps a mathematical price curve off‑chain, while on‑chain trades settle against that curve. This lets users open perpetual futures positions with up to 10× leverage, and the system guarantees liquidity because the virtual pool never runs out of “virtual” assets.

Key features:

- Multi‑chain deployment on Polygon, Polkadot and Cardano. This broad reach aims to capture traders from three very different ecosystems.

- DEX aggregator scans dozens of decentralized exchanges for the best spot price before routing the trade.

- Emergency Nuke Button converts the entire position to a stablecoin in a single transaction, mitigating flash‑crash risk.

- Swap routes support single‑to‑multiple and multiple‑to‑single token conversions, reducing gas costs.

While the tech sounds impressive, real‑world volume tells a different story. In the 24 hours ending Oct 23 2025, Matrixswap moved just $26 in total - barely enough to cover a handful of tiny trades. By comparison, Uniswap topped $1.2 billion and even niche competitors like GMX handled $187 million.

Beyond Trading: Matrix World, Phanta Bear & WORLD3 AI

Matrix Labs is not just a derivatives platform. The company launched Matrix World, a 3‑D virtual environment where developers can prototype blockchain‑enabled games and dApps. Early adopters praise its smoother graphics compared to other metaverse projects, but the user base remains tiny (a few thousand active wallets).

The Phanta Bear NFT collection (10,000 algorithmically generated bears) doubles as a membership card for exclusive Matrixswap fee rebates. Holders have reported modest discount levels - generally 5‑10 % on trading fees - but the NFTs haven’t driven significant liquidity spikes.

The most ambitious piece is the WORLD3 AI agent. Powered by Amazon Bedrock, the AI assistant can open wallets, bridge assets, and even place leveraged trades via natural language commands. An AWS case study from Sep 2023 claimed a 200 % speed boost in response time and a 110‑fold reduction in integration effort. In practice, new users report onboarding times dropping from the industry average of 45 minutes to about 7 minutes.

Token Distribution & Who Holds MATRIX

According to CoinMarketCap, there are around 3,420 token holders. The distribution leans heavily toward early investors:

- Private Round - 10 % at TGE, then daily unlocks.

- Public Round - 100 % unlocked immediately.

- Team & Advisors - long cliffs with daily unlocks over months.

- Development & Rewards - 4.17 % monthly releases.

Such a concentration means a handful of wallets can still sway the market, especially given the sub‑$30 daily volume.

Risks & Regulatory Concerns

Leveraged perpetual futures sit in a gray zone for regulators. The SEC’s 2023 action against Polymarket showed that even decentralized derivatives can be treated as securities. If a jurisdiction deems Matrixswap’s leveraged products as securities, the platform could face enforcement, forced shutdowns, or heavy compliance costs.

Liquidity is another glaring risk. With a market cap under $20 k and almost no on‑chain depth, any trader trying to open a 10× position larger than a few hundred dollars would instantly trigger slippage or liquidation. The Emergency Nuke Button helps, but it’s a last‑ditch safety net, not a liquidity solution.

Technical hurdles persist too. Cardano’s Plutus contracts are still maturing, and community reports on GitHub highlight cross‑chain settlement bugs. Until those are ironed out, the promise of true multi‑chain perpetual futures remains partially unfulfilled.

Future Outlook - What’s Coming Next?

Matrix Labs has a fairly busy roadmap:

- Q4 2023 - Mobile app release (still pending as of 2025).

- 2024 Q1 - Integration with institutional liquidity providers to boost depth.

- Late 2024 - Expansion to Solana and Avalanche (announced but not live).

- 2025 - Ongoing upgrades to the Emergency Nuke Button and AI‑driven risk management tools.

Analysts remain skeptical. A Messari senior researcher warned that projects with sub‑$100k FDVs and negligible volume “face an uphill battle”. Nevertheless, the partnership with Amazon’s AI stack could give Matrix Labs a unique edge in user experience if it ever secures enough liquidity.

How to Add MATRIX to Your Wallet

For anyone wanting to experiment, the token contract address is:

0xc8d3dcb63c38607cb0c9d3f55e8ecce628a01c36

Paste that into MetaMask or any ERC‑20‑compatible wallet, then you’ll see the balance after the network is set to Polygon (or the appropriate chain). The official integration guide on CoinGecko walks through the steps.

Final Verdict - Should You Care About MATRIX?

If you’re a casual trader looking for a high‑risk, low‑liquidity play, MATRIX might offer a cheap entry point and an experimental perpetual futures experience. But the odds of moving the price significantly, getting liquidated, or facing regulatory trouble are high.

For developers who want to tinker with virtual AMM code, Matrixswap’s open‑source GitHub repo provides a rare glimpse into multi‑chain perpetual design. The AI‑agent platform also offers a sandbox for building voice‑ or chat‑driven DeFi tools.

Overall, treat MATRIX as a niche experiment rather than a core portfolio holding. Keep an eye on liquidity upgrades and regulatory developments, and never risk more than you can afford to lose.

What is the primary purpose of the MATRIX token?

MATRIX is used to pay fees on Matrixswap, act as collateral for leveraged perpetual futures, and grant access to special features like the Emergency Nuke Button.

How does Matrixswap differ from a regular AMM like Uniswap?

Instead of pooling real tokens, Matrixswap uses a virtual AMM (vAMM) that keeps a mathematical price curve off‑chain, allowing leveraged perpetual futures with guaranteed on‑chain liquidity.

Is MATRIX listed on major exchanges?

MATRIX is mainly traded on decentralized platforms via the Matrixswap protocol. It does not appear on large centralized exchanges like Binance or Coinbase.

What are the biggest risks of using Matrixswap?

Low liquidity, potential regulatory classification as a securities offering, and technical bugs in cross‑chain settlement are the main concerns.

How can I add MATRIX to MetaMask?

Copy the contract address 0xc8d3dcb63c38607cb0c9d3f55e8ecce628a01c36, go to MetaMask’s "Add Token" screen, select "Custom Token", paste the address, and confirm.

Comments (19)