KLend Lending Calculator

Calculate Your KLend Loan

Results

Required Collateral

Enter values to calculate

Estimated Yield

Enter values to calculate

Important Risk Information

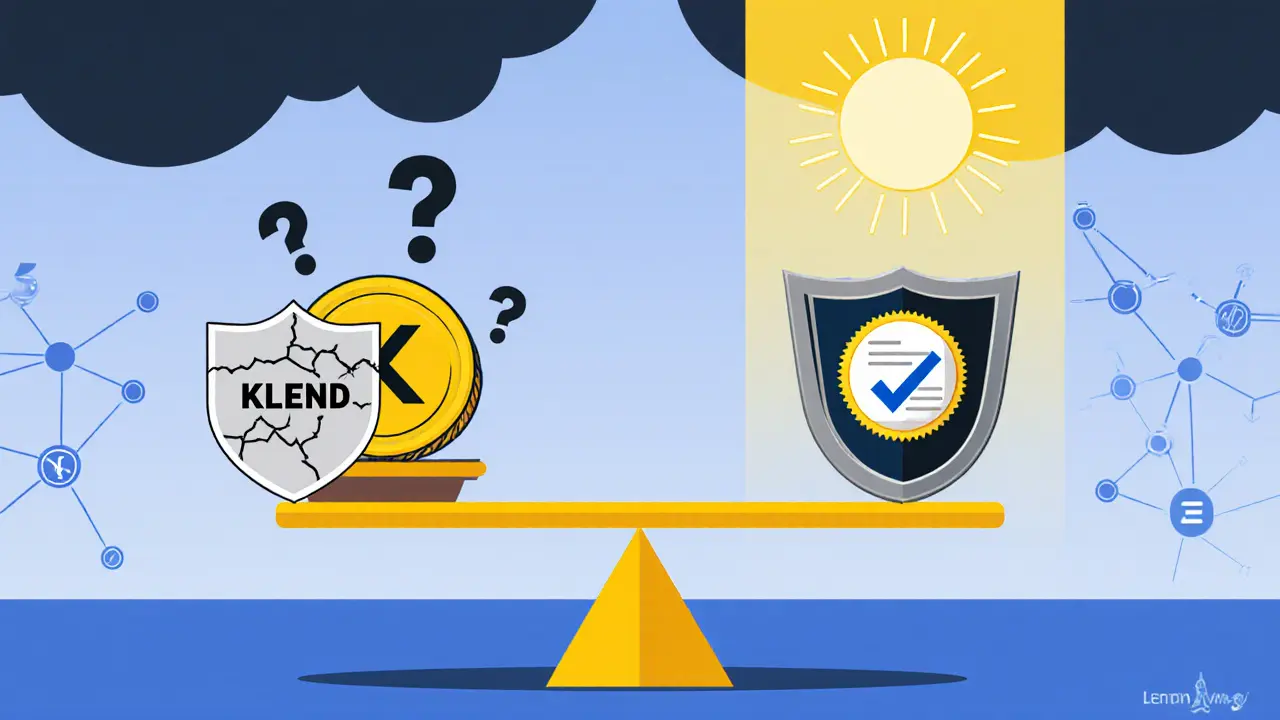

KLend is a decentralized lending protocol with no security audits. Collateral requirements are 125-150% of loan value.

Warning: High risk of liquidation if collateral value drops. Never invest more than you can afford to lose.

When you type "KLend" into a search bar, the first thing you’ll probably see is a listing that labels it as a crypto exchange. That label is misleading - KLend is actually a decentralized lending protocol, not a spot‑trading platform. In this KLend review we’ll pull apart the confusion, explain how the protocol works, compare it with real exchanges, and help you decide whether KLend belongs in your DeFi toolbox.

What Exactly Is KLend?

KLend is a DAO‑governed, over‑collateralized lending protocol that operates outside the Ethereum ecosystem. It aims to be the first non‑Ethereum DeFi lending platform that lets users lock up crypto as collateral and borrow against it. The protocol’s official line describes an “EPS style liquidity mining model” that rewards participants for providing capital to the system.

Why Is KLend Listed as an Exchange?

Data aggregators like CoinMarketCap sometimes mis‑categorize projects. As of October 25, 2025, KLend appears under the "Exchanges" tab with a status of “Volume data is untracked.” The platform has no visible order books, trading pairs, or spot‑trade volume, which are core exchange traits. The mislabel likely stems from the vague roadmap note that a “decentralized crypto spot contract platform” is “very near future.” Until that feature launches, calling KLend an exchange inflates expectations and confuses new users.

How Does KLend Work? Technical Overview

- Over‑collateralized lending model: Borrowers must deposit collateral valued at roughly 125‑150 % of the loan amount, similar to the approach used by Compound. This safety margin protects lenders from price volatility.

- DAO governance: KLend token holders vote on protocol upgrades, collateral types, and interest‑rate parameters. Decisions are executed on‑chain, giving the community direct control.

- Liquidity mining (EPS model): Participants earn KLend tokens for supplying collateral or staking LP tokens, incentivising capital inflow.

- Non‑custodial design: Users keep full control of their private keys. The protocol never holds assets in a centralized vault.

Because KLend runs on a blockchain other than Ethereum, it avoids the high gas fees that plague many DeFi apps, but it also lacks the extensive tooling and audit ecosystem that Ethereum enjoys.

Feature Comparison: KLend vs. Typical Crypto Exchanges

| Feature | KLend (Lending Protocol) | Typical Exchange (e.g., Binance) |

|---|---|---|

| Primary Function | Lending & borrowing | Spot & derivative trading |

| Custody Model | Non‑custodial (user holds keys) | Custodial (centralized wallets) |

| KYC / AML | None required | Mandatory identity verification |

| Liquidity | No public order book; liquidity provided by lenders | Deep order books, millions of daily trades |

| Trading Pairs | None (no swapping feature) | Hundreds of crypto‑fiat and crypto‑crypto pairs |

| Governance | DAO‑driven token voting | Centralized management |

The table makes it clear: KLend does not compete with platforms like Binance on any trading metric. Its value proposition is entirely focused on earning yield through over‑collateralized loans.

Pros and Cons of Using KLend

Pros

- Higher potential yields than traditional exchange lending products, thanks to the liquidity‑mining incentives.

- Non‑custodial setup reduces counter‑party risk; you never hand over private keys.

- DAO governance gives token holders a say in protocol evolution.

- Operating outside Ethereum can mean lower transaction costs.

Cons

- No spot‑trading ability - you can’t swap assets directly on KLend.

- Lack of audited security reports; unlike Aave or Compound, KLend has no publicly available third‑party audits.

- Untracked status on CoinMarketCap signals low transparency and limited market data.

- Liquidity is dependent on community participation; a thin pool can lead to high borrowing costs.

Risk Assessment - Should You Trust KLend?

Every DeFi protocol carries smart‑contract risk, but the lack of audit documentation raises the stakes for KLend. The protocol has not published an audit from firms like OpenZeppelin or Trail of Bits, which are considered industry standards. Additionally, the “untracked” label means there’s no verified trading volume, making it harder to gauge real‑world usage.

If you’re an experienced DeFi user comfortable with code reviews and risk mitigation (e.g., using a hardware wallet, limiting exposure, and monitoring on‑chain activity), KLend can be an interesting yield‑generation experiment. For newcomers or those seeking a reliable exchange experience, sticking with audited platforms such as Uniswap (for swapping) or Coinbase (for regulated trading) is a safer bet.

User Adoption - What Does the Community Say?

Searches on Reddit’s r/defi and r/CryptoCurrency return virtually no recent mentions of KLend. CoinMarketCap shows zero user reviews and no rating score. In contrast, top exchanges collect thousands of reviews and active discussion threads. The quiet community suggests KLend has either a very niche user base or is still in an early development phase.

Future Roadmap - Will KLend Become an Exchange?

The only forward‑looking statement from the project is a vague promise to “land a decentralized crypto spot contract platform in the very near future.” No concrete milestones, GitHub repo links, or development timelines have been shared publicly. Without a visible roadmap, it’s difficult to predict when-or if-KLend will add swapping or spot‑trading features.

Given the competitive landscape where established DEXs like Uniswap already dominate on‑chain swaps, KLend would need substantial liquidity incentives to capture market share.

Quick Checklist - Is KLend Worth Trying?

- Do you need a lending platform with DAO governance? → Yes, KLend fits.

- Are you looking for spot‑trading or margin contracts? → No, KLend currently lacks that.

- Is audit transparency a top priority? → No, KLend provides none.

- Do you have experience managing private keys and monitoring smart‑contract risk? → If yes, you can experiment with modest amounts.

In short, KLend is a niche DeFi lending protocol with a lot of unanswered questions. Treat it as a high‑risk, high‑potential yield experiment rather than a full‑featured exchange.

Frequently Asked Questions

Is KLend a cryptocurrency exchange?

No. KLend is a decentralized lending protocol. It does not offer spot‑trading, order books, or exchange fees.

Can I trade tokens on KLend?

Trading is not supported. The platform only lets you deposit collateral and borrow assets.

What collateral ratios does KLend require?

Documentation suggests a range of 125‑150 % over‑collateralization, similar to other over‑collateralized DeFi loans.

Is there a security audit for KLend?

As of October 2025, KLend has not published any third‑party audit reports, which makes it riskier than audited platforms like Aave or Compound.

How does KLend earn rewards?

Through an EPS‑style liquidity mining model. Users receive KLend tokens for providing collateral or staking liquidity‑provider tokens.

Whether you decide to experiment with KLend or stick to proven exchanges, always do your own research, keep your private keys safe, and never invest more than you can afford to lose.

Comments (9)