Imagine sending Bitcoin to an Ethereum wallet. Or using your NFT from one platform to pay for a service on another. Right now, that’s impossible without bridges, wrappers, or third-party intermediaries. Why? Because most blockchains speak different languages. Interoperability protocols and standards are the solution - the common grammar that lets blockchains talk to each other without translation errors.

Why Blockchains Need to Talk to Each Other

Blockchains were built to be independent. That’s their strength: no central authority, no single point of failure. But isolation comes at a cost. If every blockchain is its own silo, users are stuck. You can’t move assets freely. You can’t use DeFi apps on one chain while storing data on another. Liquidity gets fragmented. Developers have to rebuild the same tools over and over. Real-world use cases demand connection. A supply chain tracking goods on Hyperledger needs to verify payments on Bitcoin. A gaming NFT built on Solana should work in a metaverse running on Polygon. Without interoperability, blockchain becomes a collection of disconnected islands - not a network.The Four Levels of Interoperability

Interoperability isn’t one thing. It’s layered, like building a bridge. You don’t just lay down steel - you need foundations, design, meaning, and rules.- Foundational interoperability is the bare minimum: two systems can send raw data. Think of it like sending a text file. The receiver gets the bytes, but has no idea what they mean.

- Structural interoperability means the data is formatted the same way. Both systems use JSON or XML. Fields line up. A date is stored as YYYY-MM-DD everywhere. This is where most blockchains are today - they can exchange data, but only if it’s shaped right.

- Semantic interoperability is the real goal. Both systems understand what the data means. If Chain A sends “token amount: 5.3”, Chain B doesn’t just see numbers - it knows it’s USDC, not SOL, and that it’s a transfer, not a staking reward. This needs shared vocabularies, like standardized token IDs and event types.

- Organizational interoperability is the unseen layer. It’s about trust, governance, legal compliance, and incentives. Who pays for cross-chain transactions? Who audits them? Who settles disputes? Without this, even perfect technical connections fail.

Most blockchain projects today are stuck at level two. True interoperability - the kind that feels seamless to users - requires level three and four.

Key Protocols Making It Happen

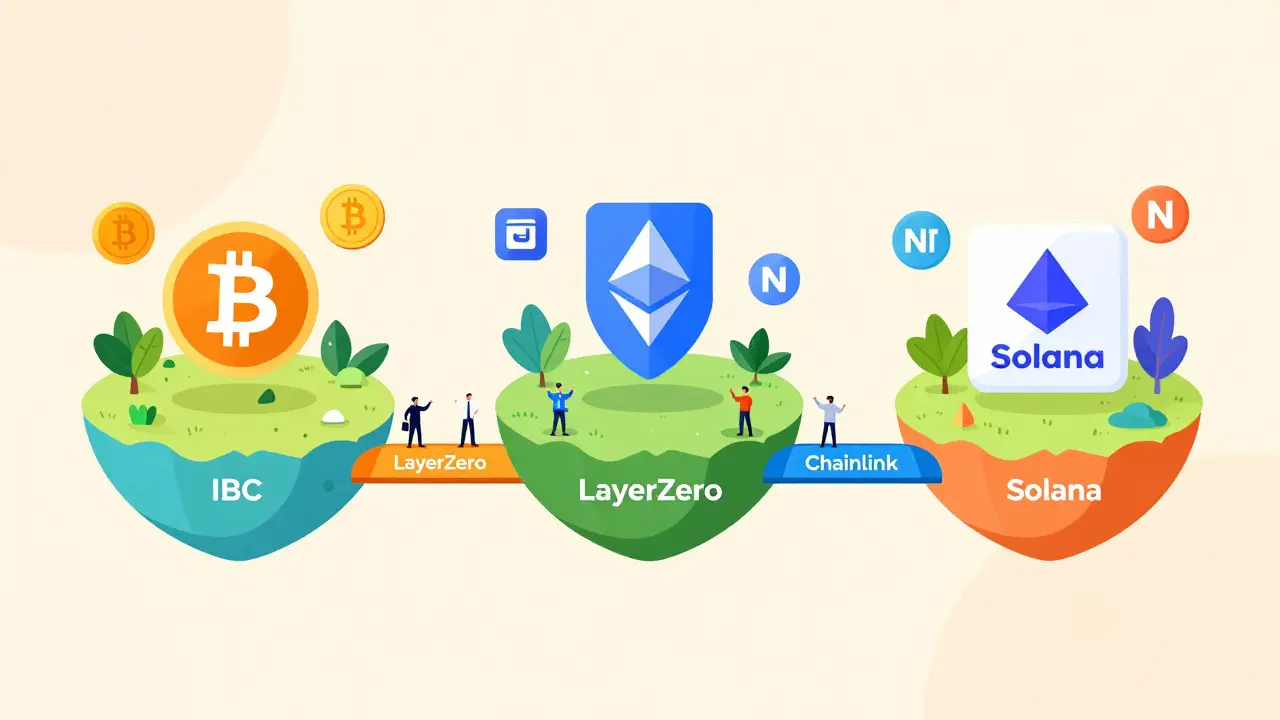

Several protocols are pushing blockchain interoperability forward. They’re not just tools - they’re new rules of the road.- Inter-Blockchain Communication (IBC) is the backbone of the Cosmos ecosystem. It lets independent blockchains (called zones) send messages to each other securely. IBC doesn’t merge chains - it connects them like postal services. Each chain keeps its own consensus, but can verify messages from others using light clients. Cosmos Hub acts as a relay station.

- Chainlink CCIP (Cross-Chain Interoperability Protocol) is designed for enterprise use. It’s not just about moving tokens. CCIP lets smart contracts on Ethereum trigger actions on Solana, Avalanche, or Polygon. It uses decentralized oracles to verify events across chains, making it secure for payments, insurance claims, or real estate transfers.

- LayerZero takes a different approach. Instead of relying on a central relay, it uses two components: an oracle (to confirm events) and a relayer (to deliver messages). This makes it highly flexible - it works across any EVM or non-EVM chain. It’s used by projects like Stargate Finance for cross-chain swaps.

- Polkadot’s parachain model is built for interoperability from the ground up. Parachains connect to a central relay chain that handles security and message passing. Unlike IBC, which assumes chains are equal, Polkadot gives the relay chain authority over validation. This makes it faster but less decentralized.

- Atomic Swaps are the original cross-chain method. They let users trade assets directly between blockchains without intermediaries. But they’re clunky - require matching liquidity, are slow, and only work for simple token swaps. They’re being replaced by more advanced protocols.

Each protocol has trade-offs. IBC is secure but slow. LayerZero is fast but relies on relayers. Polkadot is efficient but centralized. Chainlink is enterprise-grade but complex. There’s no one-size-fits-all.

Standards That Hold It All Together

Protocols need standards to work at scale. Without them, every implementation is a custom puzzle piece.- ERC-20 and ERC-721 are the most widely adopted standards on Ethereum. They define how tokens and NFTs behave. But they’re not enough for cross-chain. New standards like ERC-6551 (token-bound accounts) and EIP-4337 (account abstraction) are helping wallets and contracts interact across chains more intelligently.

- Chain Agnostic Token Standards are emerging. Projects like TokenScript and Universal Token Standard (UTS) aim to define tokens that carry metadata and behavior that any chain can interpret - not just Ethereum-based ones.

- Message Format Standards like ABI (Application Binary Interface) and JSON-RPC ensure that when Chain A sends a request to Chain B, Chain B knows how to decode it. Without these, even if data arrives, it’s useless.

- Security Standards like CCIP-Read (from Chainlink) define how cross-chain data is verified. They prevent fake events - like a fake “payment received” message - from tricking a contract.

These standards aren’t set in stone. They evolve through community proposals, GitHub debates, and developer consensus. That’s why interoperability is still messy - no single governing body controls it.

Real-World Use Cases That Work Today

Interoperability isn’t theoretical. It’s already changing how people use blockchain.- DeFi Aggregators like 1inch and Matcha scan dozens of chains for the best swap rates. They use interoperability protocols to route trades across chains without users needing to switch wallets.

- Multi-chain Wallets like Phantom and Trust Wallet now support 50+ chains. Behind the scenes, they use IBC, LayerZero, or CCIP to move assets and display balances from different networks in one view.

- Supply Chain Tracking companies like VeChain and TradeLens use cross-chain systems to track goods. A product’s journey starts on a private blockchain for internal logs, then updates a public chain for customs and compliance - all synced automatically.

- Gaming and Metaverse platforms like The Sandbox and Decentraland let users bring NFTs from other games. That’s only possible because of standardized NFT metadata and cross-chain bridges.

These aren’t niche experiments. They’re growing fast. In 2025, over $12 billion in assets moved across chains using interoperability protocols - up from $2 billion in 2023.

Where It All Falls Apart

Interoperability sounds simple until it breaks.- Security risks are the biggest concern. Bridges have been hacked for over $2 billion since 2020. Why? Because they’re complex. They require trust in relayers, oracles, or multisigs. A flaw in one chain can drain funds on another.

- Fragmented standards mean developers waste time building for each protocol separately. There’s no universal “interoperability API” yet.

- Regulatory uncertainty makes enterprises hesitant. If a token moves from a regulated chain to an unregulated one, who’s liable? What tax rules apply?

- Latency and cost still exist. Cross-chain transactions can take minutes and cost more than on-chain ones. Users expect instant, cheap swaps - most systems don’t deliver that yet.

Worse, many projects call themselves “interoperable” when they’re just using a bridge. That’s like saying your car is “road-compatible” because you can tow it. True interoperability means native communication - not bolted-on workarounds.

What’s Next? The Road to Seamless Integration

The future isn’t one protocol to rule them all. It’s a layered ecosystem.- Standardization bodies like the Blockchain Interoperability Alliance and W3C are working on universal token and message formats.

- Zero-knowledge proofs (ZKPs) are being used to verify cross-chain events without revealing data. This could make bridges trustless and private.

- Modular blockchains like Celestia and EigenLayer are separating consensus from execution. This lets developers plug into existing security layers - making cross-chain interaction cheaper and faster.

- AI-driven interoperability is emerging. Tools now analyze contract code and suggest the safest bridge or protocol for a given transaction.

The goal isn’t to merge all chains into one. It’s to make them feel like one. You shouldn’t need to know if you’re using Ethereum, Solana, or Cosmos. You just send your token - and it arrives.

How to Choose the Right Interoperability Solution

If you’re building or using a blockchain app, here’s how to pick:- What are you moving? Tokens? NFTs? Data? Complex smart contracts? Different protocols handle different things.

- How fast does it need to be? For real-time payments, LayerZero or IBC might be too slow. For batch settlements, it’s fine.

- How secure does it need to be? For enterprise or finance, use Chainlink CCIP or Polkadot. For casual use, a popular bridge might be okay.

- Which chains do you need? Not all protocols support every chain. Check compatibility.

- Who maintains it? Is it open-source? Is there an active community? Avoid protocols with no public audits or inactive GitHub repos.

There’s no perfect solution yet. But the right one for your use case? It exists.

What’s the difference between interoperability and a bridge?

A bridge is a tool - usually a smart contract that locks assets on one chain and mints wrapped versions on another. Interoperability is the broader goal: native, secure, standardized communication between chains. Bridges are a temporary fix. Interoperability protocols like IBC or CCIP aim to make bridges unnecessary by letting chains talk directly.

Can I use interoperability without knowing the technical details?

Yes. Most users interact with interoperability through wallets or DeFi apps that handle it in the background. When you swap ETH for SOL in your wallet, you’re using interoperability - you don’t need to know if it’s LayerZero, IBC, or a bridge underneath. The interface hides the complexity.

Why hasn’t one standard won yet?

Because blockchains have different goals. Ethereum prioritizes security and decentralization. Solana wants speed. Cosmos favors sovereignty. Each protocol reflects those values. No single standard can satisfy all. The market will likely settle on a few dominant ones, not one.

Are there any risks in using cross-chain protocols?

Yes. The biggest risk is smart contract bugs. Many cross-chain systems rely on third-party relayers or oracles. If those are compromised, funds can be stolen. Always check for audits, use well-known protocols, and avoid new, untested bridges. Never put more money into a cross-chain transaction than you’re willing to lose.

Will interoperability make blockchains less secure?

Not if done right. Security isn’t about isolation - it’s about verification. Protocols like IBC use light clients to verify other chains’ states without trusting them. ZKPs can prove events happened without revealing data. The goal is to move security from centralized bridges to decentralized, cryptographically verified systems.