When it comes to cryptocurrency, Russia doesn’t play by the same rules as most countries. While some nations are rushing to embrace digital assets, the Russian Central Bank has built one of the strictest regulatory systems in the world - not to encourage crypto, but to contain it. As of 2026, the rules are clearer, tighter, and more controlling than ever. And if you think you can slip through the cracks, think again.

Domestic Crypto Payments Are Still Banned - Full Stop

You won’t find a single Russian bank accepting Bitcoin for rent, groceries, or even a coffee. The Central Bank of Russia (CBR) has held firm since 2021: crypto cannot be used as payment within the country. This isn’t a suggestion. It’s the law. Violations carry legal consequences, and financial institutions that even hint at facilitating domestic crypto transactions risk heavy penalties or outright shutdowns. The reasoning is simple: the CBR fears losing control over the ruble. Cryptocurrencies operate outside the state’s monetary system. If people start using them for everyday spending, inflation control, interest rate policy, and banking stability all become harder to manage. So, even though Bitcoin is traded on exchanges, you can’t use it to pay your utility bill. Not legally.International Trade Is the Only Loophole

Here’s where things get interesting. In summer 2024, Russia quietly changed one rule: companies can now use cryptocurrencies to settle international trade deals. This wasn’t an endorsement of crypto - it was a survival tactic. With Western sanctions cutting off traditional banking channels, Russian exporters and importers needed an alternative. Crypto became that alternative. Now, a Russian manufacturer exporting machinery to Turkey can receive payment in USDT or BTC. A Siberian oil trader can pay a supplier in Kazakhstan using Ethereum. But here’s the catch: this only works across borders. The moment that crypto hits Russian soil - whether in a wallet, bank account, or exchange - it’s back under the ban. This dual-track system lets Russia stay connected to global markets without letting crypto seep into its domestic economy. It’s a firewall with one door - and that door only opens outward.2026 Capital Rules: Crypto Exposure Limited to 1% of Bank Capital

The biggest change coming in 2026 isn’t a ban. It’s a cap. Russian banks that want to touch crypto at all - even just holding it as an asset or offering custody services - will be forced to limit their exposure to no more than 1% of their total capital. That’s not a suggestion. It’s a hard limit. If a bank has 100 billion rubles in capital, it can’t hold more than 1 billion rubles worth of crypto assets. And here’s the kicker: every ruble of customer money invested in crypto must be backed by a ruble of the bank’s own money. No leverage. No borrowing. No risky bets. This rule, outlined in the CBR’s May 2025 informational letter IN 03-23/87, is being called “CryptoBasel” by legal experts. It’s modeled after global banking safety standards - Basel II through IV - but applied with Russian precision. The goal? Make crypto so expensive and risky for banks to handle that they simply avoid it. Andrey Tugarin, a banking lawyer who advises Russian financial firms, says this isn’t new. “The CBR has been acting this way since 2023,” he explains. “This is just putting old practices into law.”

Stablecoins Are Getting Their Own Rules - By End of 2025

Stablecoins like USDT and USDC are the most-used crypto assets in Russia’s international trade. They’re stable, easy to transfer, and widely accepted. That’s why the Ministry of Finance and the Central Bank are rushing to draft formal rules for them. By December 2025, Russia will have its own legal definition of stablecoins. These rules will require issuers to prove they hold enough reserves (in rubles, gold, or approved foreign assets) to back every coin in circulation. Audits will be mandatory. Transparency requirements will be strict. And only state-approved entities will be allowed to issue them. This isn’t about making stablecoins popular. It’s about making sure they can’t be abused. If a stablecoin issuer disappears, or if reserves vanish, the government wants to know - and be ready to act.Every Crypto Transaction Over 600,000 Rubles Must Be Reported

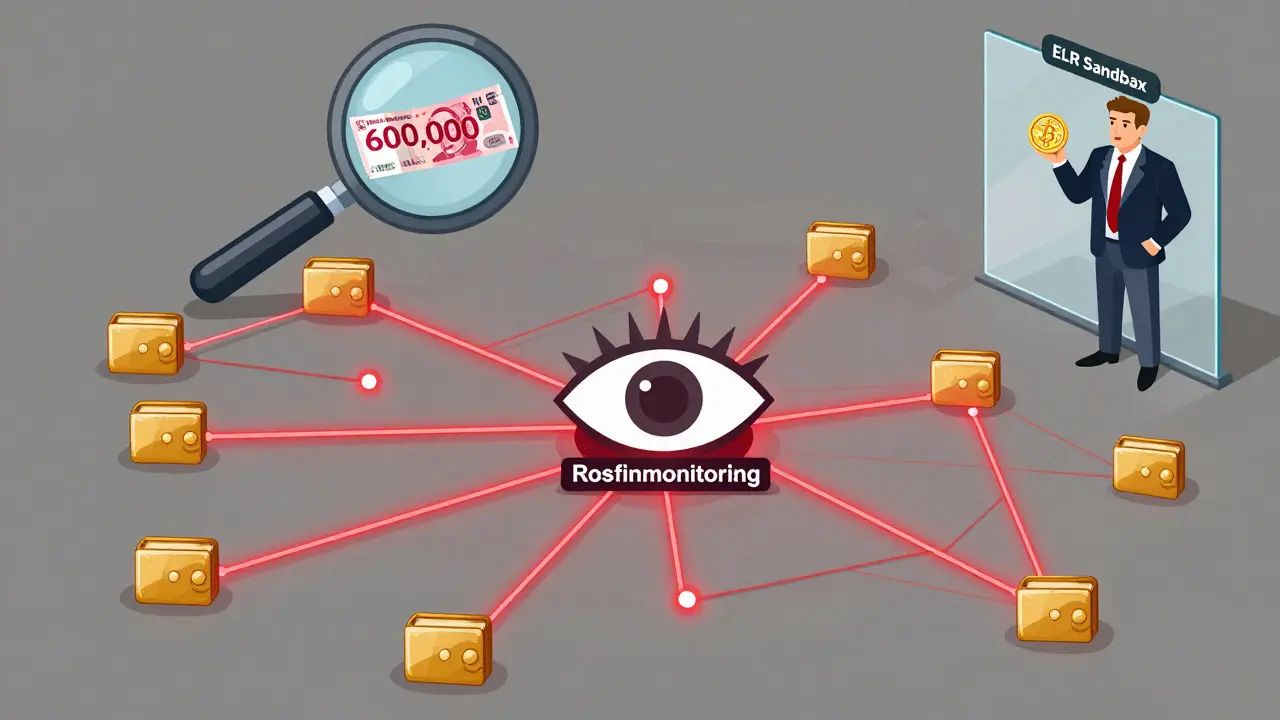

If you’re an individual or business moving crypto in Russia - even if it’s just holding it - you’re being watched. Any transaction above 600,000 rubles (about $6,500 USD) must be reported to the tax authorities. That includes transfers between wallets, exchanges, or even peer-to-peer deals. This isn’t just about taxes. It’s about tracing. The CBR, working with the Ministry of Digital Development, has built a digital surveillance platform that can link anonymous crypto addresses to real identities. It’s not perfect - but it’s getting better. And it’s already being used to track suspicious activity. Plus, if you’re using a crypto exchange or broker in Russia, you’ve already gone through KYC. No ID? No account. No bank account? No access. The system is designed to make anonymity impossible.Only “Especially Qualified” Investors Can Play in the Experimental Zone

The CBR created something called the Experimental Legal Regime (ELR). Think of it as a crypto sandbox - but with razor wire around it. Only people who meet strict financial thresholds can enter. You need to prove you have over 15 million rubles in liquid assets. You need to pass a knowledge test on crypto risks. You need to sign documents acknowledging you could lose everything. And even then, your access is limited. You can trade crypto within the ELR system, but you can’t use it to buy goods. You can’t withdraw it to an external wallet without approval. You can’t transfer it to someone who isn’t also in the ELR. The goal? Let a tiny group of wealthy, sophisticated investors dabble - while keeping crypto away from the general public.

Every Crypto Service Provider Must Join the System - Or Disappear

If you run a crypto exchange, a mining farm, a wallet service, or even a P2P trading platform in Russia, you have one choice: comply or get blocked. Rosfinmonitoring, Russia’s financial intelligence unit, has made it clear: all virtual asset service providers (VASPs) must integrate with the state’s surveillance network. That means real-time reporting of every transaction, full KYC on every user, and direct access for regulators to your systems. No exceptions. No gray areas. Even small operators who thought they could fly under the radar are being forced to register - or face immediate shutdowns. Some have already been taken offline. The message is blunt: if you’re in the crypto business in Russia, you’re not independent. You’re an extension of the state’s control.Why This Model Is Unique - And Likely to Spread

Most countries either ban crypto outright (like China) or try to regulate it lightly to attract investment (like Singapore or Switzerland). Russia is doing something else entirely: it’s building a surveillance state for crypto. Every transaction is recorded. Every user is identified. Every institution is capped. Every loophole is patched. The system doesn’t aim to stop crypto - it aims to own it. This approach is extreme. But it’s working. Russia has avoided a crypto-driven financial crisis. It hasn’t lost control of its currency. And it’s still trading globally. Other countries facing sanctions or struggling with financial instability may look at Russia’s model - not to copy it, but to learn how to contain crypto without fully banning it.What This Means for You

If you’re a Russian citizen: don’t try to use crypto for daily payments. Don’t assume you can hide transactions. The system is watching. And the penalties are real. If you’re a foreign business: you can still trade with Russian companies using crypto - but only for cross-border deals. Don’t expect to open a bank account in Russia or move crypto into the domestic system. If you’re an investor: the ELR is the only legal path - and it’s only for the ultra-wealthy. Everything else is either illegal or too risky to touch. The Russian Central Bank isn’t trying to make crypto popular. It’s trying to make sure crypto never becomes a threat. And so far, it’s working.Can I use Bitcoin to pay for goods in Russia?

No. Using cryptocurrency for any domestic payment - whether for groceries, rent, or services - is illegal under Russian law. The Central Bank of Russia banned this in 2021, and enforcement has only tightened since then. Violations can lead to fines or account freezes.

Are stablecoins legal in Russia?

Stablecoins are not yet fully legal for general use, but they are permitted in international trade. New regulations for stablecoin issuers are expected by the end of 2025. These will require full reserve backing, audits, and state approval. Only government-authorized entities will be allowed to issue them.

Can Russian banks invest in crypto?

Russian banks can hold crypto assets, but only under strict limits. Starting in 2026, no bank can hold more than 1% of its total capital in cryptocurrency. Additionally, every ruble of customer funds invested in crypto must be matched by a ruble of the bank’s own money. This makes crypto investment financially unattractive for banks.

What happens if I don’t report a crypto transaction over 600,000 rubles?

Failure to report crypto transactions above 600,000 rubles to tax authorities is a violation of Russian financial reporting laws. Penalties include fines, asset freezes, or criminal investigation. The Central Bank’s surveillance system tracks these transactions, and non-compliance is easily detected.

Can I use a foreign crypto exchange from Russia?

Technically, yes - but it’s risky. While using foreign exchanges isn’t explicitly illegal, the Russian government blocks access to many platforms. More importantly, any transaction you make through them above 600,000 rubles must still be reported. If you’re identified as an active user, you may face scrutiny from tax or financial regulators.

Is mining cryptocurrency legal in Russia?

Mining is not banned, but it’s tightly controlled. All mining operations must register with authorities and comply with energy usage regulations. Large-scale miners are required to integrate with state surveillance systems. Unregistered mining is increasingly targeted for shutdowns, especially if it uses subsidized electricity or avoids reporting.