By 2025, the line between artificial intelligence and cryptocurrency isn’t just blurring-it’s gone. AI-driven crypto tokens aren’t just speculative bets anymore. They’re the fuel powering real-world systems: decentralized AI training, autonomous agent economies, and secure data marketplaces. This isn’t science fiction. It’s happening right now, with over 39 billion in market value locked into projects that actually do something.

What Exactly Are AI Cryptocurrencies?

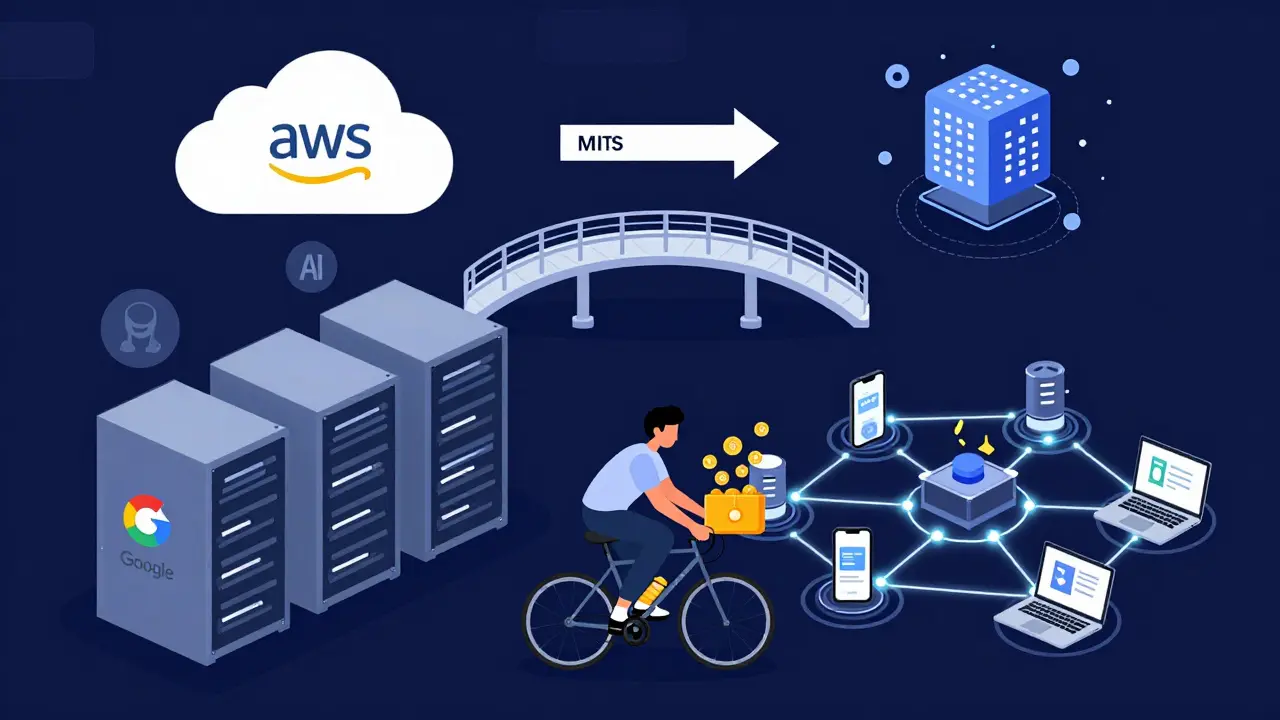

Forget Bitcoin as digital gold. AI cryptocurrencies are digital tools designed to run AI systems on blockchain networks. They pay for compute power, reward model contributions, and enable machines to trade services with each other-all without middlemen. Think of them as the operating system for decentralized AI.

Take Render Network (RNDR). Its token lets users rent out idle GPU power from a global network of 1.2 million units. A developer in Perth running Stable Diffusion can train images for 37% less than AWS. That’s not a gimmick-it’s a working alternative. Bittensor goes further. It turns AI models into competitors. Developers submit trained models to the network, and the best ones earn tokens based on real-world performance. In March 2025, Chainalysis audited its system: 98.7% accuracy, 47 million daily inference requests.

Then there’s the x402 protocol. It handles microtransactions as small as $0.000001 with settlement under 800 milliseconds. Why does that matter? Because it’s the backbone of autonomous AI agents-software bots that negotiate, buy, and sell services on their own. Gartner predicts this will grow into a $30 trillion economy by 2030.

How AI Is Fixing Blockchain’s Weak Spots

Blockchains are slow, opaque, and hard to scale. AI is fixing that.

Traditional blockchains like Bitcoin process 7 transactions per second. Ethereum, even with upgrades, hits 1,200. Now, AI-enhanced chains are hitting 1,500+ with smarter routing and predictive load balancing. Messari’s Q3 2025 report shows they finalize transactions 40% faster than legacy networks.

Security is another win. Zero-knowledge proofs now let AI models analyze encrypted data without ever seeing it. Homomorphic encryption lets nodes compute on encrypted inputs. That’s huge for privacy-sensitive use cases-like medical data analysis or financial risk modeling-without breaking blockchain’s trustless rules.

Smart contracts are getting smarter too. Instead of rigid if-then logic, AI-powered contracts now adapt. If a payment fails due to market volatility, the contract can reroute funds, delay execution, or trigger a human review. It’s not just code anymore-it’s responsive logic.

The Dark Side: Volatility, Energy, and Complexity

It’s not all smooth sailing. AI crypto tokens are 55% more volatile than Bitcoin or Ethereum. One day, a project’s token surges 40% after a major upgrade. The next, it drops 30% because a key developer left. That’s not unusual-it’s the norm.

Energy use is another concern. Cambridge Centre for Alternative Finance found AI training on blockchain networks uses 35% more energy than centralized cloud providers. Bittensor’s 2025 upgrade cut its consumption by 33%, but the problem hasn’t disappeared. If you’re running AI models on thousands of distributed nodes, you’re using more electricity than a single data center.

And then there’s the learning curve. Developers need to know Solidity, Python, machine learning, cryptography, and blockchain architecture-all at once. Consensys Academy reports it takes 8-12 weeks to become proficient. Compare that to 4-6 weeks for plain blockchain dev. Most beginners crash and burn trying to deploy AI agents without understanding the underlying protocols.

Wallet integration is a nightmare for regular users. Trustpilot reviews show 28% of complaints are about wallet syncing, gas fees, and confused interfaces. If you’re not a techie, this stuff feels like hacking.

Who’s Winning-and Who’s Losing?

The market is dominated by five players: Render Network, Bittensor, Fetch.ai, SingularityNET, and Ocean Protocol. Together, they control 68% of the $39 billion AI crypto market. That’s not competition-it’s consolidation.

Render Network wins because it solves a real pain point: expensive AI compute. Developers use it because it just works. Bittensor wins because it’s built like a marketplace-models compete, users vote, rewards are transparent. Ocean Protocol thrives on decentralized data. In Q3 2025, it processed 12.7 million data transactions, letting users sell anonymized health or weather data directly to AI firms.

But many projects are failing. NeuralChain collapsed in July 2025 after promising "decentralized AGI" and vanishing with $8.7 million. The red flag? No working product, just whitepapers and hype. That’s the pattern. The winners have working code. The losers have marketing.

Real-World Use Cases That Actually Work

Here’s what’s happening outside of trading charts.

- Decentralized AI Training: Bittensor trained 8,432 unique AI models in August 2025. Each one was submitted by a developer, tested by the network, and rewarded with tokens. No company owned them. No central server.

- Autonomous Agent Economies: The x402 protocol handled 2.4 billion micro-transactions in Q4 2025. Think of it as AI bots buying cloud time, data, or API calls from other bots-automatically.

- Data Marketplaces: Ocean Protocol lets individuals sell anonymized data-from fitness trackers to travel habits-directly to AI companies. One user in Perth made $180 in Q1 2025 just from sharing anonymized cycling data.

- Decentralized Identity: World Chain verified 17 million users in six months. It’s a blockchain-based "proof of human" system. No government ID needed. Just a phone and a selfie.

Small businesses are feeling it too. PixelPunch, a graphic design studio in Melbourne, cut image generation costs by 40% after switching from Midjourney to a decentralized AI service. They paid in RNDR tokens. No subscription. No limits. Just pay-per-use.

What’s Coming in 2026 and Beyond

The next leap is multi-agent negotiation. The x402 protocol’s Q1 2026 update will let AI agents haggle. Need 500 GPU hours? Your agent will scan 12 networks, compare prices, negotiate a bulk discount, and lock in the deal-all without human input.

Regulation is coming. The EU’s AI Act already blocks 68% of AI crypto projects from operating there unless they comply with strict transparency rules. The U.S. SEC is watching closely. If a token behaves like a security, it gets treated like one. That’s going to force a cleanup.

And then there’s the MIT study. Their 2025 paper says fully decentralized AI won’t work long-term. Why? Because training a 7-billion-parameter model on-chain is like trying to run a supercomputer on a smartphone. The answer? Hybrid systems. Think: AI models trained on centralized clouds, but verified and paid for on blockchain. That’s where the real future lies.

Should You Get Involved?

If you’re a developer: Start with Fetch.ai’s agent framework. It’s beginner-friendly. @AgentDev101 on GitHub says: "Begin with simple agent templates. Saves 20+ hours of debugging." Don’t try to build a full AI network from scratch.

If you’re a trader: Be cautious. AI tokens are volatile. Don’t put in money you can’t afford to lose. The sector saw a 15% drop in Q3 2025 after AI stocks cooled. This isn’t a pump-and-dump game-it’s a long-term infrastructure bet.

If you’re a business: Experiment. Try Render Network for AI compute. Use Ocean Protocol for data access. Test decentralized identity with World Chain. You don’t need to go all-in. Just dip a toe.

The future isn’t about replacing Bitcoin. It’s about replacing AWS, Google Cloud, and OpenAI-with something open, transparent, and distributed. It’s messy. It’s early. But it’s real.

Are AI cryptocurrencies just another crypto bubble?

Some are, but not all. Projects like Render Network and Bittensor have working products, real users, and measurable utility. Others are pure speculation with no code or revenue. Look for tokens that pay for actual services-compute, data, or AI model access-not just hype. The ones with daily transaction volume and developer activity are the ones likely to survive.

Can I use AI crypto if I’m not a developer?

Yes, but it’s limited. Platforms like World Chain let you verify your identity with a phone. Ocean Protocol lets you sell data through simple apps. You don’t need to code. But if you want to use AI services like training models or running agents, you’ll need a wallet, some crypto, and the patience to learn. Most tools still assume technical knowledge.

How is AI crypto different from using AI on centralized platforms like AWS or OpenAI?

Centralized platforms control everything: pricing, access, data, and rules. With AI crypto, you’re part of a network. You can rent your GPU, sell your data, or run an AI agent and get paid in tokens. No company owns the system. No blackout. No sudden price hike. But it’s slower, less polished, and requires more effort to use.

What’s the biggest risk in investing in AI crypto right now?

Regulation. The EU and U.S. are moving fast to classify AI tokens as securities or financial products. Projects that don’t comply could be shut down overnight. Also, many AI crypto projects rely on token speculation for funding. If the market cools, they run out of cash. Look for projects with real revenue, not just token sales.

Will AI crypto replace traditional AI services?

Not replace-complement. High-frequency trading, enterprise AI, and regulated services (like banking or healthcare) still need speed and compliance. Those will stay centralized. But for open innovation, data sharing, and decentralized automation, AI crypto offers something no corporation can: true peer-to-peer control. The future is hybrid: centralized for scale, blockchain for trust.