Ardor DEX Fee Calculator

Compare Exchange Transaction Costs

See how much you'd pay in fees using Ardor DEX versus major platforms. Based on October 2025 data.

Your Estimated Fees

$0.00| Exchange | Fee |

|---|---|

| Ardor DEX | $0.005 |

| Uniswap | $0.00 |

| PancakeSwap | $0.00 |

| dYdX | $0.00 |

Important Note

Ardor DEX fees are fixed at ~$0.005 per trade, but other exchanges may have variable fees depending on network congestion. Low liquidity on Ardor DEX may cause slippage for larger trades.

Most crypto traders today use Uniswap, PancakeSwap, or dYdX - platforms with billions in daily volume and slick interfaces. But what if you’re not looking for the biggest exchange? What if you want something quieter, more integrated, and built on a blockchain designed to solve real scaling problems? That’s where Ardor DEX comes in. It doesn’t have the hype of the top players. It doesn’t show up in most “Best DEX 2025” lists. But for a certain kind of user - someone who values security, multi-chain flexibility, and doesn’t need massive liquidity - it might just be the hidden gem you’ve overlooked.

What Is Ardor DEX, Really?

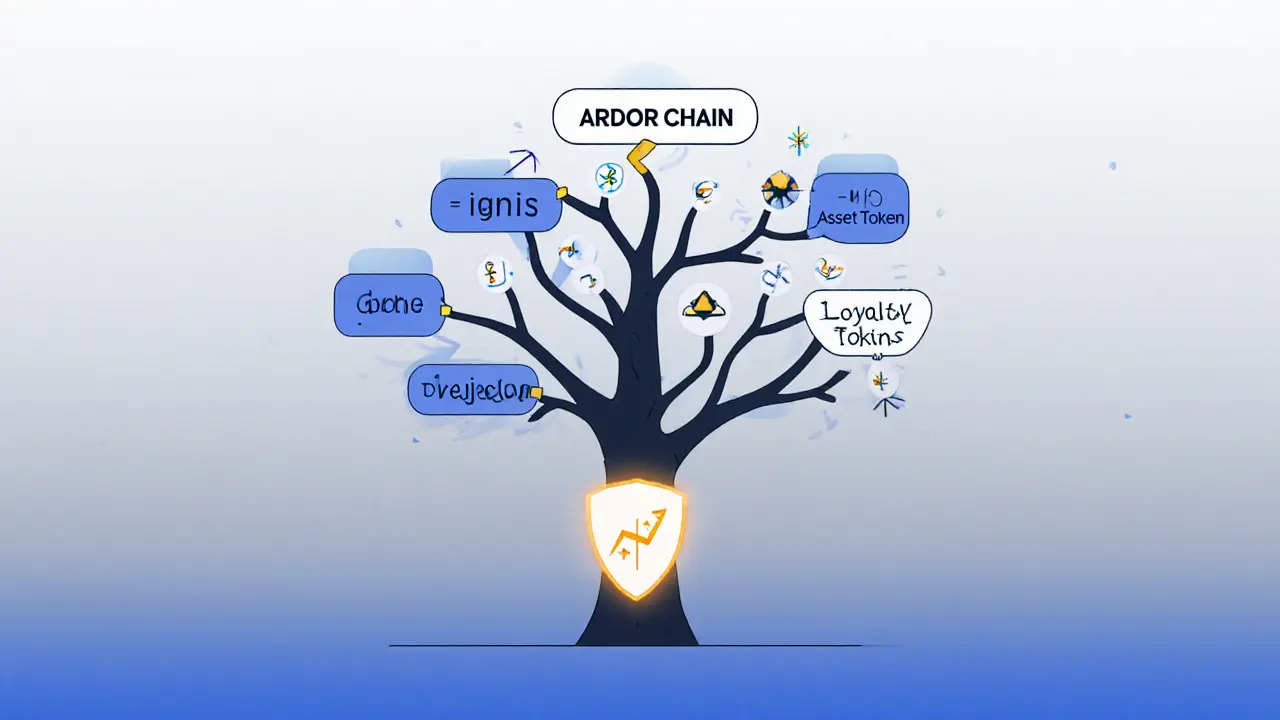

Ardor DEX isn’t a standalone app like Uniswap. It’s built right into the Ardor blockchain, a platform created by Jelurida, the same team behind Nxt. Think of it as a Swiss Army knife for blockchain: one system that handles security, token creation, and trading - all in one place. The exchange is just one feature of a larger ecosystem. You don’t download a separate DEX app. You use the Ardor Wallet, which has swap functionality built in. That means you can send ARDR, trade child-chain tokens, and manage assets without ever leaving the wallet.The magic lies in its parent-child chain structure. The main Ardor chain handles security using proof-of-stake. Child chains - like Ignis, for example - handle all the transactions and token issuance. This separation means trading on a child chain doesn’t slow down the main chain or make fees spike. It’s a clever fix for the congestion problems that plague Ethereum-based DEXs.

As of October 2025, the ARDR token trades around $0.068. The market cap sits outside the top 100 cryptocurrencies, which tells you something: this isn’t a mainstream play. But it’s not dead either. The Ardor Wallet has over 10,000 downloads on Google Play and holds a 4.8/5 rating. People are using it. They just aren’t shouting about it on Twitter.

How Does Trading Work on Ardor DEX?

Using the DEX is straightforward if you’re already familiar with wallets. First, you need ARDR tokens - they’re the fuel for transactions. You can’t pay fees in Bitcoin or Ethereum. You need ARDR. That’s a hurdle for newcomers, but once you have it, trading is smooth.You open the Ardor Wallet, go to the DEX tab, pick the token you want to sell, then choose what you want to buy. The system matches orders directly on the blockchain. No liquidity pools. No automated market makers. It’s a true order-book style exchange, meaning prices are set by buyers and sellers, not algorithms. This gives you more control over your trades, especially if you’re doing larger swaps.

Transactions finalize in about a minute. That’s faster than Bitcoin, slower than Solana, but perfectly fine for everyday trading. Fees are low - typically less than $0.01 per trade - and they’re paid in ARDR. The wallet supports multiple child-chain tokens, though exact numbers aren’t listed. You’ll find tokens for things like loyalty programs, asset tokenization, and niche DeFi projects that built on Ardor’s child chains.

Pros: Why Ardor DEX Stands Out

- Integrated Security: The parent chain secures every child chain. You don’t need separate validators for each token. That reduces complexity and attack surfaces.

- Ultra-Low Fees: At under a penny per trade, it’s hard to beat. Even compared to BNB Chain or Polygon, Ardor wins on cost.

- No Gas Wars: Because transactions are handled on child chains, you never get caught in a fee spike during a bull run.

- Privacy-Focused: No KYC. No identity checks. Just a wallet and your private keys.

- Multi-Chain Without the Mess: You can trade tokens from different child chains without bridging. That’s a huge advantage over platforms that require you to move assets between blockchains.

For someone who wants to hold ARDR and trade niche tokens without dealing with 10 different wallets or bridges, Ardor DEX is a quiet winner.

Cons: Where Ardor Falls Short

- Low Liquidity: There’s no denying it. Trading volume is tiny compared to Uniswap ($1.7B/day) or PancakeSwap ($892M/day). If you’re trying to swap $10,000 worth of a token, you’ll likely face slippage or find no takers.

- Small Ecosystem: You won’t find major tokens like USDT, WBTC, or LINK on Ardor. It’s mostly tokens created on its own child chains - useful for specific use cases, but not for general crypto trading.

- Steeper Learning Curve: Understanding parent-child chains isn’t intuitive. New users might get confused about which chain their token lives on. It’s not as simple as connecting a wallet and swapping.

- Limited Documentation: There’s no detailed API guide, no developer tutorials on how to list tokens, and few third-party tools. It’s not beginner-friendly for crypto newcomers.

- No Mobile App for iOS: Only Android. That’s a red flag for many users in 2025.

If you’re looking for a DEX to trade ETH, SOL, or AVAX - walk away. Ardor DEX isn’t built for that.

Ardor DEX vs. The Big Players

| Feature | Ardor DEX | Uniswap (Ethereum) | PancakeSwap (BNB Chain) | dYdX (Order Book) |

|---|---|---|---|---|

| Trading Model | Order Book | AMM (Automated Market Maker) | AMM | Order Book |

| Average Daily Volume | Unknown (likely under $1M) | $1.72B | $892M | $1.1B |

| Transaction Speed | ~1 minute | 15-30 seconds | ~3 seconds | ~2 seconds |

| Fee Token | ARDR | ETH | BNB | ETH |

| Fee per Trade | ~$0.005 | $1-$10 | $0.10-$0.50 | $0.05-$0.30 |

| Supported Tokens | Child-chain tokens only | 10,000+ | 5,000+ | 200+ |

| Mobile App | Android only | Yes (iOS & Android) | Yes (iOS & Android) | Yes (iOS & Android) |

| Best For | Niche tokens, low fees, security-focused users | High liquidity, popular tokens | High volume, low fees on BNB Chain | Advanced traders, futures, leverage |

The table says it all. Ardor DEX isn’t trying to compete with the giants. It’s built for a different kind of user. One who doesn’t care about meme coins or leveraged trading. Someone who wants to trade tokens from a private blockchain project, keep fees near zero, and avoid the noise of DeFi.

Who Is Ardor DEX Really For?

This isn’t a platform for day traders or crypto speculators. If you’re chasing quick flips or buying the latest Solana meme coin, Ardor DEX won’t help you.But if you’re:

- Running a business that issued tokens on a child chain (loyalty points, digital assets, etc.)

- Already holding ARDR and want to trade child-chain tokens without switching wallets

- Concerned about security and hate the idea of bridging assets between chains

- Looking for a low-cost, private way to trade niche crypto assets

…then Ardor DEX is one of the few platforms that actually fits your needs.

Is It Safe?

Yes. The Ardor blockchain uses proof-of-stake with a fixed supply of 999,999,999 ARDR tokens. Validators secure the entire network, including all child chains. There’s no known major exploit on the Ardor chain since its launch in 2016. The wallet has been audited by third parties and is open-source.The biggest risk isn’t hacking - it’s user error. If you lose your private key, there’s no recovery. No customer support can help you. That’s true for every non-custodial wallet, but Ardor doesn’t make it easy to explain this to beginners. The interface is clean, but the underlying system is complex.

Future Outlook

The DEX market is projected to hit $3.48 trillion in volume by the end of 2025. But that growth is being led by a handful of platforms. Ardor DEX isn’t part of that surge. It’s not listed in Eco Support’s top 50 DEXs. No major influencers talk about it. The ARDR token’s RSI is neutral at 41.40, and short-term price predictions are bearish.But here’s the thing: Ardor isn’t trying to be the next Uniswap. It’s a niche tool for a niche problem. The parent-child chain model is brilliant. It solves real issues that Ethereum and Solana still struggle with. If the team can grow adoption among enterprise blockchain users - say, companies using child chains for supply chain tracking or digital IDs - then the DEX could gain organic traction.

Right now, it’s a quiet, reliable, under-the-radar option. Not flashy. Not popular. But solid.

Final Verdict: Should You Use Ardor DEX?

If you’re a casual trader looking for the biggest pools and fastest swaps - skip it. Go to Uniswap or PancakeSwap.If you’re someone who values security over speed, low fees over liquidity, and wants to trade tokens that exist only on private blockchains - then Ardor DEX is worth your attention. It’s not perfect. It’s not easy. But it’s honest. It does one thing well: let you trade tokens securely, privately, and cheaply - without needing to trust anyone else.

Download the Ardor Wallet on Android. Buy a small amount of ARDR. Try swapping one child-chain token. You might not love it. But you’ll understand why it exists - and why, for some, it still matters.

Is Ardor DEX safe to use?

Yes. Ardor DEX runs on the Ardor blockchain, which uses a secure proof-of-stake consensus mechanism. The parent chain secures all child chains, reducing attack surfaces. The Ardor Wallet is open-source and has been audited. However, like all non-custodial wallets, you’re responsible for your private keys. If you lose them, there’s no recovery.

Can I trade Bitcoin or Ethereum on Ardor DEX?

No. Ardor DEX only supports tokens issued on its own child chains, like Ignis. You cannot trade BTC, ETH, SOL, or other major cryptocurrencies directly. You’d need to use a bridge or centralized exchange to convert those assets into ARDR or a child-chain token first.

Do I need ARDR to use the exchange?

Yes. ARDR is the native token of the Ardor blockchain and is required to pay transaction fees. You can’t trade on the DEX without holding some ARDR. It’s not used as a trading pair - only as gas.

Is there an iOS version of the Ardor Wallet?

No. As of 2025, the official Ardor Wallet is only available on Android. There is no iOS app, and no official announcement about one being developed. This is a major limitation for users on Apple devices.

How does Ardor DEX compare to Uniswap in terms of fees?

Ardor DEX fees are dramatically lower. Most trades cost under $0.01, paid in ARDR. On Uniswap, fees can range from $1 to $10 per trade, depending on Ethereum network congestion. Ardor wins on cost, but loses on liquidity and token variety.

What’s the future of Ardor DEX?

Its future depends on adoption within enterprise blockchain projects. If companies using Ardor’s child chains for asset tokenization or supply chain tracking start using the DEX to trade those tokens, volume could grow. But without major marketing, partnerships, or a mobile iOS app, it will likely remain a niche tool for a small, technical user base.