Rhea Finance Liquidity Calculator

Liquidity Rewards Estimator

Calculate your potential daily and monthly rewards from providing liquidity on Rhea Finance. Based on current protocol parameters.

If you’ve been scrolling through the ever‑growing list of decentralized exchanges, you’ve probably wondered whether the newest kid on the block, Rhea Finance is a hype‑driven flash or a genuinely useful tool for NEAR‑based traders.

What Is Rhea Finance?

Rhea Finance launched on July 30, 2025 after the merger of two NEAR Protocol projects - Ref Finance and Burrow Finance. It positions itself as an all‑in‑one DEX that combines spot trading, liquidity provision, and on‑chain lending under a single web interface. By aggregating the previously separate liquidity pools, Rhea claims to cut slippage and simplify cross‑chain swaps that would otherwise require juggling multiple dashboards.

How the Platform Works

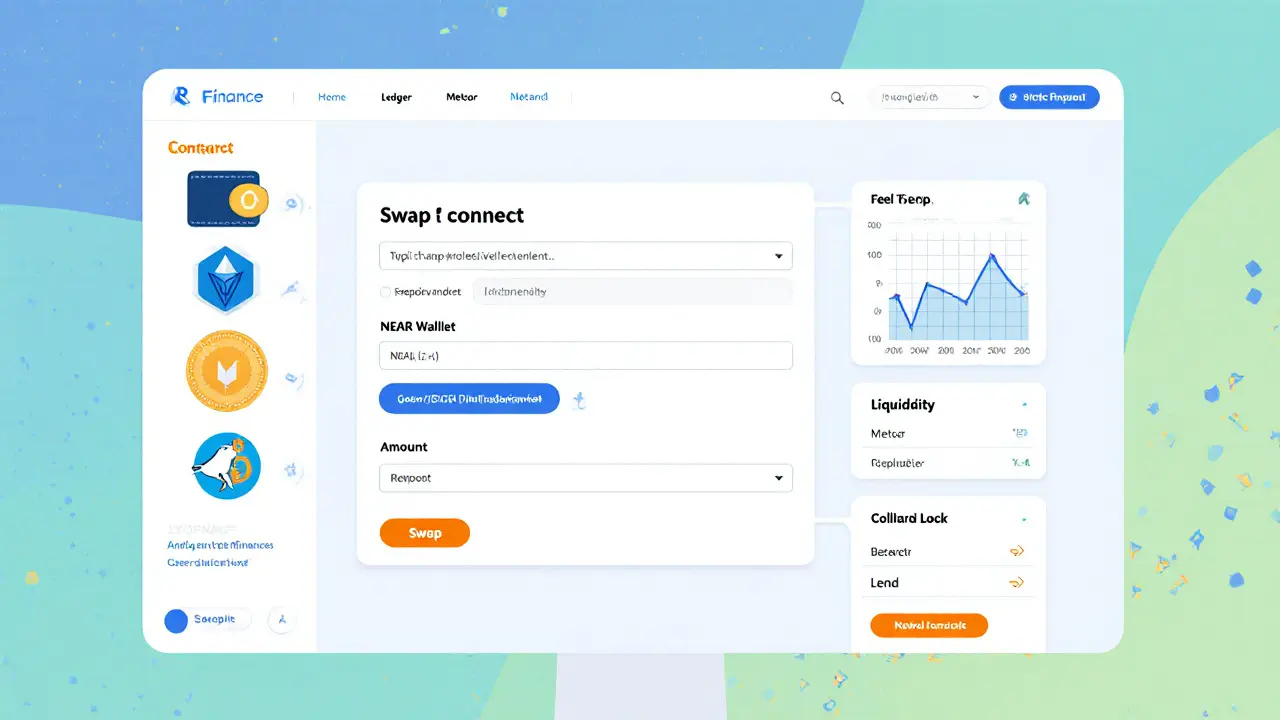

From a user‑perspective, the workflow mirrors most modern DEXs:

- Connect a NEAR‑compatible wallet (Ledger, Meteor Wallet, or the native NEAR Wallet).

- Select a trading pair from the list of 106 available pairs across 47 coins.

- Enter the amount, review the estimated gas fee, and hit “Swap”.

- Optionally add the pair to the liquidity pool to earn a share of the transaction fees.

- If you need borrowing power, switch to the “Lend” tab and pledge collateral to borrow against.

The UI is purpose‑built for NEAR assets, so you won’t see Ethereum or Binance Smart Chain tokens unless the upcoming bridge (expected Q1 2026) goes live.

Tokenomics of the RHEA Token

The native token, RHEA, has a fixed supply of 1 billion. Only 200 million (20 %) are in circulation as of October 2025, with the remaining 800 million locked in a three‑year vesting schedule. The token powers governance, fee discounts, and liquidity mining rewards. Its price has been volatile - CoinCodex predicts a bearish dip to $0.0178 by November 2025, while 3Commas sees a modest upside toward $0.0225 in December.

Market Performance & Liquidity

According to CoinGecko, Rhea Finance sits in the 93rd percentile for 24‑hour volume and the 77th percentile for order‑book depth among DEXs. The average bid‑ask spread is about 0.6 %, which is tighter than many niche DEXs but still wider than the multi‑chain giants. Weekly active wallets have risen to roughly 48 000, a 32 % increase since the pre‑merger era.

Trading volume typically crosses $1.3 million per day, and a single 24‑hour spike of 5.6 % moved $1.31 million in volume in early October 2025. The platform’s biggest liquidity pools revolve around NEAR‑USDT and NEAR‑RHEA pairs.

How Rhea Finance Stacks Up Against the Competition

Below is a quick snapshot comparing Rhea Finance to three well‑known DEXs. The numbers are drawn from CoinGecko, DeFi Llama and each protocol’s published stats as of October 2025.

| DEX | #Trading Pairs | Avg. Spread | Volume Percentile | Ecosystem Focus |

|---|---|---|---|---|

| Rhea Finance | 106 | 0.6 % | 93rd | NEAR Protocol |

| Uniswap V3 | 1,800+ | 0.2 % | 99th | Ethereum & Multi‑chain |

| PancakeSwap | 600+ | 0.4 % | 95th | Binance Smart Chain |

| SushiSwap | 1,200+ | 0.35 % | 96th | Multi‑chain |

Rhea’s strength is the consolidated liquidity from Ref Finance and Burrow Finance, which reduces the price impact for NEAR‑centric swaps. Its main drawback is the limited token list - it can’t compete with Uniswap’s 1,800‑plus pairs or SushiSwap’s broad multi‑chain support.

User Experience, Support & Community

First‑time users typically need 5‑7 hours to explore the merged dashboard, while seasoned DeFi traders can get comfortable in 2‑3 hours. The platform’s documentation scores 4.2 / 5 for completeness, but many users cite missing troubleshooting examples.

Support channels are limited to Telegram (12,543 members) and Discord (8,732 members). Non‑urgent queries average an 18‑hour response time, which explains the 41 % negative reviews mentioning slow support on Trustpilot (3.8 / 5 overall rating).

On the upside, the UI is praised for its “intuitive NEAR‑native interface” - 68 % of positive reviews highlight this point. A Medium post by Alex Chen notes a 65 % reduction in time spent managing separate DeFi positions after the merger.

Risks, Fees & Safety Considerations

Because Rhea Finance is fully decentralized, there is no central custodian to freeze assets. That also means you’re responsible for securing your private keys and for estimating gas fees accurately, especially during network congestion. Users report 3‑5 % slippage on larger swaps - a reminder that the “consolidated liquidity” claim isn’t a silver bullet.

Fees consist of a 0.3 % protocol fee (split between liquidity providers and the treasury) plus a variable NEAR gas cost, typically under $0.0002 per transaction. No hidden withdrawal fees apply, but moving RHEA onto a centralized exchange like Bitget incurs the usual network fee.

The vesting schedule of 800 million RHEA tokens poses a potential sell‑pressure risk once the tokens unlock. If the release outpaces user growth, price dips could intensify.

Future Roadmap & Outlook

The most anticipated development is the upcoming Ethereum bridge slated for Q1 2026, which would open Rhea Finance to a much larger token universe. Bitget’s $7,000 RHEA incentive campaign in August 2025 boosted new‑user sign‑ups by 47 % - a sign that promotional pushes can drive short‑term growth.

Delphi Digital warns that without successful cross‑chain expansion, Rhea may remain confined to a single‑digit market share within the NEAR ecosystem. Conversely, a smooth bridge launch could lift its volume percentile into the 95‑plus range.

Bottom Line - Should You Trade on Rhea Finance?

If you’re already active in the NEAR ecosystem and value a single dashboard for swapping, providing liquidity, and borrowing, Rhea Finance is worth a trial. Expect tighter spreads than many niche DEXs, but be ready for occasional higher slippage on big trades. Newcomers should allocate extra time to learn gas‑fee settings and keep an eye on the RHEA token’s vesting releases.

Rhea Finance crypto exchange offers a solid entry point for NEAR‑centric traders, yet its long‑term upside hinges on cross‑chain integration and community‑driven liquidity growth.

Frequently Asked Questions

Is Rhea Finance safe to use?

Rhea Finance is a fully decentralized protocol, meaning there’s no central authority that can freeze assets. Security depends on the underlying NEAR blockchain (which has no major hacks to date) and on users keeping their private keys safe. Audits have been performed on the smart contracts, but as with any DeFi platform, users should only allocate funds they’re comfortable risking.

What wallets work with Rhea Finance?

All NEAR‑compatible wallets are supported - Ledger hardware wallet, Meteor Wallet, the official NEAR Web Wallet, and other browser extensions that expose a NEAR key pair.

How do I earn fees on Rhea Finance?

Provide liquidity to any of the 106 trading pairs. You’ll receive a share of the 0.3 % protocol fee proportional to your contribution. The platform also runs periodic liquidity mining campaigns that reward participants with additional RHEA tokens.

Will Rhea Finance support Ethereum tokens?

A cross‑chain bridge to Ethereum is planned for Q1 2026. Once live, users will be able to swap ERC‑20 tokens through the same interface, expanding the token selection dramatically.

How can I get RHEA tokens?

RHEA is listed on several centralized exchanges (Bitget, Binance, GATE, MEXC) and can also be earned as a liquidity mining reward on Rhea Finance itself. Buying on a CEX is the fastest way; earning on‑chain requires providing liquidity or borrowing against collateral.

Comments (16)