PEFI Yield Calculator

Calculate potential returns from PEFI staking or liquidity provision. Note: Current APY is very low due to low trading volume. This calculator is for illustrative purposes only based on historical data.

Potential Returns

Penguin Finance (PEFI) is a DeFi protocol built on the Avalanche network that tries to make yield farming cheap and fast. In plain English, it’s a set of smart contracts that let you stake, farm, and trade with almost no gas fees. Below you’ll get a step‑by‑step look at how it works, why it mattered in 2021, and what its reality looks like in 2025.

Quick Takeaways

- Launched April 1 2021 on Avalanche’s C‑Chain.

- PEFI token price fell from $4.61 to under $0.01.

- Liquidity exists mainly on Pangolin DEX; daily volume is under $40.

- Smart contracts were audited by CertiK (moderate risk).

- Community activity has dropped >90% since the 2021 hype.

What Penguin Finance Actually Is

Penguin Finance is a Penguin Finance is a decentralized finance (DeFi) protocol that runs on the Avalanche network, offering low‑fee yield farming, staking, and a prediction‑market game called Emperor Penguin. The project’s goal was to lower the entry barrier that high gas fees on Ethereum created for retail users.

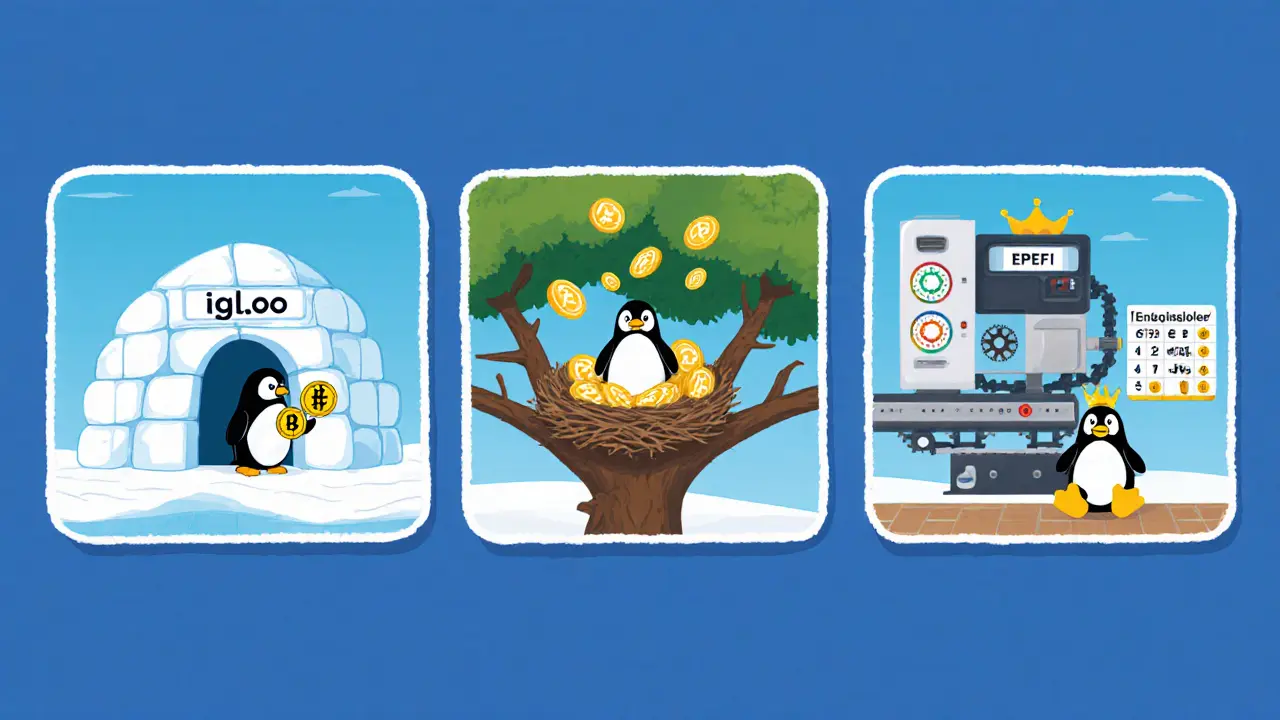

The protocol bundles a few familiar concepts: Igloos (yield farms that accept LP tokens from the Pangolin DEX), Penguin Nests (staking pools for the native token), and an auto‑compounder that reinvests rewards without you lifting a finger.

How the PEFI Token Powers the Ecosystem

PEFI is the utility token that fuels every action on the platform. When you provide liquidity to an Igloo, you earn PEFI as a reward. When you stake PEFI in a Penguin Nest, you receive a share of the protocol’s fee revenue (although fees have been near zero since 2023). The token also pays the small transaction fees that keep the smart contracts running.

At launch, the tokenomics were aggressive: 70% of the supply was allocated to liquidity mining, 15% to the team (locked), and the rest to community incentives. Today, about 91% of the 21 million max supply is in circulation, meaning most of the original rewards have already been distributed.

Technical Backbone: Avalanche and Audits

Running on Avalanche Network is a high‑throughput blockchain that finalises transactions in under one second and charges less than $0.01 per transaction on average. This speed made Penguin Finance attractive when Ethereum gas could spike above $50.

The first smart‑contract audit was performed by CertiK on 16 June 2021, flagging a moderate risk due to heavy code forking from PancakeSwap, SushiSwap, and Goose Finance. No critical vulnerabilities were found, but the report warned that extensive forking without deep customization could lead to undiscovered bugs.

Core Features in Plain Terms

- Igloos: Deposit liquidity‑provider (LP) tokens from Pangolin (e.g., WAVAX/PEFI). Earn PEFI rewards that auto‑compound.

- Penguin Nests: Stake raw PEFI and claim a slice of protocol fees. Yield is currently negligible because trading volume is tiny.

- Auto‑Compounder: A built‑in bot that reinvests earned PEFI after each block, boosting APY without manual actions.

- Emperor Penguin Game: A prediction‑market dApp where users bet on price movements. The game’s UI is still live but user activity is extremely low.

Liquidity Landscape: Where Can You Trade PEFI?

The only significant market for PEFI is the Pangolin DEX, a decentralized exchange native to Avalanche. The PEFI/WAVAX pair accounts for roughly 99% of daily volume, which sits at about $33 USD. That’s a drop from the multi‑million‑dollar volumes seen in mid‑2021. No major centralized exchanges list PEFI anymore.

How Penguin Finance Stacks Up Against Other Avalanche DeFi

| Protocol | Market Cap (USD) | 24h Volume (USD) | Avg. Tx Fee | Active Users (Daily) |

|---|---|---|---|---|

| Penguin Finance | ~$120 k | ~$33 | <$0.01 | <50 |

| Trader Joe | $185 M | $12 M | ~$0.02 | ~15 k |

| Benqi | $85 M | $6 M | ~$0.03 | ~8 k |

Penguin Finance’s numbers are tiny in every column. The low fees are still a plus, but without liquidity or users the advantage disappears.

Community Pulse and Development Activity

When the protocol launched, its Discord peaked at over 15 000 members and Twitter was posting multiple times a day. By late 2023 the Discord had slipped below 2 000 members and Twitter averaged barely one post per month.

The GitHub repo shows the last code commit on 17 Feb 2022. No roadmap updates have been announced since Q4 2022. Users on Reddit’s r/DeFi note that the UI often hangs, and the “Igloos” sometimes fail to process a simple stake within minutes.

Risks You Should Know Before Holding PEFI

- Liquidity risk: With a single active market, a large sell order can wipe out the price instantly.

- Security risk: CertiK flagged moderate risk; lack of recent audits means new bugs could go unnoticed.

- Adoption risk: Daily active users are below 50, making network effects negligible.

- Regulatory risk: Although tiny, the SEC could treat PEFI as a security if the project ever attempts a full token‑sale revival.

Is There Any Reason to Keep an Eye on Penguin Finance?

If you’re hunting for ultra‑low‑fee yield farms and you have a strong belief that Avalanche will regain massive user growth, the protocol’s cheap transaction costs could become useful again. However, that would require fresh liquidity injections, new development pushes, and a community revival - none of which are on the horizon based on current signals.

Quick Checklist for Potential Investors

- Check the current price: ~<$0.01 per PEFI.

- Verify liquidity: Only PEFI/WAVAX on Pangolin, depth < $1 k.

- Confirm audit status: Last audit by CertiK (June 2021), no updates.

- Assess community health: Discord <2 k, Twitter inactive.

- Determine exit strategy: Expect high slippage on any sell order.

Frequently Asked Questions

What is the main purpose of Penguin Finance?

Penguin Finance aims to provide cheap, fast yield‑farming services on Avalanche, letting users earn PEFI rewards with sub‑second transaction finality and near‑zero gas fees.

Where can I buy or trade PEFI?

The primary market is the Pangolin DEX (PEFI/WAVAX pair). No major centralized exchanges list the token as of 2025.

Is PEFI a good investment?

Given the tiny market cap, near‑zero liquidity, and stagnant development, PEFI is largely speculative. It may suit traders looking for high‑risk, low‑price tokens, but it lacks fundamentals for a long‑term hold.

What are the main security concerns?

The CertiK audit labeled the contracts as moderate risk due to extensive code forking. No new audits have been performed since 2021, so undiscovered vulnerabilities could exist.

How does Penguin Finance compare to other Avalanche DeFi platforms?

Compared with Trader Joe and Benqi, Penguin Finance has far lower liquidity, market cap, and daily users. Its fee advantage is similar, but the lack of depth makes it impractical for most traders.

Bottom line: Penguin Finance was an interesting experiment in ultra‑low‑fee DeFi, but today it lives in the shadow of larger Avalanche projects. If you’re curious, treat any PEFI exposure as a small, high‑risk experiment rather than a core portfolio holding.