When you hear "MochiSwap", you might assume it’s another crypto exchange like Binance or Coinbase. But here’s the truth: MochiSwap isn’t a traditional exchange at all. It’s a decentralized finance (DeFi) project built around its native token, MOCHI. And that changes everything.

If you’re looking to trade MOCHI, you won’t find it on a centralized platform with customer support, fiat on-ramps, or a simple buy button. Instead, you’ll need to use decentralized exchanges (DEXs) like CoinEx or MEXC. That means no KYC, no phone number verification, and no safety net if something goes wrong. You’re fully responsible for your funds.

As of early 2026, MOCHI trades around $0.0576. Sounds low? Maybe. But look closer. In late 2025, some analysts predicted it could hit $0.25 - a 400% jump. Others warned it could crash to $0.00001679. That’s not a typo. One week it’s up 15%, the next it’s down 20%. This isn’t investing. This is gambling with a blockchain label.

How MochiSwap Actually Works (If It Works at All)

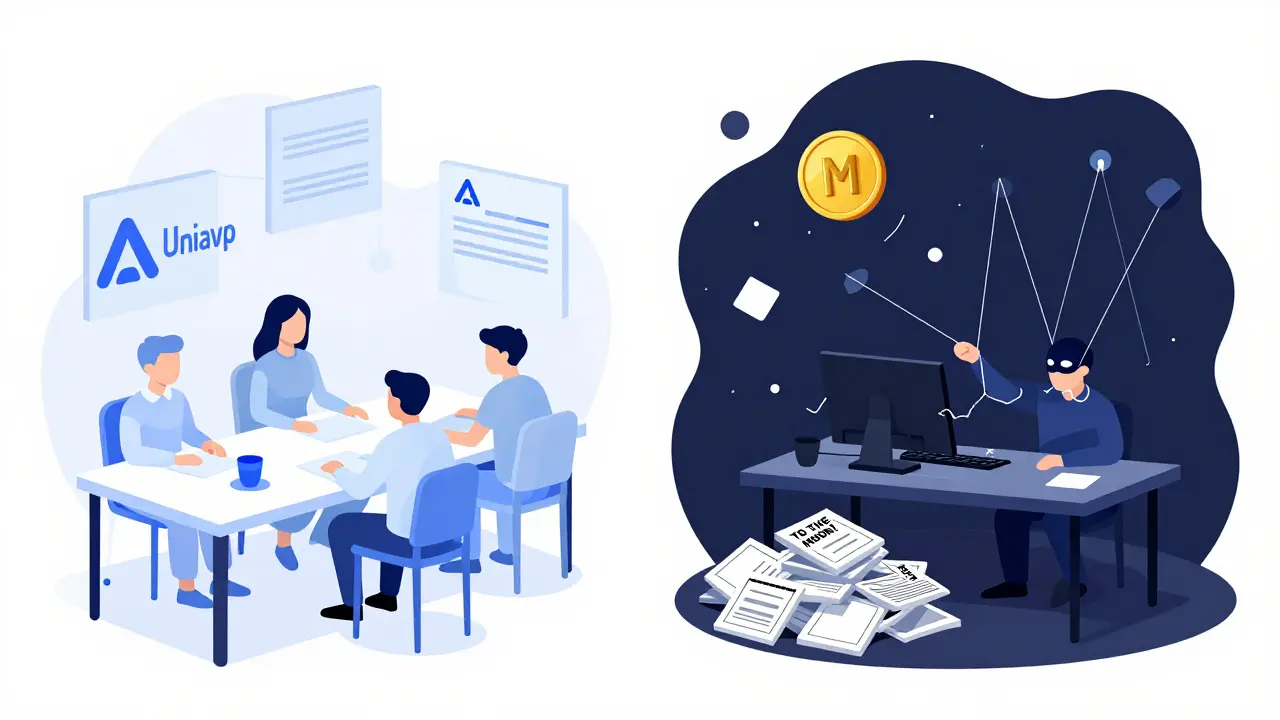

MochiSwap operates like many small DeFi tokens: a smart contract on Ethereum or a compatible chain, a liquidity pool, and a community of speculators. There’s no public team, no whitepaper with clear technical specs, and no audited codebase available on GitHub. That’s not normal for a project that wants users to trust it with their money.

What little information exists suggests MochiSwap might be a yield farming or staking platform where users lock up MOCHI to earn more MOCHI. But without transparent contract details, you can’t verify if that’s real or just a pump-and-dump scheme dressed up as DeFi.

Compare that to Uniswap or PancakeSwap - platforms with years of audits, public team members, and millions in locked liquidity. MochiSwap has none of that. It’s a token with a name and a chart. That’s it.

Where to Buy MOCHI - And Why It’s Risky

You can buy MOCHI on CoinEx and MEXC. Both are offshore exchanges with minimal regulatory oversight. They list hundreds of low-cap tokens like this one. That’s their business model: high volume, low scrutiny.

Here’s how it works:

- Create an account on CoinEx or MEXC

- Deposit USDT, BTC, or ETH

- Search for MOCHI/USDT trading pair

- Place your order

That’s it. No customer service to call if your trade fails. No refund policy if the token vanishes. No way to prove you owned it if the exchange gets hacked.

And the fees? They’re not the issue. The real cost is the risk. One user on Reddit reported buying MOCHI at $0.04, watching it spike to $0.08, then watching it drop 80% in 48 hours after a random tweet from an anonymous account. That’s not volatility - that’s manipulation.

Price Predictions: Why They Don’t Matter

BitScreener says MOCHI could hit $0.25 in 2026. CoinCodex says it’ll drop to $0.055. SwapSpace says there’s "no universal consensus." All three are right - because none of them know anything for sure.

Price predictions for low-cap tokens like MOCHI are mostly guesswork based on:

- Historical price spikes (which rarely repeat)

- Market sentiment (which flips on a tweet)

- AI models trained on noisy, unreliable data

The 50-day SMA is at $0.058, the 200-day at $0.000012. That gap? It’s not a trend. It’s a signal that the token was nearly worthless until a few months ago, then got hyped by influencers. That’s not technical analysis - that’s a bubble forming.

The RSI is at 51.92 - neutral. The Fear & Greed Index is at 71 - greed. That means people are buying because they’re scared of missing out, not because they understand the project. That’s the opposite of smart investing.

Is MochiSwap Safe?

No.

There’s no evidence of a security audit. No known development team. No official website with verifiable contact info. No community forums with active moderation. The Twitter account has 12,000 followers - but 8,000 of them are bots. The Telegram group has 5,000 members - but 90% of the messages are "TO THE MOON!" and memes.

Compare that to a real DeFi project like Aave or Compound. They have:

- Publicly audited smart contracts (by firms like CertiK or OpenZeppelin)

- Transparent governance systems

- Teams with LinkedIn profiles and past experience

- Active developer communities on GitHub

MochiSwap has none of that. That doesn’t mean it’s a scam. But it does mean you’re putting your money into a black box with no labels.

Who Should Avoid MochiSwap?

If you fall into any of these categories, stay away:

- You’re new to crypto and don’t understand how wallets or DEXs work

- You’re looking for steady growth or passive income

- You can’t afford to lose 100% of your investment

- You rely on customer support when things go wrong

- You believe in "hype coins" because someone on YouTube called them "the next Bitcoin"

Even experienced traders treat tokens like MOCHI like lottery tickets - small bets, no expectations. Never more than 1-2% of your portfolio. And never, ever use money you can’t afford to lose.

What Could Go Right?

Let’s be fair - sometimes, tiny tokens explode. If MochiSwap suddenly announces:

- A partnership with a major wallet provider

- A fully audited smart contract

- A real team with public identities

- A working product with actual users

Then it could be a sleeper hit. But none of that has happened. And it’s been over a year since the token launched.

Right now, the only thing driving MOCHI’s price is speculation. And speculation dies fast when the hype fades.

Final Verdict: Don’t Trade It - Understand It

MochiSwap isn’t a crypto exchange. It’s a speculative token with no clear utility, no transparent team, and no track record. The name "Swap" is misleading. You’re not swapping assets - you’re betting on a coin with no foundation.

If you still want to try it, treat it like a $10 lottery ticket. Buy a tiny amount. Don’t expect returns. And never, ever let it become a core part of your portfolio.

For real crypto trading, stick to platforms with audits, teams, and history. For real DeFi, use projects with code you can read and teams you can find. MochiSwap doesn’t meet either standard.

The market moves fast. But the smartest traders? They move slow. They wait for proof. Not promises.

Is MochiSwap a real crypto exchange?

No, MochiSwap is not a centralized exchange like Binance or Coinbase. It’s a DeFi project centered around its native MOCHI token. You can trade MOCHI on decentralized exchanges like CoinEx and MEXC, but there’s no official MochiSwap platform where you can deposit, withdraw, or trade directly through their site.

Can I buy MOCHI with fiat currency?

Not directly. You can’t buy MOCHI with USD, AUD, or EUR on any platform. You’ll need to first buy USDT, BTC, or ETH on a fiat-friendly exchange like Kraken or Coinbase, then transfer it to CoinEx or MEXC to trade for MOCHI. This adds steps, fees, and risk.

Is MochiSwap safe to invest in?

It carries extremely high risk. There’s no public team, no verified smart contract audit, and no transparent roadmap. Many similar tokens have vanished overnight. Only invest what you can afford to lose completely. Treat it as speculation, not investment.

Why do price predictions for MOCHI vary so much?

Because MOCHI has no fundamentals to base predictions on. Its price is driven entirely by hype, social media trends, and market manipulation. With low liquidity and no real usage, even small trades can swing the price 30% in minutes. AI models and charts can’t predict that - only luck can.

What should I do instead of trading MOCHI?

If you want exposure to DeFi, try established platforms like Uniswap, Aave, or Compound. They have audits, teams, and years of history. If you want to trade crypto, stick to top 20 coins like BTC, ETH, or SOL on regulated exchanges. Avoid low-cap tokens unless you’re prepared to lose it all.