DEX Liquidity Checker

Check Liquidity Status

Enter a token pair to verify if this DEX has active liquidity and trading volume.

No liquidity detected

Based on article data: Zero active trading pairs and $0.00 daily volume

Critical Risk Factors:

- 0 active trading pairs

- $0.00 24-hour volume

- Unverified smart contracts

- Token price crash (99.76% from ATH)

If you’ve been scanning the crypto landscape for a cheap swap platform and stumbled on MakiSwap, you’re probably wondering whether it’s a hidden gem or a red flag. Below we break down everything you need to know - from the tech behind it to the stark reality of its trading activity - so you can decide if you should even bother connecting your wallet.

What is MakiSwap?

MakiSwap is a decentralized cryptocurrency exchange (DEX) built on the Huobi Eco Chain (HECO). Launched in 2021 by the Unilayer team, it operates non‑custodially - meaning you keep full control of your private keys and the platform never holds your funds.

How does a DEX like MakiSwap work?

At its core, MakiSwap runs an automated market maker (AMM) model. Instead of matching buyers and sellers directly, it uses liquidity pools that hold two tokens in a constant‑product formula. When you swap, the pool’s ratio shifts and the price updates automatically. The process is fast, cheap (thanks to HECO’s low gas fees), and requires only a Web3‑compatible crypto wallet like MetaMask or Trust Wallet.

Meet the native token: MAKI

The platform’s utility token, MAKI, serves two main purposes: governance and fee redistribution. Holders can vote on protocol upgrades, and a slice of the 0.2 % trading fee is funnelled back to MAKI stakers. As of October 2025 the token trades around $0.0029 with a market cap just over $200 K, a staggering -99.76 % drop from its all‑time high. Such a plunge has sparked widespread accusations of a Ponzi‑style scheme.

Liquidity and trading activity - the hard facts

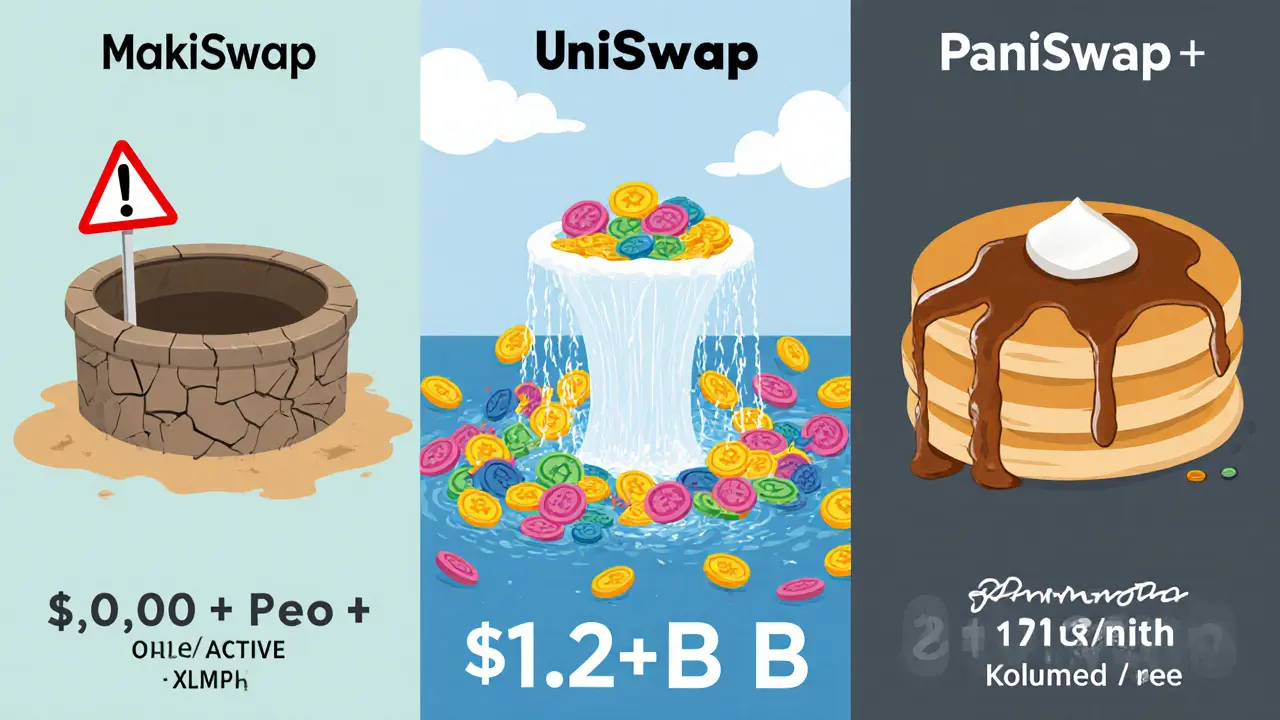

On paper the fees look competitive - 0.2 % per swap, no deposit or withdrawal charges - but the numbers tell a different story. Current analytics show zero active trading pairs and $0.00 24‑hour volume. In other words, there’s nobody willing to provide liquidity, making any swap virtually impossible. Compare that to Uniswap or PancakeSwap, which each host thousands of pairs and billions in total value locked (TVL).

Security concerns and fraud warnings

Because MakiSwap is non‑custodial, you bear the entire security burden. The smart contracts are public, but there’s little evidence of recent audits or bug‑bounty programs. Multiple review sites have flagged the MAKI token as an “air‑coin” and warned of potential Ponzi activity. Users report lost funds, unresponsive support, and difficulty withdrawing yield‑farming rewards. If you’re not comfortable reading Solidity code or verifying contract provenance yourself, the risk level is high.

Side‑by‑side comparison with leading DEXs

| Feature | MakiSwap (HECO) | Uniswap (Ethereum) | PancakeSwap (BSC) |

|---|---|---|---|

| Active Trading Pairs | 0 | 12,000+ | 7,500+ |

| 24‑h Volume (USD) | $0 | $3.2 B | $1.1 B |

| Average Swap Fee | 0.2 % | 0.3 % | 0.25 % |

| Chain Support | HECO only | Ethereum + Layer‑2s | BSC + select side‑chains |

| Liquidity Incentives | None (no active pools) | Yield farming, liquidity mining | Yield farming, lotteries |

| Audit Status | Unverified / outdated | Audited by multiple firms | Audited, but occasional exploits |

| Community Size | Very small, < 1 % of DEX market | Millions of active users | Hundreds of thousands |

User experience - is it beginner‑friendly?

Connecting a wallet to MakiSwap is technically straightforward, but the platform expects you to already have HECO‑compatible assets. That means you must bridge tokens from Ethereum or BSC, incurring extra gas costs and added steps. Documentation is sparse, community channels are almost silent, and there’s no live chat or ticket system. For a newcomer, the learning curve feels more like a DIY tutorial than a polished product.

Final verdict: should you use MakiSwap?

In a nutshell, the answer is no for most traders. The MakiSwap review reveals a DEX with zero liquidity, a token that has crashed nearly 100 %, and multiple fraud warnings. If you are an experienced developer looking to experiment with HECO smart contracts, you might find the codebase interesting. Otherwise, stick to established platforms that offer real liquidity, audited contracts, and active community support.

Quick checklist before you consider any DEX

- Check active trading pairs and 24‑hour volume.

- Confirm recent security audits.

- Verify that the native token has genuine utility beyond fee rebates.

- Assess community activity - forums, Discord, Telegram.

- Make sure you understand the bridge process if the DEX isn’t on your primary chain.

Is MakiSwap safe to use?

Safety is questionable. The platform lacks recent audits, shows zero liquidity, and has been flagged for potential Ponzi activity. Only use it if you fully understand the risks and are comfortable with possible loss of funds.

How do I connect a wallet to MakiSwap?

Open the site, click “Connect Wallet”, choose a Web3 wallet (MetaMask, Trust Wallet, etc.), and ensure the wallet is set to the HECO network. If your assets are on another chain, you’ll need to bridge them using a service like AnySwap before swapping.

What is the MAKI token used for?

MAKI provides governance rights and a share of the platform’s trading fees. However, with virtually no trading activity, the fee‑distribution benefit is negligible.

Can I earn yield on MakiSwap?

Yield‑farming was advertised, but with zero active pools there are currently no legitimate farms to join. Any existing farms are likely abandoned.

How does MakiSwap compare to Uniswap?

Uniswap runs on Ethereum, hosts thousands of pairs, has billions in TVL, and undergoes regular security audits. MakiSwap operates on HECO, has zero liquidity, and shows no recent development, making Uniswap the far superior choice for most users.

Comments (8)