Smart contracts on Ethereum aren’t magic. They’re not mysterious code that runs on its own like a robot butler. They’re simple programs - written in code - that automatically do what they’re told when certain conditions are met. Think of them like vending machines: you put in the right amount of money, press the button, and out comes your snack. No clerk needed. No paperwork. Just rules, executed by the network.

What Exactly Is a Smart Contract?

A smart contract is a piece of code stored on the Ethereum blockchain. It has two main parts: code (the rules) and state (the data it keeps track of). Once deployed, it lives at a unique address on the blockchain, just like your Ethereum wallet does. Anyone can see it. No one can delete it. And once it runs, the outcome is final.These contracts are built using languages like Solidity and Vyper. Solidity is the most popular - it looks a bit like JavaScript but is designed specifically for blockchain. A basic smart contract might look like this:

contract SimpleStorage {

uint256 private count = 0;

function increment() public {

count += 1;

}

function getCount() public view returns (uint256) {

return count;

}

}This contract stores a number. When someone calls increment(), the number goes up by one. When someone calls getCount(), it reads the number back. Simple. But powerful.

How Do They Run?

Smart contracts don’t run on your laptop or phone. They run on the Ethereum Virtual Machine (EVM) - a global computer made up of thousands of machines around the world. Every time a contract needs to execute, every node on the Ethereum network runs the same code and checks the result. If they all agree, the change gets written to the blockchain.This is why they’re so secure. There’s no single point of failure. No company controlling the system. No server you can hack. The network itself enforces the rules.

When you interact with a smart contract - say, sending ETH to a DeFi protocol - you’re triggering a function inside it. The contract checks conditions using built-in variables like:

msg.sender- who sent the transaction?msg.value- how much ETH was sent?block.timestamp- what’s the current time on the blockchain?

For example, a contract might say: “Only the person who created this contract can withdraw funds.” That’s coded as:

require(msg.sender == minter, "Not the owner");If the sender isn’t the minter, the transaction fails. No money moves. No error message from a bank - just a quiet rejection by the network.

How Are They Deployed?

You can’t just upload a smart contract like a website. You have to deploy it. That means sending a special transaction to the Ethereum network that includes the compiled code.Before deployment, the code is compiled from Solidity into bytecode - a low-level language the EVM understands. Then, you pay gas fees - ETH paid to miners or validators to process your transaction. Deploying a contract costs more than sending ETH because it’s writing a lot of data to the blockchain.

Developers test contracts first on testnets like Sepolia or Goerli. These are fake versions of Ethereum where ETH has no value. You can get free test ETH to try things out without spending real money. Once it works, you deploy to the mainnet.

Tools like Remix IDE (browser-based), Hardhat, and Foundry make this process easier. You write the code, click “Deploy,” connect your wallet like MetaMask, and approve the transaction. That’s it. The contract now lives on the blockchain forever.

What Can They Do?

Smart contracts power most of what you see in crypto today.- DeFi apps - like lending platforms where you deposit ETH and earn interest automatically.

- NFTs - each one is a token governed by a smart contract that proves ownership and lets you transfer it.

- DAOs - organizations run by code. Voting happens through contracts. Funds release only if enough people approve.

- Token standards - ERC-20 for fungible tokens (like USDC), ERC-721 for NFTs. These are just agreed-upon rules that make tokens work across different apps.

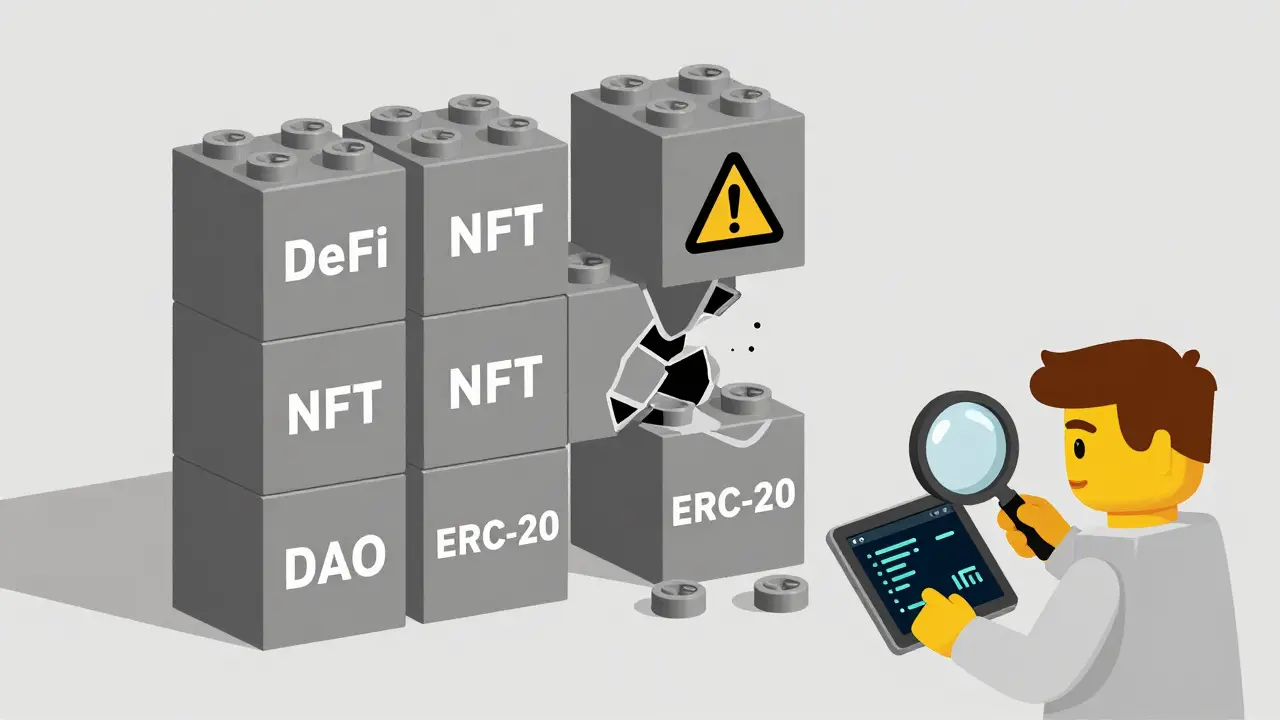

Because contracts are public, they can call each other. One contract can trigger another. That’s called composability. It’s like Lego blocks for finance. You can stack DeFi protocols on top of each other to create complex systems - like borrowing from one app, using the loan to buy tokens on another, and automatically selling them when the price hits a target.

What Are Their Limits?

Smart contracts aren’t perfect. They have real constraints.They can’t see the real world. A contract can’t know the price of Bitcoin, the weather in Sydney, or if a flight was delayed. To get that data, you need an oracle - a trusted third-party service that feeds off-chain info into the contract. If the oracle is hacked, the contract can be fooled.

They have size limits. Ethereum caps contract code at 24KB. That’s small. If your contract is too big, it won’t deploy. Developers work around this with patterns like the Diamond Pattern, which splits large contracts into smaller, modular pieces.

They’re immutable. Once deployed, you can’t fix a bug. If someone finds a flaw - like the infamous DAO hack in 2016 - the only way to fix it is to convince the whole network to roll back the blockchain. That’s hard. That’s controversial. That’s why security audits are critical.

They cost money to run. Every step in a contract costs gas. Complex logic = higher fees. That’s why simple contracts are preferred. If a contract needs to do too much, it becomes expensive and slow.

Why Do They Matter?

Smart contracts remove middlemen. Banks, lawyers, notaries - they’re all replaced by code. That means:- Faster transactions - no waiting days for clearance.

- Lower costs - no fees for intermediaries.

- Transparency - anyone can verify the rules and outcomes.

- Trustlessness - you don’t need to trust the other person. You trust the code.

Imagine a rental agreement where rent is paid automatically on the 1st of every month. If the tenant doesn’t pay, the lock changes. If they do, the door unlocks. No landlord. No collection agency. Just code.

Or think of insurance. A flight delay? The contract checks a trusted flight data feed. If the delay is over 3 hours, it automatically sends you compensation. No forms. No calls. No arguing.

These aren’t sci-fi ideas. They’re live on Ethereum right now.

What’s Next?

Ethereum keeps evolving. Upgrades like the Merge (which switched from mining to staking) made the network more efficient. Future upgrades will reduce gas fees and increase capacity. Layer-2 solutions like Arbitrum and Optimism are already handling millions of transactions at a fraction of the cost, while still using Ethereum’s security.Smart contracts are the engine behind it all. As tools get better and developers learn to write safer code, we’ll see them used in supply chains, voting systems, healthcare records, and even government services.

They’re not perfect. But they’re the closest thing we have to a rule-based, global, trustless system. And they’re only getting started.

Can smart contracts be changed after deployment?

No, smart contracts on Ethereum are immutable once deployed. If there’s a bug or flaw, you can’t edit the code. The only way to fix it is to deploy a new contract and migrate users to it. That’s why testing on testnets and auditing code before deployment is critical.

Do I need to know how to code to use smart contracts?

No. You don’t need to write code to use smart contracts. Apps like Uniswap, MetaMask, or OpenSea are built on top of them. You just interact with the interface - clicking buttons, sending ETH, or connecting your wallet. The code runs behind the scenes. But if you want to create your own contract, then yes - learning Solidity is necessary.

What’s the difference between a smart contract and a regular app?

A regular app runs on a company’s server. That company can change the rules, shut it down, or access your data. A smart contract runs on the Ethereum blockchain. No single person controls it. The rules are fixed in code and enforced by thousands of computers. You can’t censor it. You can’t take it down. That’s the key difference.

Why do smart contracts need gas fees?

Gas fees pay the network to run your contract. Every operation - reading data, writing data, sending ETH - takes computing power. Gas ensures that people don’t overload the network with infinite loops or spam. It also protects the network by making malicious or sloppy code expensive to run.

Can smart contracts interact with Bitcoin or other blockchains?

Not directly. Ethereum and Bitcoin operate on separate networks. But you can use wrapped tokens - like wBTC - which are Bitcoin locked in a smart contract on Ethereum, represented as an ERC-20 token. Or use cross-chain bridges, which are themselves smart contracts that lock assets on one chain and mint equivalents on another. These are trust-dependent and carry risk.

Are smart contracts legal?

Legality varies by country. In many places, smart contracts are treated as legally binding if they meet basic contract law requirements - offer, acceptance, consideration. Some jurisdictions, like Arizona and Tennessee in the U.S., have passed laws recognizing blockchain signatures and smart contracts as valid. But enforcement still relies on traditional courts if disputes arise.