Smart Contracts: What They Are, How They Work, and Where They’re Used in Crypto

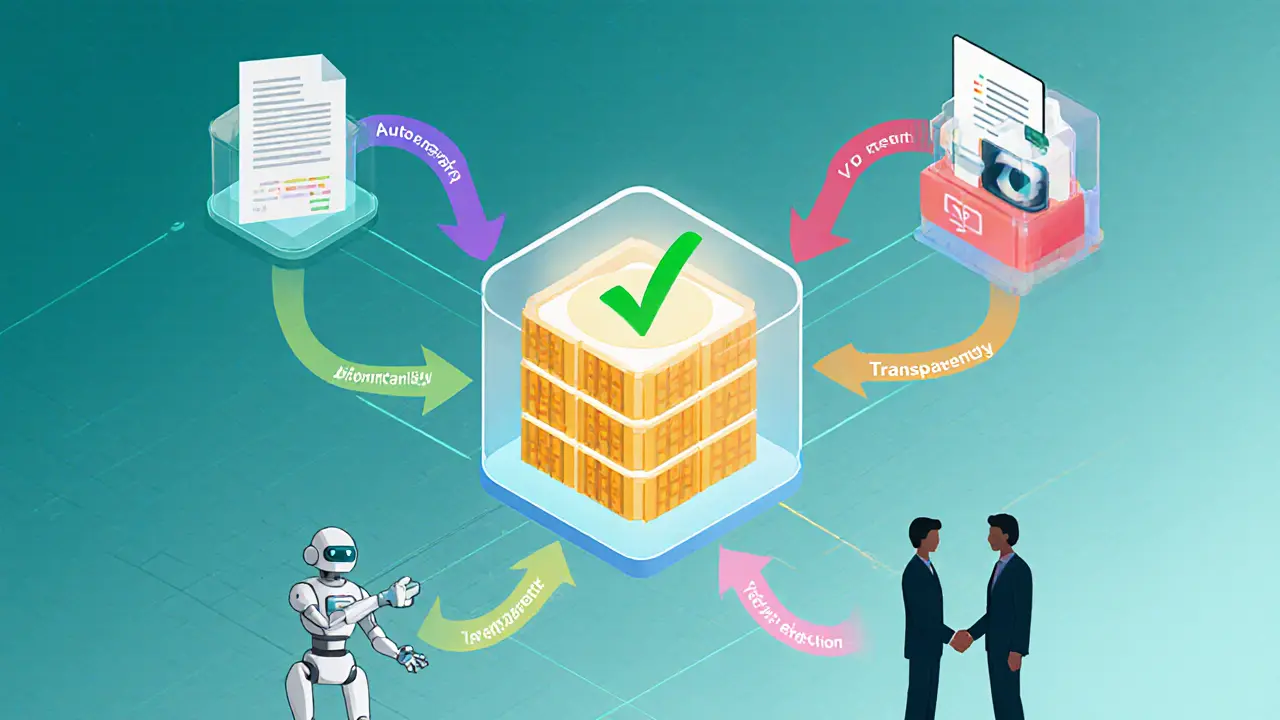

When you hear smart contracts, self-executing agreements coded directly onto a blockchain that run without human intervention. Also known as blockchain contracts, they’re the quiet engines behind most crypto projects you interact with — from swapping tokens on a decentralized exchange to claiming an airdrop or buying an NFT. Unlike traditional contracts that need lawyers or banks to enforce them, smart contracts automatically trigger actions when conditions are met. No middlemen. No delays. Just code doing what it was told.

They’re built on platforms like Ethereum, a blockchain network designed to run decentralized applications using programmable contracts, but now exist on many others, including BNB Chain, Polygon, and Base — all of which show up in the posts below. You’ll find them powering DeFi, a system of financial services like lending, borrowing, and trading that runs without banks on platforms like Quickswap v2 and FEG Exchange. They’re also behind token sales, automated rewards, and even how some airdrops determine who gets free coins — like the KOM airdrop or BIRD airdrop — by checking wallet activity against predefined rules.

But smart contracts aren’t magic. They’re only as good as the code written for them. A single bug can cost millions — just look at what happened with some DeFi protocols that lost funds because of flawed logic. That’s why projects like MM Finance and TomoDEX get scrutinized so closely: if the contract isn’t audited, it’s risky. And while they enable financial freedom, they also remove safety nets. If you send funds to a wrong address or interact with a scam contract, there’s no customer support to reverse it. That’s why understanding how they work isn’t just for developers — it’s for anyone using crypto today.

What you’ll find in the posts below isn’t theory. It’s real-world examples. You’ll see how smart contracts are used (and misused) in crypto exchanges, airdrops, and tokenomics. You’ll learn how to spot unsafe contracts, understand what makes a DeFi protocol trustworthy, and why some projects — like Schrödinger (SGR) or Alterverse (AVC) — raise red flags not because of price, but because of how their contracts behave. Whether you’re claiming a free token or swapping crypto on a DEX, smart contracts are the invisible hand shaping your experience. Know how they work, and you’ll never be just another user at the mercy of code you don’t understand.