Decentralized Finance (DeFi): Trends, Tools, and Opportunities

When talking about Decentralized Finance, a blockchain‑based financial system that runs without banks or other middlemen. Also known as DeFi, it lets anyone with an internet connection lend, borrow, trade or earn yield directly on chain. Decentralized finance is reshaping how we think about money, and its impact shows up in everything from quick flash loans to community‑driven airdrops.

Key Concepts in Decentralized Finance

One of the hottest tools in DeFi right now is the flash loan, a zero‑collateral loan that must be repaid within a single transaction. Platforms like Aave and dYdX enable developers to borrow huge sums, execute arbitrage, or refinance positions instantly. The flash loan model requires smart contracts that can enforce atomic execution, so a failed transaction reverts everything, protecting lenders from loss.

Another pillar of the ecosystem is the crypto airdrop, where projects distribute free tokens to community members. Airdrops serve as both marketing and decentralization tools, rewarding early adopters and encouraging network effects. Successful airdrops follow clear eligibility rules, use secure claim mechanisms, and disclose tokenomics up front to avoid scams.

Speaking of tokenomics, every DeFi protocol needs a solid economic model. Tokenomics defines supply caps, inflation rates, staking rewards, and governance rights. Well‑designed tokenomics aligns incentives for users, developers, and investors, making the platform sustainable long term. In contrast, poor tokenomics often leads to price dumps and loss of trust.

Environmental concerns are also shaping DeFi's future. Carbon‑neutral blockchain solutions, such as proof‑of‑stake networks and on‑chain carbon offset programs, aim to reduce the energy footprint of DeFi applications. Projects that adopt greener infrastructure can attract eco‑conscious users and meet upcoming regulatory standards.

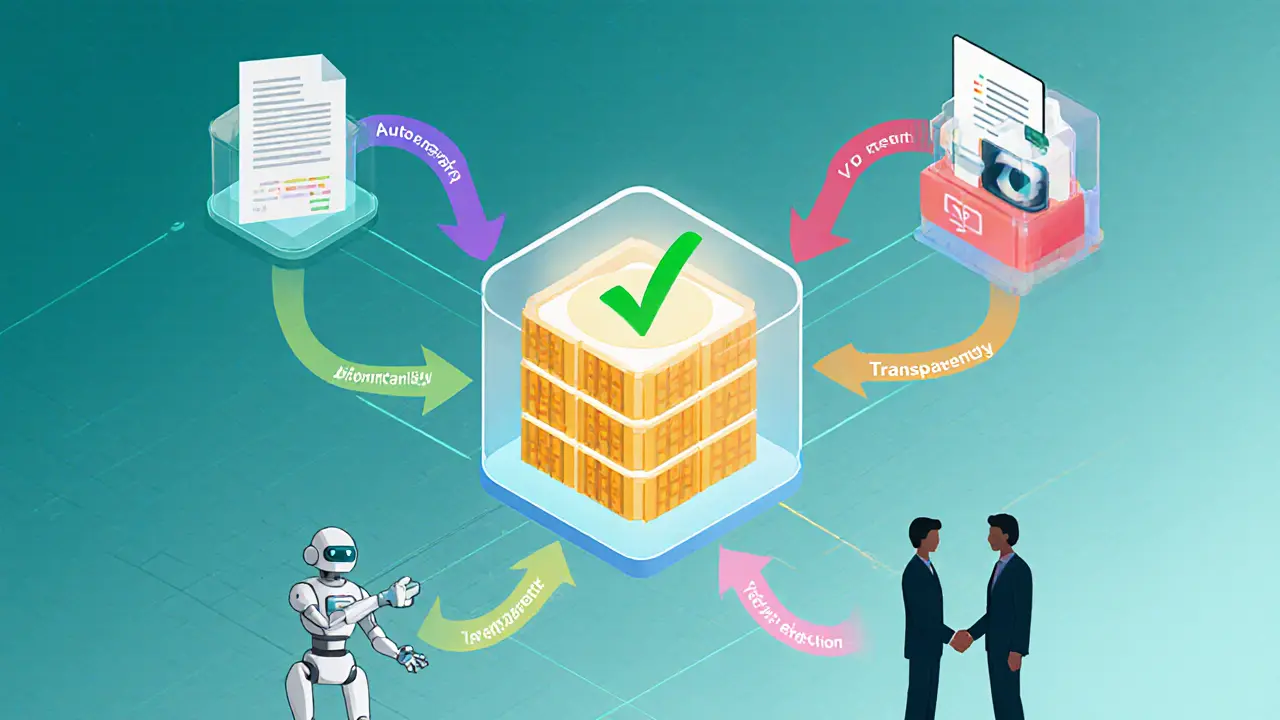

All these pieces—flash loans, airdrops, tokenomics, and sustainable chains—interact inside the broader DeFi landscape. Decentralized Finance encompasses flash loans, requires robust tokenomics, and is influenced by carbon‑neutral blockchain efforts. Together they create a dynamic environment where innovators can build new financial products without traditional gatekeepers.

Below you’ll find a curated selection of articles that dive deeper into each of these areas, from practical guides on flash loan providers to step‑by‑step airdrop claim instructions, and analyses of green blockchain practices. Whether you’re just curious or ready to launch your own DeFi project, the posts following this intro give you the actionable insights you need.