Real Estate Tokenization Explained

When working with Real Estate Tokenization, the process of turning a physical property into blockchain‑based digital tokens that represent ownership shares. Also known as property tokenization, it opens up real‑world assets to anyone with an internet connection. The technology relies on blockchain, a distributed ledger that records token transactions in a tamper‑proof way and uses smart contracts, self‑executing code that enforces the terms of ownership and transfer. By combining these tools, investors can buy, sell, or trade fractional ownership, small, tradable slices of a larger property without dealing with traditional paperwork.

How Tokenization Changes the Real‑Estate Playbook

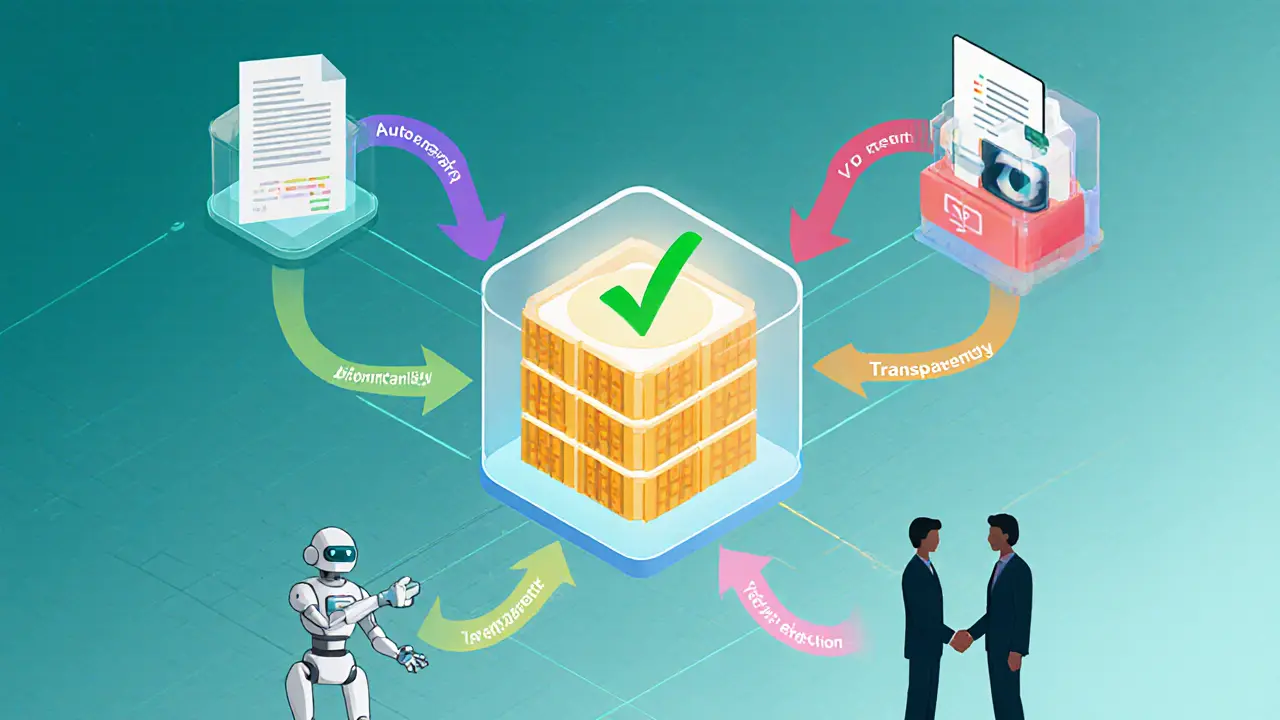

Real Estate Tokenization brings three core attributes to the market: liquidity, accessibility, and transparency. Liquidity emerges because tokens can be listed on secondary markets, letting owners exit positions in minutes instead of years. Accessibility grows as investors no longer need hundreds of thousands of dollars to buy a whole building; a token might cost as little as a few dollars, opening the asset class to retail participants. Transparency is baked in through the blockchain’s immutable ledger, which records every transfer and can be audited in real time. These attributes mirror the benefits highlighted in recent DeFi platform guides, where fast settlement and low fees are key selling points.

The token’s value hinges on clear tokenomics – the total supply equals the property’s appraised value, and each token represents a proportional share. Smart contracts manage dividend distribution, voting rights, and compliance checks, echoing the role of digital identity solutions that secure user data while preserving privacy. When a rental income arrives, the contract automatically allocates payouts to token holders, reducing administrative overhead and error risk.

Integration with decentralized finance (DeFi) unlocks even more possibilities. Token holders can collateralize their real‑estate tokens on lending platforms, borrow stablecoins, or earn yield by providing liquidity in token pools. This crossover between property assets and DeFi mirrors the trends seen in flash‑loan guides, where leveraging smart contracts multiplies capital efficiency.

However, the journey isn’t without hurdles. Regulatory frameworks differ across jurisdictions; some countries treat tokens as securities, demanding KYC/AML compliance, while others lack clear guidance. Valuation accuracy is critical – a token’s price must reflect the underlying property's market value, which can shift due to location, condition, or macro‑economic factors. Security remains paramount; smart contracts must be audited to prevent exploits, much like the security checklists recommended for crypto exchanges.

Environmental concerns also play a role. Carbon‑neutral blockchain solutions, such as proof‑of‑stake networks, reduce the energy footprint of token transactions, aligning property token projects with green investment criteria. In Southeast Asia, countries like Singapore and Indonesia are piloting tokenized real‑estate pilots, leveraging the region’s rapid crypto adoption and growing digital‑identity infrastructure. These initiatives echo the broader market insights from the India crypto adoption report, where high retail participation drives innovation.

Below you’ll find a curated batch of articles that dive deeper into each aspect mentioned here – from step‑by‑step token creation guides and legal considerations, to DeFi integration strategies and security best practices. Whether you’re a developer, investor, or simply curious about how blockchain reshapes property markets, the collection offers practical takeaways you can start using right away. Let’s explore the details together.