Crypto Scam: How to Spot and Avoid Common Crypto Scams in 2025

When you hear crypto scam, a deceptive scheme designed to steal cryptocurrency from unsuspecting users. Also known as cryptocurrency fraud, it’s not just about lost money—it’s about broken trust in a space built on transparency. Every year, billions vanish because people trust the wrong platform, click the wrong link, or chase a promise that sounds too good to be true. And yes, it still happens—even to experienced traders.

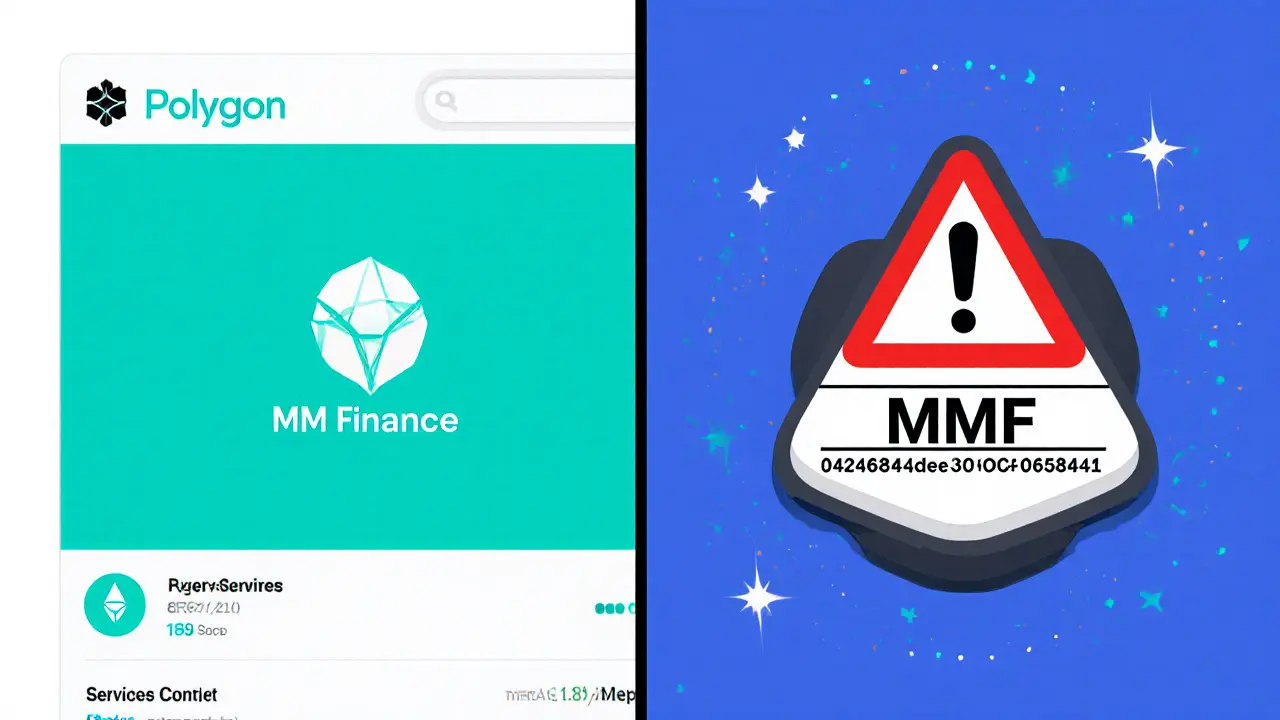

Crypto exchange scam, a fake or unregulated trading platform that disappears after collecting deposits is one of the most common. Look at platforms like İkipara or TomoDEX—some had real-looking websites, active social media, and even user testimonials. But they lacked licenses, had no real liquidity, and vanished overnight. Then there’s the airdrop scam, a fake token giveaway that asks you to connect your wallet or pay a "gas fee" to claim free coins. These often mimic real projects like Bird Finance or KOM airdrops, but they’re designed to drain your wallet the moment you sign in. And don’t forget DeFi scam, a smart contract that looks like a yield farm but is actually a honeypot. Projects like Liquidus or Carlo might promise 100% APY, but if the contract can’t be audited, or if the team is anonymous, you’re already at risk.

Scammers don’t need to be clever—they just need to be fast. They copy real project names, use fake YouTube reviews, and flood Telegram groups with bots. They target people who are new, excited, or desperate to make money fast. The truth? If you didn’t hear about it from a trusted source, and it asks for your private key or wallet connection, it’s a scam. Real projects don’t ask you to send crypto to claim a reward. Real exchanges don’t vanish after a few months. And real airdrops don’t charge you anything to participate.

You’ll find posts here that expose exactly how these scams operate—from the hidden code in a fake DEX to the fake customer support chats used to trick users into handing over access. We’ve reviewed exchanges like Bzetmex and MakiSwap that raised red flags. We’ve dug into risky tokens like MIIDAS and AVC that promised big returns but had zero liquidity. We’ve even tracked how North Korean hackers use crypto to bypass sanctions, showing you how fraud scales from individual tricks to organized crime.

By the end of this collection, you won’t just know what a crypto scam looks like—you’ll know how to walk away from it before you even click "Connect Wallet."