ARDR token: What it is, how it works, and why it matters in blockchain

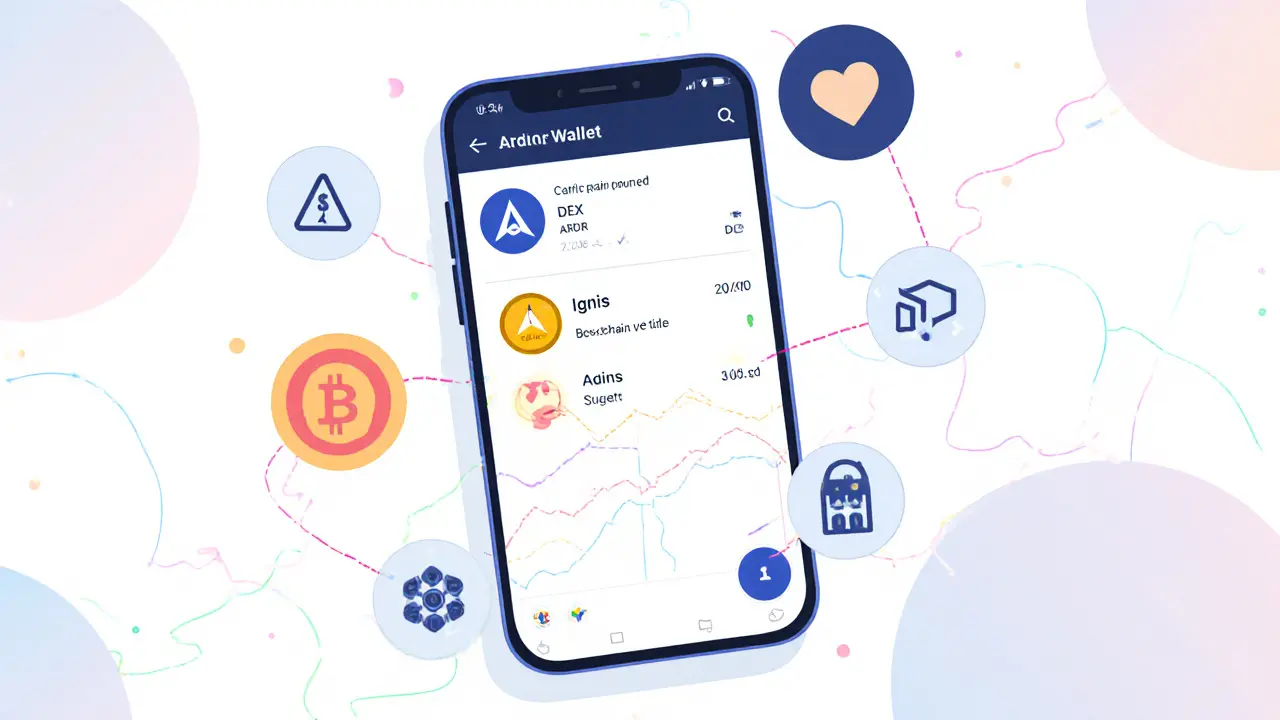

When you hear ARDR token, the native cryptocurrency of the Ardor blockchain platform designed to enable scalable, child-chain-based transactions. Also known as Ardor coin, it’s not just another crypto asset—it’s the fuel for a unique blockchain architecture built to fix the congestion problems that plague networks like Ethereum. Unlike most blockchains that try to do everything on one chain, Ardor separates responsibilities: the main chain handles security and consensus, while lightweight child chains, independent blockchains that run on top of Ardor and handle specific use cases like payments, supply chain tracking, or NFTs manage all the transaction data. This means you get the security of a large network without the slow speeds and high fees.

Think of Ardor like a highway system where the main road (the parent chain) keeps traffic safe and regulated, but each exit leads to a local road (a child chain) where cars move faster because they’re not sharing space with everything else. That’s why companies and developers who need custom blockchain solutions—without reinventing security—turn to Ardor. It’s not flashy like meme coins, but it’s practical. The Nxt platform, the original blockchain that evolved into Ardor, known for its proof-of-stake consensus and early smart contract features laid the groundwork back in 2013, making Ardor one of the oldest continuously running blockchain systems still in active use today. ARDR holders stake their tokens to secure the network and earn rewards, just like in proof-of-stake systems, but without the complexity of managing multiple validators.

What you won’t find on Ardor are wild price swings driven by hype. What you will find is real infrastructure: businesses using child chains for loyalty programs, governments testing land registry systems, and developers building tools that don’t require users to pay $50 in gas fees just to send a token. The ARDR token doesn’t trade like a lottery ticket—it trades like a utility. And while most crypto projects chase trends, Ardor quietly solves problems that still exist today: scalability, fragmentation, and cost.

Below, you’ll find real-world examples of how Ardor’s structure is being used—or misused—across Southeast Asia and beyond. Some posts dive into child chain applications that actually work. Others warn about scams pretending to be part of the Ardor ecosystem. Whether you’re a developer, investor, or just curious, this collection cuts through the noise to show what Ardor really does, who uses it, and why it still matters in 2025.