Ardor DEX: What It Is, How It Works, and Why It Matters in Southeast Asia

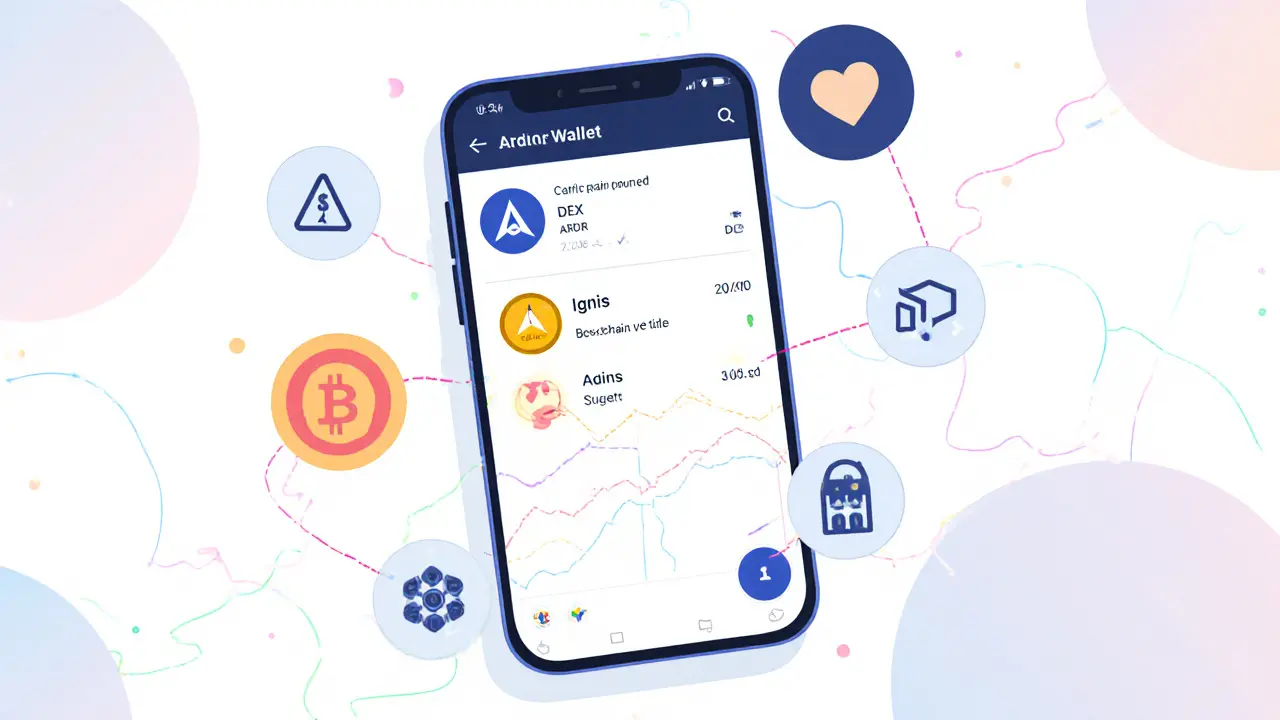

When you hear Ardor DEX, a decentralized exchange built on the Ardor blockchain that enables secure, child-chain-based token swaps without relying on centralized servers. Also known as Ardor Exchange, it’s one of the few DEXes that runs on a parent-child chain architecture—meaning trading happens on lightweight, customizable child chains while the main chain handles security and consensus. Unlike most DEXes that run on Ethereum or Solana, Ardor DEX doesn’t compete for gas fees or network congestion. It was designed from the start to be lightweight, scalable, and energy-efficient—perfect for users in Southeast Asia where internet speeds vary and electricity costs matter.

The Ardor blockchain itself is a direct evolution of the Nxt platform, one of the earliest proof-of-stake blockchains. What makes Ardor unique is its ability to run multiple child chains, each with their own tokens, rules, and features—all secured by the main Ardor chain. This means Ardor DEX, a decentralized exchange built on the Ardor blockchain that enables secure, child-chain-based token swaps without relying on centralized servers. Also known as Ardor Exchange, it’s one of the few DEXes that runs on a parent-child chain architecture—meaning trading happens on lightweight, customizable child chains while the main chain handles security and consensus. doesn’t need to reinvent security. It inherits it. That’s why projects building on Ardor can launch tokens with minimal overhead. And because the DEX runs on a child chain, users get faster trades, lower fees, and no risk of network-wide slowdowns. This isn’t just theory—it’s been tested since 2018, long before most DeFi platforms existed.

Many people assume all DEXes are the same: connect your wallet, swap tokens, pay gas. But Ardor DEX is different. It doesn’t require you to hold native tokens like ETH or SOL to trade. You trade using tokens issued on child chains, and fees are paid in ARDR—the native coin of the main chain. This makes it accessible in regions where holding major cryptocurrencies is harder. You don’t need to buy ARDR first to use the DEX, but you do need it to pay for transaction fees, which keeps the network secure and spam-free. This design is why Ardor still has active users in places like Indonesia, the Philippines, and Vietnam, where low-cost, stable infrastructure matters more than hype.

What you won’t find on Ardor DEX? Flashy interfaces, meme tokens, or leveraged trading. It’s not built for gamblers or speculators. It’s built for people who want to trade real tokens—like those issued by local startups, community projects, or small businesses—without trusting a middleman. That’s why you’ll see posts here about real-world use cases: tokens for loyalty programs, digital vouchers, or local service payments—all traded on Ardor DEX with zero counterparty risk.

There’s no big marketing campaign behind it. No celebrity endorsements. Just a quiet, reliable system that’s been running for years. If you’re tired of DEXes that crash under volume, charge $50 in gas fees, or vanish overnight, Ardor DEX offers a different path. It’s slow to grow, but it doesn’t break. It doesn’t hype. It just works.

Below, you’ll find real reviews, technical breakdowns, and user experiences from people who’ve actually used Ardor DEX—not just talked about it. Some found it too simple. Others found it exactly what they needed. Either way, you’ll see why it still matters in a world obsessed with the next big thing.