FEG Token: What It Is, Why It Matters, and What You Need to Know

When you hear FEG Token, a memecoin built on the Binance Smart Chain with a 100% tax on buys and sells, designed to redistribute wealth among holders. Also known as FEGex, it’s not just another meme coin—it’s a high-stakes experiment in tokenomics that’s drawn both die-hard believers and sharp-eyed skeptics. Unlike traditional cryptocurrencies, FEG Token doesn’t rely on utility or a roadmap. Instead, it leans on fear, greed, and a clever redistribution model: every time someone buys or sells, 100% of the transaction fee is split between holders and burned. That’s right—no middleman, no team wallet, just pure redistribution. It’s the kind of setup that sounds too good to be true… and often is.

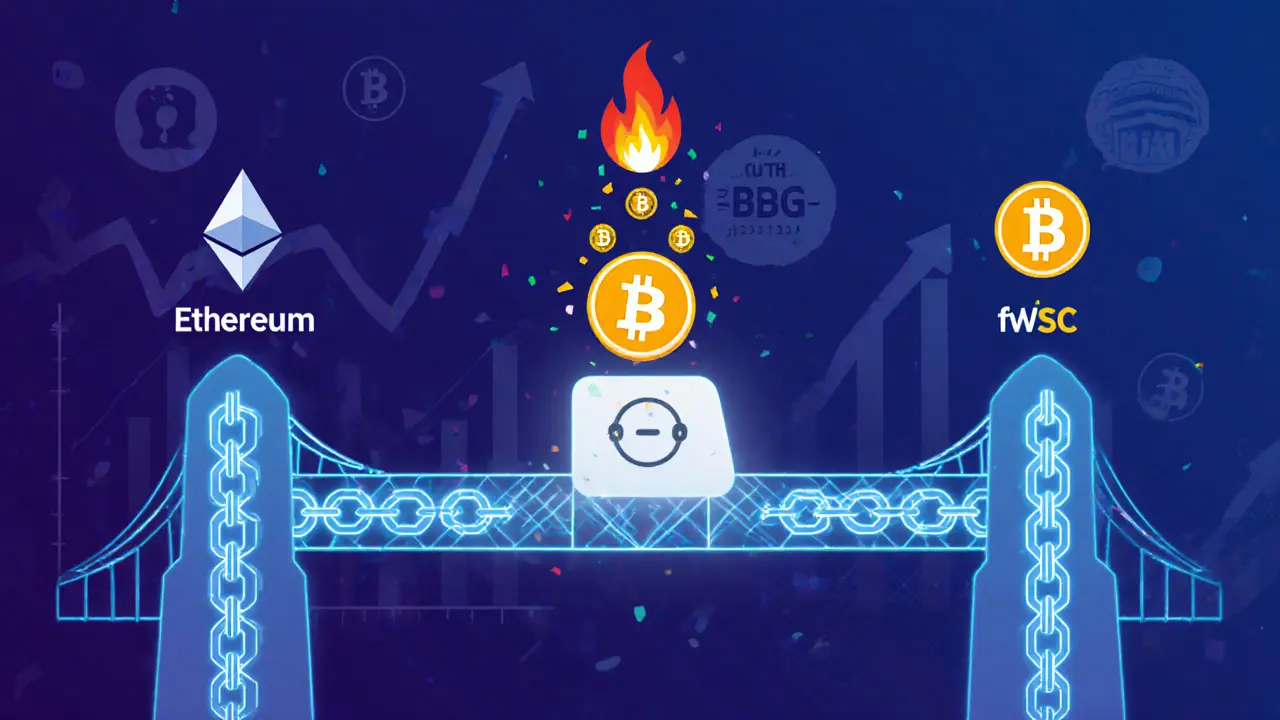

What makes FEG Token stand out is how it ties into bigger trends in crypto. It’s part of the memecoin, a category of cryptocurrencies driven by community hype, internet culture, and viral momentum rather than technical innovation wave that exploded after Dogecoin and Shiba Inu. But FEG pushes it further. It’s built on decentralized finance, a system of financial tools—like lending, trading, and staking—that operate without banks or central authorities, using smart contracts to automate rewards. Yet, it’s also a textbook case of crypto scams, projects that lure investors with promises of easy gains, then vanish or crash due to weak structure, no real development, or insider dumping. The tokenomics look flashy on paper: auto-liquidity, burn mechanics, holder rewards. But in practice, liquidity is thin, volume is spiky, and early buyers often cash out before the rest of the crowd catches on.

People chase FEG Token because it’s loud, it’s chaotic, and it feels like a lottery ticket. But if you’re thinking about jumping in, ask yourself: Are you betting on the tech, or just the hype? The posts below dig into real cases like this—how tokens like FEG rise, how they collapse, and what patterns to watch for before you invest. You’ll find breakdowns of similar coins, warnings about hidden risks, and guides on spotting red flags in tokenomics. This isn’t a promotion. It’s a reality check.